Weekly Commentary for the week ending June 21, 2025

Good morning everyone,

Federal Reserve and Economic Outlook: Key Insights for the Second Half of 2025

- Federal Reserve Policy: The Fed maintained interest rates at 4.25%-4.5% for the fourth consecutive meeting, adopting a cautious, wait-and-see approach amid economic uncertainties, including tariffs and geopolitical risks.

- Economic Resilience: Despite a first-quarter GDP contraction of 0.2%, the U.S. economy is rebounding, with the Atlanta Fed estimating 3.4% growth in Q2, averaging 1.6% for the first half of 2025.

- Tariff-Induced Inflation: Core PCE inflation hit a four-year low in April but is expected to rise to 3.1% in 2025 due to tariff-related price hikes, though the Fed views this as temporary.

- Gradual Easing Cycle: The Fed anticipates two rate cuts in 2025, resembling the mid-1990s’ slow easing rather than aggressive recession-driven cuts.

- Geopolitical Risks: Tensions, particularly the Israel-Iran conflict, raise oil price concerns, but structural changes in the U.S. economy limit broader market disruptions.

1. How Resilient Is the U.S. Economy Amid High Rates?

The U.S. economy has shown resilience despite elevated interest rates. After a 0.2% GDP contraction in Q1 2025, driven by a tariff-related surge in imports (up over 50%), the Atlanta Fed projects a 3.4% rebound in Q2, yielding a 1.6% growth pace for the first half. This follows three years of above-trend growth, and a slowdown is expected given macroeconomic uncertainties. The Fed forecasts modest growth in 2025, with acceleration in 2026-2027.

Consumer spending, comprising nearly 70% of GDP, shows mixed signals. May’s headline retail sales fell 0.9%, reflecting a pre-tariff buying surge in payback, particularly in autos. However, core retail sales rose 0.4% month-over-month and 5% year-over-year, indicating cautious but steady consumer activity. The labor market remains under scrutiny for signs of strain.

2. How Will Tariffs Impact Inflation?

Tariffs have had minimal impact on inflation so far, with core PCE at a four-year low of 2.6% in April. Companies have absorbed costs or relied on pre-tariff inventories. However, as inventories deplete, price hikes are expected, with some firms announcing increases starting in June. The Fed raised its 2025 inflation forecast to 3.1% from 2.8%, citing the average effective tariff rate of 15%—the highest since 1936. While goods prices may rise, services inflation is likely to remain stable, and the Fed expects inflation to normalize by 2026.

3. Does the Fed Remain in a Rate-Cutting Cycle?

The Fed’s pause reflects resilience in the economy and inflation concerns, but the easing cycle continues. The median dot plot projects two rate cuts in 2025, one in 2026, and one in 2027, a shallower path than previously anticipated. Markets expect a 3.2% rate by the end of 2026, compared to the Fed’s 3.6%. This cautious approach mirrors the mid-1990s’ gradual easing, avoiding the aggressive cuts of past recessions. Clarity post-summer may allow the Fed to move toward a neutral policy.

4. What Role Do Geopolitical Risks Play?

Geopolitical tensions, notably the Israel-Iran conflict, introduce uncertainty, primarily through energy markets. A potential closure of the Strait of Hormuz could push Brent crude to $90 per barrel, per Citi, though historical data suggests limited sustained impact from similar events. The U.S.’s status as a net petroleum exporter and reduced energy spending as a share of GDP mitigate risks. Over the past 15 years, geopolitical events have not caused lasting market disruptions, and structural economic shifts enhance resilience.

5. How to Position Portfolios for an Uncertain Summer

With a patient Fed and ongoing uncertainties, diversification is key. Equity markets, up 20% since April 8 lows, may face near-term volatility. Bonds offer attractive income, with investment-grade bonds with short term and 7–10-year maturities favored to balance equity volatility. A potential U.S. dollar rally and tariff clarity could drive rotation into U.S. assets, but international equities remain undervalued. Within the U.S., technology, financials and health care show promise. Balanced growth and value investments are recommended.

Market Recap

U.S. equities were mixed last week, with the Dow up 0.02%, S&P 500 down 0.15%, Nasdaq up 0.21%, and Russell 2000 up 0.42%. Big tech was varied, with NVDA gaining 1.3% and GOOGL falling 4.6%. Strong performers included banks, semis, and grocers, while managed care and pharma lagged. Treasuries firmed, with a steepening yield curve, and the Dollar Index rose 0.6%. WTI crude gained 1.1% amid Israel-Iran tensions, while gold fell 1.9%.

Coming next week:

- Notable macro events: Monday AM: June Markit PMI, May Existing Home Sales; Tuesday AM: June Consumer Confidence, June Richmond Fed Index; Wednesday AM: May New Home Sales; Thursday AM: Jobless Claims, May Pending Home Sales, Q1 Final GDP, May Durable Orders; Friday AM: May PCE, June Consumer Sentiment

Conclusion

The Fed’s cautious stance reflects a balancing act between economic resilience, tariff-driven inflation, and geopolitical risks. While growth is moderating, the economy remains robust, and the Fed’s gradual easing cycle should support markets. Investors should prioritize diversified portfolios to navigate uncertainties in the second half of 2025.

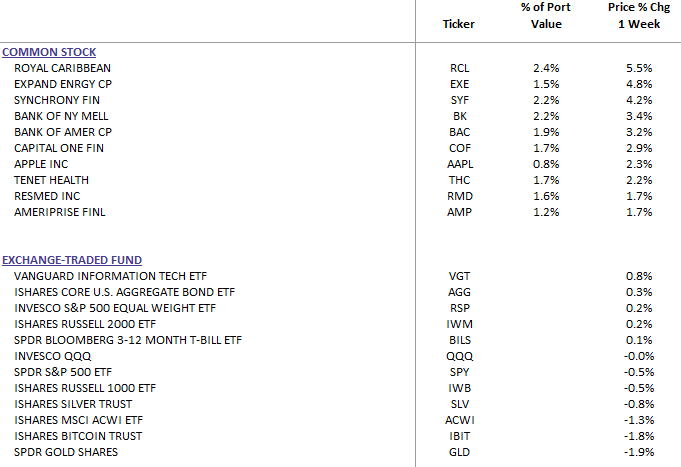

DBS Long Term Growth Top 10 and Benchmark Performance