Weekly Commentary for the week ending September 13, 2025

Weekly Market Commentary: Inflation Ticks Up, Labor Market Softens, and Fed Poised for Rate Cuts

Inflation Accelerates Modestly, but Producer Prices Cool

Consumer price growth picked up in August, with the Bureau of Labor Statistics (BLS) reporting a year-over-year (YoY) Consumer Price Index (CPI) increase of 2.9%, up from 2.7% in July. Core CPI, which excludes volatile food and energy prices, held steady at 3.1%, aligning with market expectations. Energy prices, particularly a 1.9% month-over-month rise in gasoline, were key drivers of the headline inflation uptick.

In contrast, the Producer Price Index (PPI), which measures wholesale price changes, unexpectedly decelerated to 2.6% YoY in August from 3.1% in July, falling below forecasts of 3.3%. Core PPI also dipped to 2.8%, cooler than the anticipated 3.5%. A notable 1.7% month-over-month decline in trade services inflation, reflecting narrower margins for wholesalers and retailers, contributed to this trend. These readings suggest that tariff-related price pressures have remained contained, as firms appear to absorb higher costs for now. However, we anticipate some near-term price hikes from tariffs, though these are unlikely to drive persistent inflation.

Labor Market Continues to Weaken

Recent labor market data points to a cooling economy. The BLS’s quarterly Census of Employment and Wages (QCEW) revealed a significant downward revision, showing 911,000 fewer jobs created in the 12-month period through March 2025 than initially estimated, exceeding forecasts of an 800,000-job reduction. This indicates job growth has been slower than previously thought.

Initial jobless claims for the week ending September 6 climbed to 263,000, the highest since October 2021 and well above expectations of 231,000. Continuing claims remained steady at 1.94 million. The unemployment rate, while still contained at 4.3%—below the historical average of 5.7%—has trended higher this year. Additionally, the labor force participation rate slipped to 62.3% in August from 62.7% a year ago, continuing a decades-long decline driven by tighter immigration enforcement and an aging workforce.

Consumer Sentiment Declines, Inflation Expectations Rise

The University of Michigan’s preliminary September Index of Consumer Sentiment fell to 55.4 from 58.2 in August, reflecting growing consumer concerns about business conditions, labor markets, and inflation. Despite remaining above the year’s lows from April and May, the drop underscores economic vulnerabilities. Inflation expectations for the next year held steady at 4.8%, while long-run expectations rose to 3.9%, marking a second consecutive monthly increase. Trade policy remains a key concern.

Fed Likely to Cut Rates to Support Labor Market

Despite inflation remaining above the Federal Reserve’s 2% target, the central bank is widely expected to resume interest rate cuts at its September meeting to bolster the weakening labor market. The Fed’s June projections forecasted a fed funds rate of 3.6% by the end of 2026, but bond markets are pricing in a more aggressive easing path, with rates falling below 3% over the same period.

We expect the Fed to implement one or two rate cuts this year, followed by one or two more in 2026, likely bringing the fed funds rate to the 3.0%–3.5% range. Bond yields have already started to decline, with the 10-year Treasury yield briefly hitting 4.0%, matching the year’s lows. U.S. investment-grade bonds have delivered 6.5% returns this year, outpacing their 4.9% starting yield. As the Fed cuts rates, short-term Treasury yields, particularly on T-bills, should decline, but a steepening yield curve could offset this, keeping the 10-year yield in the 4.0%–4.5% range.

Portfolio Positioning

With the labor market softening, we anticipate the economy will stabilize and potentially reaccelerate, supported by fiscal stimulus, monetary easing, and deregulation. However, with stock indexes near record highs and elevated valuations, markets may face volatility. Investors should use pullbacks as opportunities to invest at better prices or rebalance for diversification.

We favor U.S. large- and mid-cap stocks, particularly quality and cyclical names that could benefit from broadening market leadership beyond mega-cap technology. The U.S. economy’s relative strength, contained inflation, and higher interest rates should support the U.S. dollar, potentially pressuring international large-cap stocks, for which we recommend an underweight allocation.

Sector Recommendations:

- Consumer Discretionary: Likely to benefit from reduced tariff uncertainty and lower tax rates.

- Financials: Positioned to gain from less tariff exposure and a potentially steeper yield curve.

- Health Care: Offers valuation expansion potential, trading at a discount despite sector challenges.

- Technology: Should benefit from lower interest rates plus this is where earnings have continued to impress.

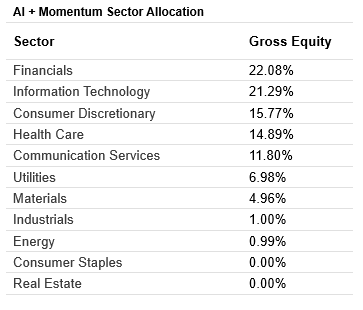

Our AI Target Sector Allocation below is based on AI momentum sector trend analysis and AI news analysis.

In fixed income, U.S. bonds continue to offer higher yields than international bonds, where rising yields reflect concerns over government debt and slowing growth. With many international central banks nearing the end of their rate-cutting cycles, we suggest an underweight allocation to international bonds.

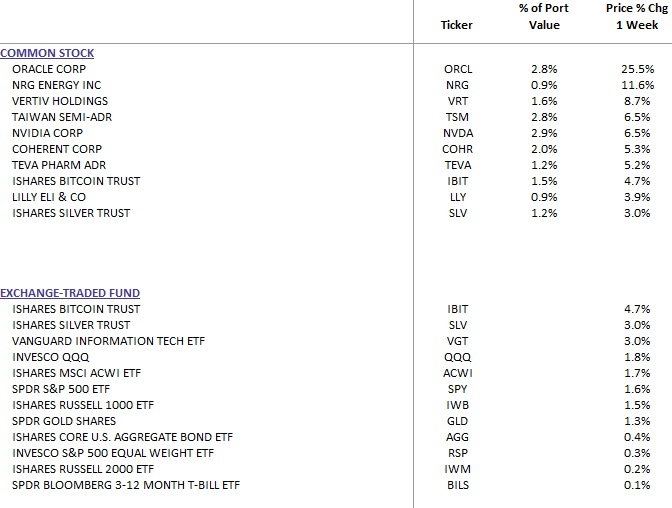

DBS Long Term Growth Top Ten and Benchmark Weekly Performance:

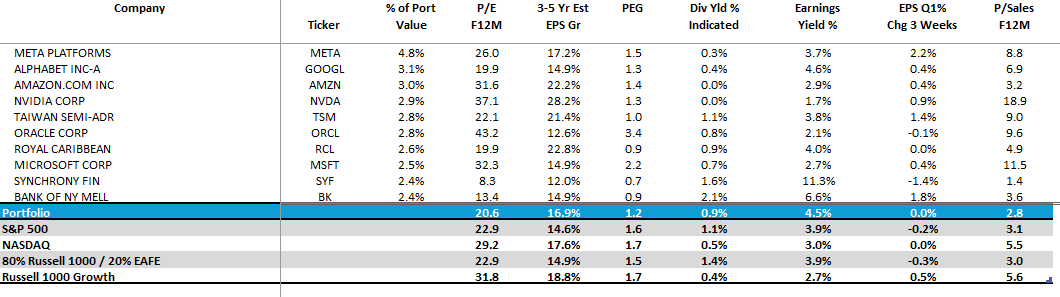

DBS Long Term Growth Portfolio Top Ten Holdings and Valuation Statistics:

The week ahead

The Federal Reserve meeting will be the big event this week, with markets also likely to watch export/import price data, retail sales and housing market indicators closely.