Weekly Commentary for the week ending January 10, 2026

The first full trading week of 2026 delivered solid gains across major indices, with the Dow Jones Industrial Average and S&P 500 both closing at fresh all-time record highs on Friday. Despite some geopolitical headlines and a softer-than-expected jobs report, investors brushed aside concerns and rotated into cyclical sectors, driving broad-based participation.

Let's start with the numbers. For the week:

- The Dow Jones Industrial Average climbed about 2.3%, closing Friday at 49,504.

- The S&P 500 rose roughly 1.6%, ending at 6,966 — a new closing record.

- The Nasdaq Composite gained 1.9%, settling at 23,671.

This performance marks a strong rebound from the late-2025 holiday lull and extends the multi-year bull market. Notably, market leadership broadened meaningfully. While tech and AI-related names remained in focus, the real action came from small cap, mid cap, materials, industrials, utilities, and even some energy and defense plays — sectors that had lagged the mega-cap growth story in recent years.

Key drivers this week

The week started with a geopolitical jolt: the U.S. military's capture of Venezuelan leader Nicolás Maduro over the weekend of January 3–4. This sent oil prices higher early in the week (Brent settling around $63+ by Friday) and boosted energy stocks, while defense names rallied on expectations of increased military spending under the current administration.

But markets quickly shifted focus to domestic fundamentals. A highlight was the rotation out of some richly valued tech and into value and cyclical areas. The S&P 500 value index outperformed growth early in the year, and small-caps (Russell 2000 and S&P 600) showed particular strength, up over 4% year-to-date in some reports.

Chipmakers like Broadcom helped power Friday's gains, but the broader story was cyclical resilience. Homebuilders and housing-related stocks surged after policy signals around mortgage support and institutional buyer restrictions. Materials led sector performance with an ~1.8% weekly gain.

The big economic event was Friday's December jobs report. It came in softer than expected on headline payrolls, but the unemployment rate dipped to 4.4% (better than anticipated), signaling a labor market that's cooling but not cracking. This data kept Fed rate-cut expectations in check — markets are now pricing in roughly two quarter-point cuts for 2026, likely starting mid-year rather than imminently.

Bond yields ticked higher on the resilient jobs tone, but equities shrugged it off. Investors seem to view the current environment as "Goldilocks": growth supportive of earnings, inflation moderating (though still above target), and a Fed that's accommodative without being overly aggressive.

Broader context and outlook

We're now in year four of this bull market, following three consecutive years of strong double-digit gains for the S&P 500 (including ~18% in 2025). Valuations remain elevated, but the AI productivity story, fiscal stimulus expectations, and potential deregulation continue to provide tailwinds.

That said, risks haven't disappeared. Tariff policies remain a wildcard — the Supreme Court punted a key ruling last week, leaving uncertainty. Geopolitical developments (Venezuela, broader global tensions) could flare up. And while AI enthusiasm is still high, some investors are shifting to a "show-me" stance: we need to see real monetization and returns on the massive capex poured into data centers, storage, and infrastructure.

Wall Street forecasts for year-end 2026 vary widely — from conservative ~7,100 on the S&P 500 to more bullish calls near 8,000 — implying anywhere from low single-digit to mid-teens gains. The consensus leans positive, driven by resilient corporate earnings and an economy that's proving more durable than many expected.

What to watch next week

Earnings season begins in earnest, starting with major banks (JPMorgan, Citigroup, Wells Fargo). This could test whether the rotation into financials and cyclicals has legs. We'll also get key inflation data — any surprises there could influence Fed expectations.

Bottom line: 2026 is off to a promising start. The market is rewarding breadth over concentration, and the bull case remains intact as long as earnings hold up and the Fed stays measured. Stay diversified, keep an eye on those cyclicals and value pockets, and remember — record highs are exciting, but discipline wins over the long haul.

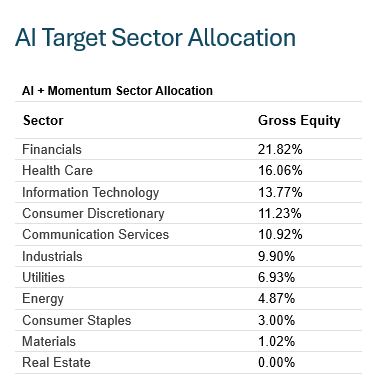

The AI + Momentum Sector Allocation strategy leverages artificial intelligence to dynamically optimize portfolio weights across U.S. equity sectors, combining predictive analytics with momentum signals to target outperforming areas while maintaining broad diversification. This AI-driven approach aims to enhance risk-adjusted returns by rotating toward high-momentum sectors amid evolving AI themes.

A major key to outperformance is not only identifying sectors that are in favor but drilling down to identify the best companies to own within those sectors!

Compared to last week, Technology went from 1st. to 3rd., and financials rose to 1st. from 3rd.

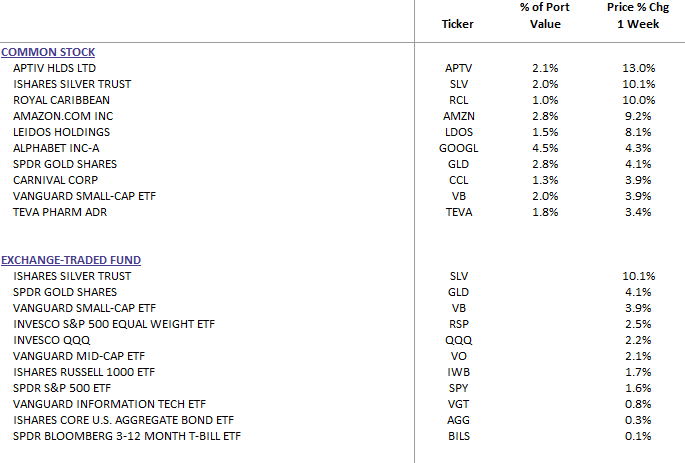

DBS Long Term Growth Top Ten and Benchmark Weekly Performance:

Our move into mid and small cap stocks while reducing exposure to technology was supported by our asset class algorithmic trend analysis methodology and AI target sector analysis.

Silver and gold continue to shine, but we are starting to see more volatility than usual and are reviewing a potential reduction to our allocation in the metals.

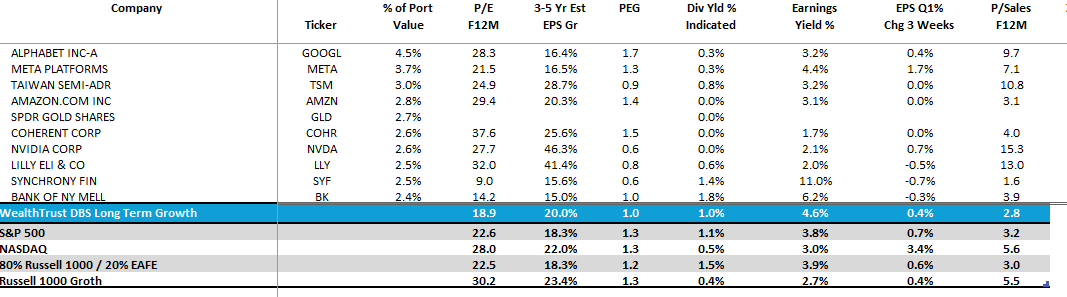

DBS Long Term Growth Portfolio Top Ten Holdings and Valuation Statistics: