Weekly Commentary for the week ending June 07, 2025

Weekly Market Commentary: Bracing for a Dynamic Summer

Key Takeaways

- Labor Market Strength: May’s jobs report added 139,000 jobs, beating expectations, with unemployment steady at 4.2%. Wages outpace inflation, though manufacturing and government jobs declined.

- Market Resilience: Global equities hit all-time highs, with the S&P 500 up 20% since April lows, supported by robust earnings, easing trade tensions, and solid economic data.

- Earnings Momentum: S&P 500 Q1 profits grew 12.5% year-over-year, led by tech (+20%), communication services (+33%), and consumer discretionary (+8%). Forward earnings estimates bolster the rally.

- Summer Challenges: Trade deadlines, Fed policy decisions, and debt ceiling talks could spark volatility, testing the market’s strong fundamentals.

- Investment Approach: Overweight equities, with bonds to manage volatility. Balance growth and value to leverage tech’s strength and broadening market leadership.

Labor Market: Steady but Moderating

May’s jobs report alleviated concerns about an economic slowdown, delivering 139,000 new jobs—above forecasts—driven by health care (+62,000) and leisure/hospitality (+48,000). The unemployment rate held at 4.2%, among the lowest since 1948, and wage growth continues to outstrip inflation, supporting consumer resilience amid tariff pressures.

However, cracks appeared: manufacturing lost 8,000 jobs, likely due to trade headwinds, and federal government employment dropped 22,000, the largest decline since 2020. Downward revisions to prior months’ gains and a declining labor-force participation rate, possibly linked to immigration restrictions, point to a gradual cooling. The “low hiring, low firing” trend persists, reinforcing economic stability and supporting the Federal Reserve’s current pause on rate changes.

Market Rally: Fundamentals Drive Gains

The MSCI All Country World Index reached record highs, with the S&P 500 surging 20% since its April 8 low, though it remains 3% shy of its February peak. This rally, defying earlier tariff-related fears, is underpinned by easing trade tensions, resilient economic indicators, and strong corporate profits. Policy shifts toward tax cuts and potential 2026 stimulus fuel optimism, with markets increasingly focused on future policy easing.

Rising valuations signal potential complacency, but earnings growth provides a solid anchor. The rally’s breadth, including gains in industrial metals and semiconductors (+5.9%), reflects robust investor confidence, though decelerating growth may tighten the margin for error.

Earnings: Corporate Resilience Shines

S&P 500 Q1 earnings rose 12.5% year-over-year, marking three consecutive quarters of double-digit growth. Tech (+20%), communication services (+33%), and consumer discretionary (+8%) led, propelled by AI investments and tariff-driven demand. NVIDIA’s return as the world’s most valuable company underscores AI’s market dominance. Forward 12-month earnings estimates hit a new high, reinforcing the rally’s foundation.

While 2025 growth estimates dropped from 14% to 8.5%, 2026 projections remain stable, suggesting a potential reacceleration. Strong corporate performance, particularly in growth sectors, continues to restore investor confidence.

Summer Catalysts: Volatility on the Horizon

The coming months could test the bull market with several pivotal developments:

- Trade Policy: Deadlines on July 9 (U.S. tariff pause) and August 12 (China’s pause) loom, complicated by ongoing talks, new probes in pharma and semiconductors, and a court ruling challenging tariff authority. Extensions are possible, but volatility is likely.

- Federal Reserve: June 18 rate cut odds have plummeted, with September now the focal point for easing. Two cuts are expected in 2025 as unemployment edges up and tariff-driven inflation proves transitory.

- Fiscal Policy: The “Big Beautiful Bill,” including a debt ceiling hike, faces Senate scrutiny. Treasury Secretary Bessent’s mid-July deadline adds urgency, while deficit concerns and political frictions, including Trump-Musk tensions, cloud the outlook.

Sector Dynamics: Opportunities in Focus

The rally’s breadth highlights opportunities in semiconductors (+5.9%), industrial metals, and China tech, driven by AI optimism and trade progress. Small caps and high-beta stocks also outperformed, signaling risk appetite. However, staples, apparel, and housing-related retail lagged, reflecting consumer caution. We recommend balancing mega-cap tech’s earnings strength with value sectors benefiting from broadening market leadership.

Outlook: Resilience Meets Caution

Fundamentals remain supportive, with the Atlanta Fed forecasting 3.8% Q2 GDP growth, a robust labor market, and inflation at a four-year low. Potential 2026 policy easing and moderated trade stances could sustain growth. However, trade, fiscal, and Fed-related headlines may drive volatility.

We recommend equity overweight, with bonds to mitigate volatility. A growth-value balance leverages tech’s earnings power and emerging opportunities in other sectors. The 10-year Treasury yield’s drop below 4.5% offers stability despite deficit and debt downgrade concerns.

Week Ahead Data: Nonfarm payrolls, ISM PMI, CPI, PPI, Michigan Consumer Sentiment.

- Events: Apple WWDC keynote, Treasury auctions ($78B 3Y, $57B 10Y, $34B 30Y), earnings (SJM, ORCL, ADBE, RH).

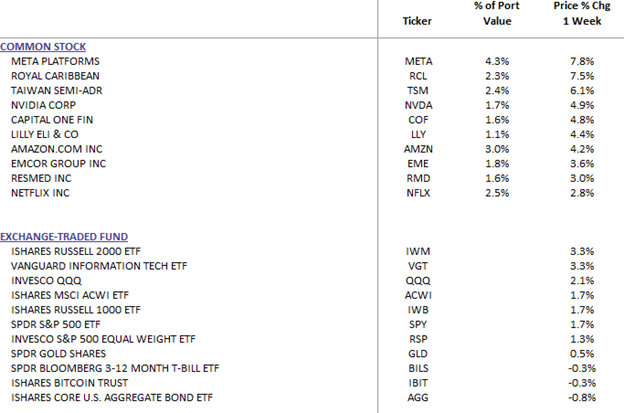

WealthTrust DBS Long Term Growth Top 10 and Index Performances