Weekly Commentary for the week ending October 11, 2025

Stocks Fall on Trade Tensions and Shutdown Concerns

U.S. stock indexes declined this week as fears of reescalation global trade tensions and a prolonged U.S. government shutdown weighed on investor sentiment. The Nasdaq Composite and S&P 500 Index were in positive territory for much of the week, driven by enthusiasm for artificial intelligence (AI)-related companies. A notable catalyst was the strategic partnership announcement between Advanced Micro Devices (AMD) and OpenAI, which propelled AMD shares up over 20% on Monday. However, equities turned sharply lower on Friday after President Donald Trump posted on social media about considering “a massive increase of tariffs on Chinese products” in response to China’s proposed export controls on rare earths. Gold prices surged past $4,000 per ounce for the first time, reflecting heightened geopolitical and economic uncertainty.

T. Rowe Price traders observed that investors are looking ahead to the third-quarter earnings season, which begins with JPMorgan Chase’s report on October 14. With the government shutdown halting major economic data releases, corporate earnings may have an outsized impact on market sentiment. FactSet analysts expect the S&P 500 to report a ninth consecutive quarter of year-over-year earnings growth.

Fed Minutes Signal Cautious Support for Rate Cuts

The Federal Reserve’s mid-September meeting minutes, released Wednesday, highlighted divergent views among policymakers navigating conflicting economic signals. Concerns about persistent inflation and a weakening labor market were prominent, with policymakers noting “upside risks to inflation remained elevated and downside risks to employment were elevated and had increased.” Most judged further policy easing likely appropriate this year, though some cautioned that monetary policy might not be particularly restrictive, advocating a measured approach to future changes.

Consumer Sentiment Steady in October

The University of Michigan’s preliminary October Index of Consumer Sentiment held steady at 55, unchanged from September. Consumers reported improved views on current personal finances and year-ahead business conditions, but expectations for future personal finances and durable goods purchases weakened. Inflation expectations for the next year dipped slightly to 4.6% from 4.7%, while long-run expectations remained at 3.7%.

U.S. Treasuries Gain Amid Trade and Shutdown Risks

U.S. Treasuries posted positive returns as yields fell sharply late in the week, driven by reescalation U.S.-China trade tensions and safe-haven demand tied to government shutdown risks. Municipal bonds showed stable performance despite a busy new issue calendar and selective investor demand. Investment-grade corporate bonds lagged Treasuries due to low trading volumes and increased investor caution. High yield bond market sentiment softened amid macroeconomic concerns, with sellers outpacing buyers and below-average trading volumes.

Government Shutdown Enters Second Week

The U.S. government shutdown, now in its second week and the fourth-longest on record at 10 days, shows little sign of resolution. Congress remains gridlocked, with the House in recess and the Senate adjourned until Tuesday after a seventh failed vote on a continuing resolution to fund the government through November 21. Disputes over including health care measures persist, stalling progress.

While short-term shutdowns typically have minimal economic impact, prolonged closures amplify disruptions. Over 650,000 federal employees have missed paychecks, a figure that could exceed three million by October 15, including active service members. Interruptions to government services, such as IRS operations and programs like Women, Infants, and Children (WIC), are mounting. Betting markets estimate a mere 5% chance of resolution before October 15, and a prolonged shutdown could dent fourth-quarter GDP, though most impacts are expected to be temporary.

Markets Focus on AI and Rate Cut Expectations

Markets have largely shrugged off the shutdown, focusing instead on AI-driven growth and anticipated Federal Reserve rate cuts. The AMD-OpenAI deal underscored the ongoing AI investment cycle, supporting the Nasdaq’s performance. Expectations for a 25-basis-point rate cut at the Fed’s next meeting are high, with a 95% probability priced in, boosting interest-rate-sensitive small-cap stocks like those in the Russell 2000, which have outperformed the S&P 500 recently.

The shutdown complicates the Fed’s decision-making by limiting economic data availability. While the Bureau of Labor Statistics plans to release October 15 CPI data, the missing September labor report and suspended October data collection leave the Fed with incomplete employment insights. Absent new data, the Fed may continue easing to address labor market risks, though a surprise inflation spike could complicate this path.

Trade Policy Sparks Volatility

President Trump’s cancellation of a planned meeting with Chinese President Xi and threats of higher tariffs on Chinese goods triggered a sharp equity sell-off on Friday. This follows recent tariff hikes on pharmaceuticals, household goods, and heavy trucks. While the economy has adapted to higher tariffs in 2025, further escalations remain a key risk.

Gold’s Record Rally

Gold prices soared above $4,000 per ounce, up 50% from $2,660 at the start of 2025. Historically, gold prices inversely correlate with real interest rates, but this relationship has weakened since 2022. Central bank reserve accumulation and safe-haven demand fail to fully explain the rally. Rising U.S. debt levels, projected to exceed GDP next year, and political pressures on the Fed, including threats to its independence, may be driving investor interest in gold as a long-term store of value. Investors should exercise caution chasing these prices; a diversified commodity basket may offer a balanced alternative.

October Volatility Looms

Equity markets have been resilient, with the S&P 500 avoiding a 1% daily decline for nearly 50 days until Friday’s sell-off, the twelfth-longest such streak since 2000. October historically sees elevated volatility, and risks like prolonged shutdowns, trade policy shocks, or unexpected economic data could disrupt markets. Elevated valuations also raise the risk of profit-taking. However, volatility could create buying opportunities, with three to four 5%-10% dips typical annually.

Looking ahead, we remain optimistic about 2026 economic growth and corporate profits, supported by potential trade policy clarity, tax cuts, and lower interest rates. Investors should maintain a long-term focus.

Portfolio Positioning

With the labor market softening, we continue to anticipate that the economy will stabilize and potentially reaccelerate, supported by fiscal stimulus, monetary easing, and deregulation. However, with stock indexes near record highs and elevated valuations, markets may face volatility. Investors should use pullbacks as opportunities to invest at better prices or rebalance for diversification.

We favor U.S. large- and mid-cap stocks, particularly quality and cyclical names. The U.S. economy’s relative strength, contained inflation, and higher interest rates should support the U.S. dollar, potentially pressuring international large-cap stocks, for which we recommend an underweight allocation.

Sector Recommendations remain the same:

- Consumer Discretionary: Likely to benefit from reduced tariff uncertainty and lower tax rates.

- Financials: Positioned to gain from less tariff exposure and a potentially steeper yield curve.

- Health Care: Offers valuation expansion potential, trading at a discount despite sector challenges.

- Technology: Should benefit from lower interest rates plus this is where earnings have continued to impress.

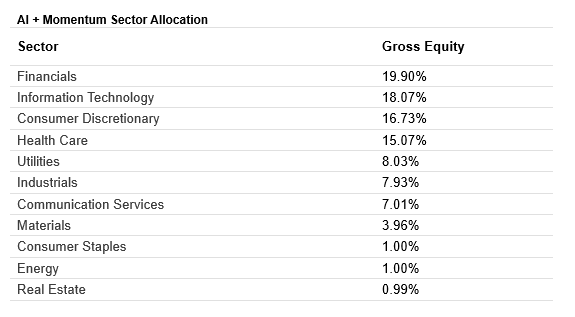

Our AI Target Sector Allocation below is based on AI momentum sector trend analysis and AI news analysis

The Week Ahead

Key releases include retail sales, housing data, and the producer price index, which could shape market sentiment amid ongoing uncertainties.

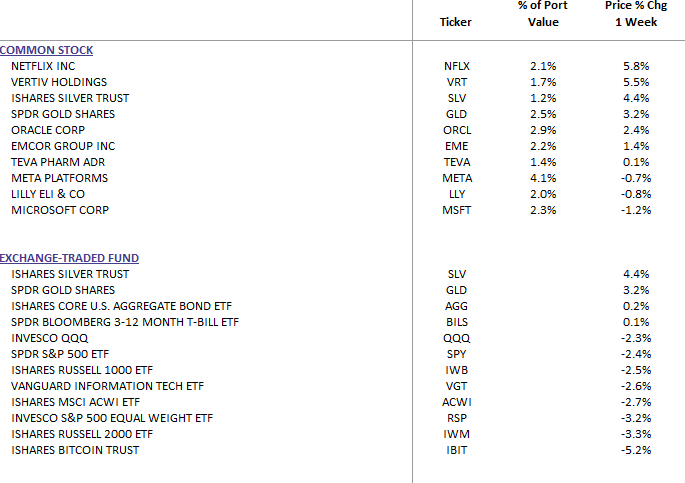

DBS Long Term Growth Top Ten and Benchmark Weekly Performance:

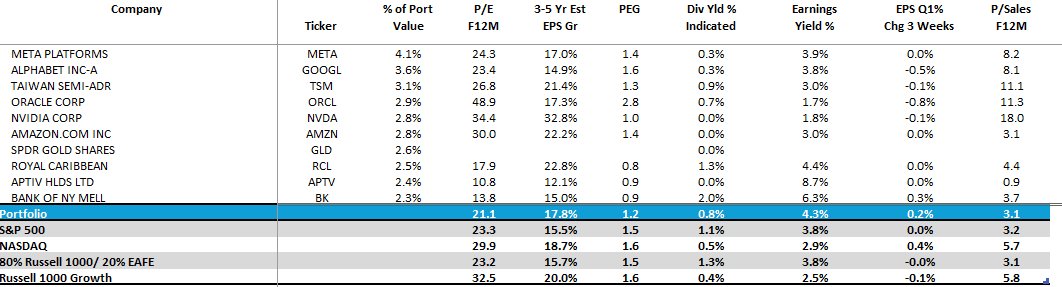

DBS Long Term Growth Portfolio Top Ten Holdings and Valuation Statistics: