Weekly Commentary for the week ending October 04, 2025

Weekly Market Commentary: Stocks Resilient thus far by Government Shutdown

Market Overview

Stocks posted solid gains this week, shrugging off the U.S. government shutdown that began on Thursday after legislators failed to reach a funding agreement. In a “bad news is good news” environment, equities drew support from the September private payrolls report from Automatic Data Processing (ADP), which showed a loss of 32,000 jobs, against expectations of 51,000 jobs added. This labor market weakness bolstered expectations for Federal Reserve rate cuts at its October 29 meeting. The technology-heavy Nasdaq Composite Index outperformed, with growth stocks outpacing value. The Russell 2000 Index of small-cap stocks, which benefit more from lower rates, significantly outperformed the broader S&P 500 Index.

West Texas Intermediate crude oil dropped over 7% after OPEC+ signaled increased production in November, weighing on value stocks. In contrast, gold rose more than 3%, extending its strong year-to-date performance, while copper, a manufacturing barometer, surged over 7%.

Economic Data Disruption

The government shutdown halted the release of key economic data, including the Bureau of Labor Statistics’ (BLS) September nonfarm payrolls report, originally scheduled for October 3. Approximately 750,000 federal employees have been furloughed, per the Congressional Budget Office, and if the shutdown persists, other critical reports like the September Consumer Price Index (CPI) on October 15 may also be delayed. In the absence of BLS data, markets leaned on alternative indicators like the ADP report, which underscored labor market cooling and reinforced expectations for Fed easing.

Fed officials’ comments were mixed. Chicago Fed President Austan Goolsbee highlighted concerns about rising services inflation and the complications of delayed CPI data, while Dallas Fed President Lorie Logan advocated for a slower normalization of policy rates.

Bond Markets

U.S. Treasuries saw positive returns as yields fell across maturities, driven by the weak ADP report and a Conference Board report showing softer-than-expected consumer confidence in September. Municipal bonds capped a strong September, supported by subdued issuance and robust demand. Investment-grade corporate bonds outperformed Treasuries, with new deals oversubscribed. High yield bond trading volumes were elevated due to month-end transactions, though issuance slowed by week’s end, according to T. Rowe Price traders.

Economic Outlook

Despite the shutdown, the economy remains resilient. The Atlanta Fed estimates third-quarter GDP growth at 3.8%, driven by strong consumer spending and heavy AI investment. Retail sales have accelerated since June, reaching their fastest pace since early 2023, and private-sector data like the Johnson Redbook Index showed 6% same-store sales growth in September. AI-driven capital expenditures, particularly from tech giants like Amazon, Google, Microsoft, and Meta, are projected to account for 30% of S&P 500 investment spending in 2026.

The shutdown may temper growth by 0.1%–0.2% per week of closure, based on historical precedent, but furloughed workers guaranteed backpay suggests a quick recovery once funding resumes. However, businesses reliant on government contracts may face permanent losses, and the administration’s threat to cut federal employment could further impact job growth if enacted.

Labor Market

The ADP report’s 32,000 job loss in September, marking the third decline in four months, aligns with a cooling labor market. The unemployment rate holds at 4.3%, but job openings have fallen below the number of unemployed workers for the first time since 2021. Companies are hiring cautiously amid macroeconomic uncertainty and anticipated AI-driven productivity gains, though layoffs remain low outside the government sector.

Federal Reserve Policy

The Fed resumed rate cuts last month, reflecting labor market softness and manageable inflation. The absence of key data complicates policymaking, with the ADP report potentially serving as the primary labor signal for the October meeting. We expect the Fed to cut rates again, targeting a neutral range of 3%–3.5% by 2026. A prolonged shutdown or permanent federal job cuts could intensify pressure for further easing, though improving labor data by December might prompt a pause.

Market Performance

The S&P 500 gained nearly 8% in Q3, with the Nasdaq up 11% and the Russell 2000 up 12%. Despite the shutdown, the S&P 500 hit three additional all-time highs, bringing its year-to-date total to 31. AI innovation and lower rates fueled gains, particularly in semiconductors, consumer discretionary, small- and mid-cap stocks, and emerging markets. Historical data shows stocks were positive during half of the 20 shutdowns since 1976, with no lasting impact on market trajectories.

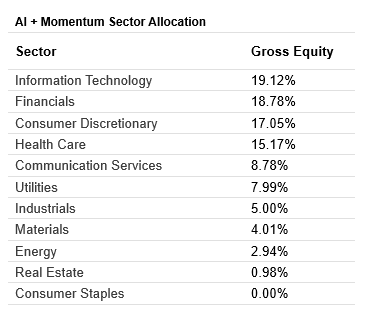

With U.S. stocks up 35% since April lows, markets may be vulnerable to profit-taking if shutdown uncertainty grows. However, near-record profit margins and expected double-digit profit growth in the Q3 earnings season support a positive outlook. We view potential pullbacks as buying opportunities, favoring U.S. large-cap stocks with AI exposure while recommending diversification into mid-caps and cyclical sectors. We continue to recommend overweighting Information Technology, Financials, Consumer Discretionary, & Healthcare but remain diversified in other sectors of the market.

Our AI Target Sector Allocation below is based on AI momentum sector trend analysis and AI news analysis.

The Week Ahead

Key releases include consumer credit, wholesale inventories, and the Michigan sentiment survey, which will provide further insight into consumer and economic trends amid the data blackout.

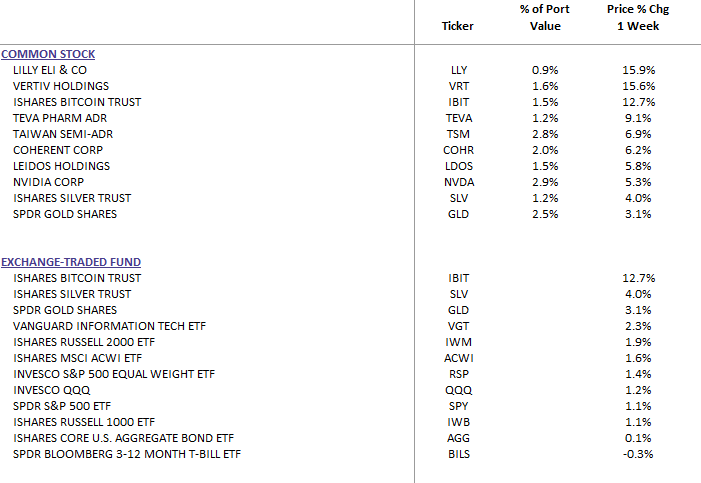

DBS Long Term Growth Top Ten and Benchmark Weekly Performance:

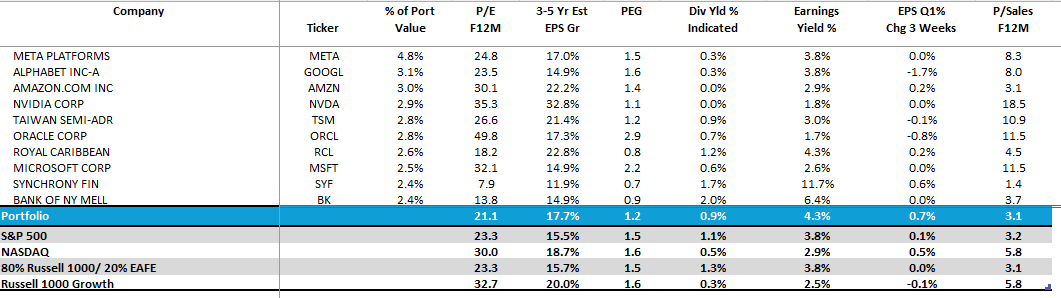

DBS Long Term Growth Portfolio Top Ten Holdings and Valuation Statistics: