Weekly Commentary for the week ending August 30, 2025

Weekly Market Commentary - September 6, 2025

Market Overview

U.S. equity indexes closed the holiday-shortened week with mixed results, as most indexes posted gains despite a late sell-off on Friday. Stocks rose through Thursday, buoyed by optimism that weaker-than-expected labor market data would prompt the Federal Reserve to cut short-term interest rates at its upcoming meeting. However, sentiment soured later on Friday as concerns emerged that rate cuts alone might not sufficiently stimulate economic growth.

- Nasdaq Composite: Gained 1.14%, driven by strong performances from Apple and Alphabet, which benefited from an antitrust ruling perceived as less severe than anticipated.

- S&P 500 Index: Rose 0.33%, reflecting cautious optimism.

- Dow Jones Industrial Average: Declined 0.32%, underperforming its peers.

- Small-Cap Stocks: Advanced for the week, as these stocks are more sensitive to interest rate expectations.

Labor Market Weakness Fuels Rate Cut Expectations

The U.S. labor market showed significant signs of softening, raising expectations for Federal Reserve intervention:

- Nonfarm Payrolls Report: August saw only 22,000 jobs added, well below estimates of 77,000 and down from July’s revised 79,000. June’s figures were revised to a loss of 13,000 jobs, marking the first negative monthly reading since December 2020. The unemployment rate rose to 4.3%, the highest since 2021.

- ADP Private Payrolls: Reported 54,000 jobs added in August, missing forecasts of 68,000 and down from July’s 106,000.

- Job Openings: July job openings fell to 7.18 million, the lowest since September 2024, with the number of unemployed Americans surpassing available openings for the first time since 2021.

This data drove a sharp increase in the probability of a Federal Reserve rate cut. According to the CME Fed Watch tool, markets priced in a 100% chance of at least a 25-basis-point cut at the September meeting, with a 10% probability of a 50-basis-point cut. Treasury yields also declined, with the 10-year U.S. Treasury note yield dropping to its lowest level since early April.

Manufacturing and Services Sector Updates

- Manufacturing: The ISM Manufacturing PMI for August rose to 48.7% from 48% in July, though it remained below 50%, signaling a sixth consecutive month of contraction. Growth in new orders (New Orders Index up 4.3 points to 51.4%) provided some optimism.

- Services: The ISM Services PMI climbed to 52% from 50.1%, indicating expansion driven by stronger business activity and new orders. Price growth remained elevated but moderated slightly in both sectors.

Implications for the Federal Reserve and Bond Yields

The softening labor market has increased expectations for monetary policy support. Fed Chair Jerome Powell’s recent comments at the Jackson Hole symposium suggested a potential shift in policy if labor market conditions deteriorate further. Markets now anticipate six rate cuts by 2026, potentially lowering the fed funds rate to around 3.0%. We believe the Fed may implement one or two cuts this year and one or two next year, targeting a neutral rate of approximately 3.5%.

Bond market reactions were notable:

- The 2-year Treasury yield fell below 3.5%, reflecting expectations of Fed rate cuts.

- The 10-year Treasury yield dropped below 4.1%, influenced by growth and inflation trends.

- The yield curve steepened, benefiting lenders like large banks by improving margins on long-term lending.

Inflation Outlook

Investors will focus on inflation data next week, with August CPI and PPI reports due before the September 17 FOMC meeting:

- CPI: Headline inflation is expected to rise to 2.9% annually (from 2.7%), while core CPI should hold steady at 3.1%.

- PPI: Headline PPI is forecast to decline to 3.5% from 3.7%, with core PPI dropping to 3.2% from 3.3%.

Both metrics remain above the Fed’s 2% target, partly due to tariff-induced price pressures. However, cooling services inflation, particularly in shelter and rent, could stabilize or reduce overall inflation if labor market weakness persists.

Portfolio Positioning

The S&P 500 has rallied over 25% since April but softening labor data and seasonal volatility in September and October pose risks. Despite these challenges, several catalysts could support markets in the near term:

- Fed Rate Cuts: Lower borrowing costs could stimulate sectors like housing.

- Fiscal Stimulus: The recent U.S. tax bill supports corporate R&D and capital spending.

- Trade Policy Clarity: Reduced uncertainty could encourage corporate investment and hiring.

We view potential market pullbacks as opportunities to position for a stronger year-end and 2026, particularly in sectors poised to benefit from lower rates and fiscal incentives.

Conclusion

The U.S. economy is at a pivotal moment, with a softening labor market and persistent inflation shaping expectations for Federal Reserve action. While near-term volatility is possible, the prospect of rate cuts and supportive fiscal policies provides a constructive backdrop for equities. Investors should remain vigilant, focusing on sectors and companies resilient to economic shifts and positioned for growth in a lower-rate environment.

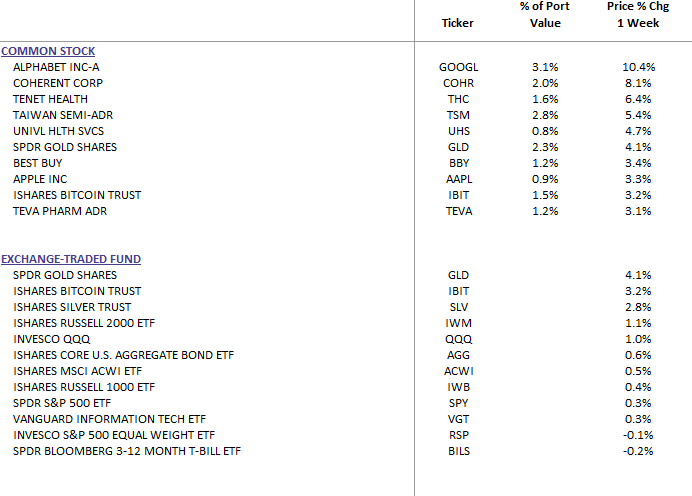

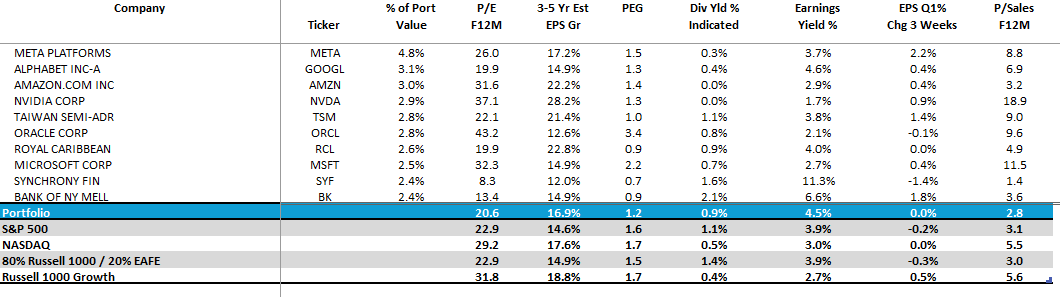

DBS Long Term Growth Top Ten and Benchmark Weekly Performance:

Top 10 Equity Review WealthTrust DBS Long Term Growth Portfolio