Weekly Commentary for the week ending January 31, 2026

The last full trading week of January featured choppy, range-bound action in U.S. equities, with modest net losses across major indices amid a mix of earnings reports, the Fed's policy pause, and reactions to the Warsh nomination. Volatility ticked higher mid-week on tariff headlines and geopolitical noise, but dip-buying provided some support.

Key index closes on January 30:

- The S&P 500 finished at approximately 6,939, down about 0.4% on the final day and posting a small weekly decline of around 0.3–0.4%.

- The Dow Jones Industrial Average closed near 48,892, off roughly 0.4% for the day and about 0.5% for the week, pressured by sharp drops in names like UnitedHealth.

- The Nasdaq Composite showed early-week resilience with tech gains but ended lower, down around 0.9% on Friday and modestly for the week overall.

Drivers included mixed Q4 earnings—with AI themes holding firm but offsets from healthcare and other sectors—plus the Fed's steady stance and the surprise Warsh nomination announcement late in the week. Sector rotation favored materials, consumer discretionary, and staples at times, while financials and tech faced more headwinds. Overall, the week reflected a market pausing after strong 2025 momentum, with improving breadth but still narrow leadership in quality growth and AI names.

Fed Takes a Pause: January FOMC Details

A major focal point was the Federal Open Market Committee's January 28 meeting, where the Fed decided to maintain the federal funds target range at 3.5%–3.75%. This marked a deliberate pause after three consecutive rate cuts in late 2025.

The statement upgraded the economic assessment: activity is expanding at a solid pace, supported by resilient consumer spending and growing business investment. While job gains have been low, the labor market shows signs of stabilization and improvement. Inflation remains elevated, though the Fed's preferred gauge—the Personal Consumption Expenditures (PCE) price index—has moderated somewhat due to cooling services inflation. However, goods inflation has risen partly from tariffs, keeping overall inflation above the 2% target and slowing the disinflation pace.

This language points to a more patient Fed stance. After aggressive easing last year, policymakers appear comfortable waiting for clearer evidence that inflation is sustainably cooling toward target. Tariff-related price pressures are expected to fade around midyear, as much of the impact stems from one-time adjustments in mid-2025 that should roll out of year-over-year comparisons. We anticipate the Fed resuming modest rate cuts once more confirming data emerges—likely not immediately, but possibly later in 2026.

Warsh Nomination: Potential Dovish Shift?

Adding intrigue, President Trump nominated Kevin Warsh as the next Fed Chair on January 30. Warsh, a former Fed Governor who played a key role during the 2008 crisis, brings strong credentials and experience. His views are mixed but lean toward supporting rate cuts more than current Chair Powell in some contexts.

Warsh argues the U.S. is entering a higher-productivity era—fueled by AI, new technologies, and potential deregulation—which could enable faster growth with contained inflation. He's been critical of the Fed's oversized balance sheet from past quantitative easing rounds, suggesting that shrinking it (monetary tightening) could offset inflation risks from rate cuts (monetary easing). This mix, he believes, would better support growth while addressing outdated inflation forecasting approaches.

Confirmation won't be quick. The Senate Banking Committee (with a narrow Republican majority) must review nominees, and opposition from figures like Senator Thom Tillis—tied to the ongoing DOJ investigation into Fed building renovations—could delay proceedings. If confirmation extends beyond Powell's chair term in May 2026, Vice Chair Philip Jefferson would serve as acting chair. Powell's Board term runs to January 2028, and he has signaled intent to stay amid the investigation.

This nomination introduces uncertainty but could signal a more growth-oriented Fed policy mix if confirmed.

On Friday, January 30, 2026, amid sharp volatility in precious metals triggered by President Trump's nomination of Kevin Warsh as next Fed Chair, we took decisive risk-off action.

We significantly reduced our silver position at the open, when it was already down ~14% from the prior close. Silver then plunged further, ultimately dropping around 28–31% by close (settling in the low-to-mid $80s per ounce, one of the worst single-day declines since 1980), driven by a surging dollar, profit-taking after January's parabolic run, and shifting Fed policy expectations.

This move locked in gains from silver's strong earlier performance while avoiding much of the intensified sell-off.

Concurrently, we added to our short-term Treasury position for defense. With yields on shorter maturities stable to slightly firmer (e.g., 2-year ~3.5–3.6%), this boosts liquidity, income, and protection against near-term uncertainty.

We're maintaining this increased Treasury allocation until volatility from Fed transition news, tariffs, and earnings creates clearer entry points in risk assets.

This reflects our disciplined focus on capital preservation in turbulent conditions while staying positioned for eventual rebounds. We're monitoring closely and remain balanced and opportunistic.

Monthly Market Overview (January 2026)

January delivered a modestly positive close for U.S. equities despite late-week volatility—a encouraging sign per the historical "January Barometer," which often foreshadows solid annual performance. The S&P 500 eked out a gain of around 1.5% (from roughly 6,902 at year-start to ~6,939), the Dow up about 1.6%, and the Nasdaq roughly flat to slightly lower. Small caps (Russell 2000) outperformed strongly, up 5–6% in spots, hinting at broadening participation beyond mega-caps.

This resilience occurred amid solid but moderating growth: consumer strength persisted, job gains stabilized (unemployment ~4.4%), and inflation stayed sticky above 2% due to tariffs and lingering effects. The Fed's shift to neutral—balancing employment and inflation risks—supported a soft-landing narrative. Corporate earnings remained mixed but resilient, with AI capex as a key driver.

The AI + Momentum Sector Allocation strategy leverages artificial intelligence to dynamically optimize portfolio weights across U.S. equity sectors, combining predictive analytics with momentum signals to target outperforming areas while maintaining broad diversification. This AI-driven approach aims to enhance risk-adjusted returns by rotating toward high-momentum sectors amid evolving AI themes.

AI Target Sector Allocation

AI + Momentum Sector Allocation | |

Sector | Gross Equity |

Information Technology | 17.58% |

Consumer Discretionary | 13.88% |

Financials | 12.94% |

Industrials | 12.11% |

Health Care | 10.78% |

Communication Services | 10.10% |

Utilities | 8.07% |

Energy | 5.13% |

Consumer Staples | 5.01% |

Real Estate | 2.03% |

Materials | 1.98% |

A major key to outperformance is not only identifying sectors that are in favor but drilling down to identify the best companies to own within those sectors!

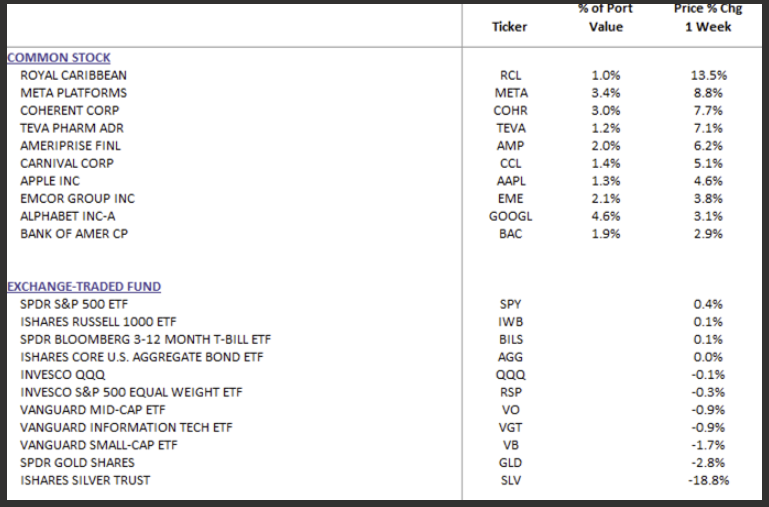

DBS Long Term Growth Top Ten and Benchmark Weekly Performance:

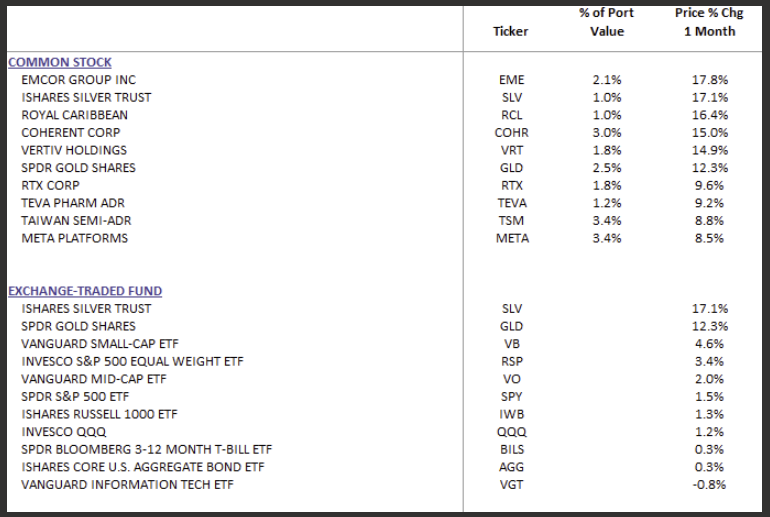

DBS Long Term Growth Top Ten and Benchmark Monthly Performance:

Looking Ahead

Heading into February, expect continued volatility from Fed transition headlines, tariff developments, and earnings digestion—but with an upward tilt. Consensus year-end 2026 targets for the S&P 500 sit around 7,500–8,000 (implying 8–15% upside from current levels near 6,940), fueled by projected 12–14% earnings growth, AI tailwinds, and potential policy support.

Risks persist: stickier inflation, tariff escalations, labor softening, or tech overvaluation could spark corrections. The base case favors diversified, quality exposure—resilient earnings, dividend growers, selective international and emerging plays—over momentum chasing. View pullbacks as opportunities in this secular bullish trend.