Weekly Commentary for the week ending November 1, 2025

Weekly Market Commentary:

U.S. stock indexes closed mixed amid a narrow, large-cap tech-driven rally. We'll cover the Fed's latest rate decision, a temporary U.S.-China trade truce, corporate earnings momentum, and the building disruptions from the ongoing government shutdown. Let's dive in.

Starting with equities: U.S. indexes ended the week on a mixed note, with large-cap benchmarks posting gains while smaller caps lagged. The technology-heavy Nasdaq Composite led the pack, up 2.2% for the week, propelled by continued outperformance from mega-cap tech names riding the wave of artificial intelligence spending. The S&P 500 advanced 0.7% to close at 6,840, and the Dow Jones Industrial Average rose 0.8% to 47,563.

But beneath the surface, the market breadth was strikingly narrow. The S&P 500 moved higher even as seven of its 11 sectors posted losses. An equal-weighted version of the index underperformed its market-cap weighted counterpart by a whopping 268 basis points—or 2.68 percentage points—highlighting how concentrated the gains were in a handful of giants.

The third-quarter earnings season is in full swing, with over two-third of S&P 500 companies having reported by week's end, including five of the Magnificent Seven. As of Friday morning, 64% of the index had posted results, and a strong 83% beat consensus estimates, per FactSet data. Reactions to the mega-caps were mixed: Microsoft, Apple, and Meta Platforms saw shares decline post-earnings, while Amazon and Alphabet traded higher. NVIDIA stood out, with its stock pushing the company's market cap above $5 trillion midweek—the first ever to cross that milestone.

Shifting to geopolitics: Heading into the week, eyes were on Thursday's meeting in South Korea between U.S. President Donald Trump and Chinese President Xi Jinping. The leaders struck a one-year trade truce, reducing U.S. tariffs on Chinese imports, suspending China's export controls on rare earth materials, and resuming purchases of U.S. soybeans and other ag products. The deal's concessions are modest and leave room for future escalation, but it delivered short-term relief, lifting sentiment and helping equities rebound from earlier trade-related jitters.

Now, to the Federal Reserve: The central bank's October meeting was a highlight. As widely anticipated, the Fed cut its target range for the federal funds rate by 25 basis points to 3.75%–4.00%. That's now 150 basis points off the cycle peak. But two dissents underscored internal divisions: Governor Stephen Miran wanted a 50-basis-point cut, while Kansas City Fed President Jeffrey Schmid voted to hold steady.

Post-meeting, Chair Jerome Powell tempered expectations for December, saying another cut "is not a foregone conclusion." With a data blackout from the government shutdown, policymakers may err on caution. Markets had priced in over 90% odds for a December move pre-announcement; that's now dialed back to around 60%.

This hawkish tilt rippled through fixed income. Treasuries slid, with yields ending higher across most maturities—the 10-year up about 10 basis points to 4.09%. Bond prices and yields move inversely, of course. Investment-grade corporates lagged Treasuries amid heavy supply, while high-yield sentiment held up on earnings news before softening on rate-cut doubts.

Framing the Fed's stance: These cuts aren't about flooring the accelerator with stimulus. High rates tamed post-pandemic inflation; now, with labor softening, the Fed's easing off the brakes toward neutral "cruise control" settings. They also plan to halt balance sheet runoff in December, unwinding quantitative easing as holdings normalize—little market impact there, as it was telegraphed.

On the trade front, this truce is a navigated speed bump. It pauses reciprocal tariffs, halves the 20% fentanyl-related levy on China, eases rare-earth restrictions, and restarts soybean buys. Supply chains get breathing room, potentially capping price pressures into the holidays and supporting corporate margins.

The shutdown's disruptions are mounting—soon the longest on record. We'd have seen Q3 GDP data otherwise, but private indicators show resilience: State unemployment claims stable, ADP weekly payrolls at steady ~60,000 gains in October. Still, the CBO estimates the shutdowns already shaved 1% off Q4 annualized GDP, rising to 1.5% by mid-November and 2% by month-end—that's nearly $40 billion in lost output. Unpaid workers, interrupted services, SNAP disruptions for 40 million Americans—pressure's building for Congressional resolution. Markets are looking through it for now, but endurance has limits.

Corporate profits remain a bright spot. With two-thirds of the S&P reported, beat rates are robust, signaling companies navigating tariffs and slower growth adeptly. AI momentum persists: Despite Microsoft and Meta stumbles—latter on debt-fueled capex plans—Apple and Amazon delivered, with the latter up over 10% Friday. Nasdaq and S&P hit records; the rally from April lows nears 40%.

Bubble concerns? Powell dismissed them, citing real earnings versus dot-com era. Long-term, AI investments must sustain fundamentals to match valuations.

October saw volatility spikes, but the month closed unscathed. November brings uncertainties: Fed timing, shutdown drag, rally fatigue. Yet we're optimistic but cautious. Macro tailwinds—easing rates, tax cuts, trade thaw—point to growth pickup into 2026. AI has legs for big tech; small caps benefit from rates and growth.

We don't believe we are completely out of the woods when it comes to earnings and/or tariff disruptions and have increased our short-term treasuries and cash positions in order to take advantage of any opportunities resulting from overreaction to asset class, sector or individual equity selloffs. Because the market is at all-time highs and even though most companies are beating their quarterly earnings and revenue estimates, companies such as Meta are being oversold do to some wording in their earnings summary that is interpreted as an imperfection. In our view, these are quite often buying opportunities, and we want the liquidity to take advantage of these situations. Similar to the Warren Buffett Model!

Ahead: ISM services and manufacturing PMIs, ADP employment Wednesday. BLS jobs report likely delayed by shutdown.

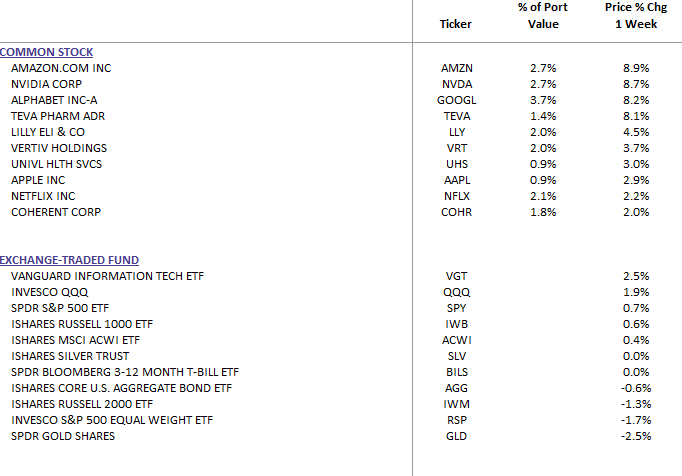

DBS Long Term Growth Top Ten and Benchmark Weekly Performance:

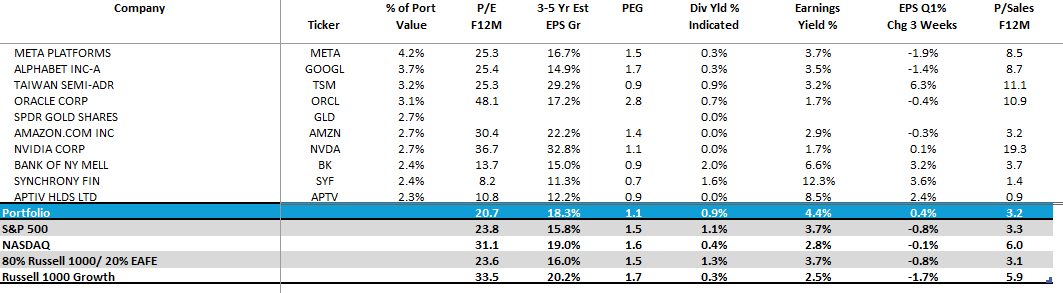

DBS Long Term Growth Portfolio Top Ten Holdings and Valuation Statistics: