Monthly Commentary for May 2025

Key Takeaways

- Tech Earnings Shine: S&P 500 earnings grew 12.9% in Q1 2025, surpassing expectations of 7.2%, driven by strong performances in technology and healthcare. NVIDIA’s robust results, despite China trade restrictions, highlighted sustained AI demand.

- Tariff Developments: US-China tariff reductions (from 145% to 30% for 90 days) and a US-UK deal boosted markets, but ongoing uncertainties, including a potential Supreme Court case and stalled China talks, persist.

- Market Performance: The S&P 500 rose 6% in May, with tech, consumer discretionary, and industrials leading. The index is up 0.5% YTD, with historical data suggesting positive 12-month returns after strong May performance.

- Rising Yields: Treasury yields surged, with the 10-year at 4.50% and 30-year at 5.15%, driven by fiscal concerns and hawkish Fed expectations, posing risks to growth.

- Outlook: While corporate resilience and trade de-escalation fuel optimism, investors should stay diversified, balancing tech exposure with financials and healthcare, and monitor trade talks and Fed policy.

Market Overview

May 2025 delivered a robust equity rally, with the S&P 500 and Nasdaq posting their strongest monthly gains since November 2023. The S&P 500 climbed 6%, recovering from a 6% YTD decline through April, and is now up 0.5% for the year. The primary driver was a US-China tariff de-escalation, with the US cutting tariffs on Chinese goods from 145% to 30% for 90 days and China reducing tariffs on US goods from 125% to 10%. Big tech led the charge, with Tesla (+22.8%) and NVIDIA (+24.1%) driving gains in technology (+10.79%), communication services (+9.61%), consumer discretionary (+9.38%), and industrials (+8.63%). Laggards included healthcare (-5.72%), energy (+0.30%), and real estate (+0.85%).

Treasury yields surged, with the 10-year reaching 4.50% and the 30-year hitting 5.15%, the highest since October 2023. The dollar index dipped 0.1%, gold fell 0.1%, Bitcoin futures rose 11%, and WTI crude oil gained 4.4%.

Tech Earnings: A Bright Spot

S&P 500 Q1 earnings grew 12.9%, exceeding forecasts of 7.2%, with technology and healthcare leading. NVIDIA’s $44 billion revenue, despite a $2.5 billion China sales hit, underscored strong AI chip demand, with its data-center business up 73%. Mega-cap tech firms (Microsoft, Meta, Google, Amazon) reaffirmed $330 billion in 2025 AI-focused capital expenditure, easing concerns about tariff impacts or slowing AI investment.

Our Take: Tech’s resilience signals confidence in AI’s long-term returns, reflected in May’s sector gains. Investors should balance tech exposure with sectors like financials and healthcare, which are less tariff-sensitive and poised for growth if economic conditions improve.

Tariff Uncertainty Persists

The US-China tariff cuts and a US-UK deal sparked optimism, but trade headline volatility remains. A federal appeals court reinstated Trump-era tariffs after a May 28 US Court of International Trade block, with a potential Supreme Court appeal looming. Treasury Secretary Bessent noted stalled US-China talks, suggesting high-level intervention may be needed. The White House also delayed 50% tariffs on European allies until July 9 and signaled broader tech restrictions on China, though details are sparse.

Our Take: Tariff uncertainty continues, but investor fatigue may be setting in. Companies have managed costs by building inventories, keeping PCE inflation at 2.1% in April (below 2.2% forecasts). Price pressures may rise in coming quarters, but peak tariff fears are likely behind us. Clarity by July 9 (end of the 90-day tariff pause) or August 12 (China pause) could stabilize markets.

Corporate and Economic Resilience

Despite trade headwinds, corporate margins held firm, supported by a strong labor market and contained inflation. Consumer confidence surged in May, and M&A/IPO activity added optimism. S&P 500 earnings are on track for mid- to high-single-digit growth in 2025, with nine of 11 sectors expected to post positive growth.

Our Take: Earnings resilience and potential Fed rate cuts in late 2025, alongside a 2026 tax bill, could drive growth reacceleration. Markets may price in this optimism early, supporting equities into 2026.

Sector Performance and Outlook

Outperformers:

- Technology (+10.79%): Led by NVIDIA and Tesla, driven by AI and consumer demand.

- Communication Services (+9.61%): Boosted by media and telecom strength.

- Consumer Discretionary (+9.38%): Strong retail and auto performance.

- Industrials (+8.63%): Supported by engineering and construction.

Underperformers:

- Healthcare (-5.72%): Weighed by managed care and pharmaceuticals.

- Energy (+0.30%): Hit by oil price volatility.

- Real Estate (+0.85%): Pressured by rising yields.

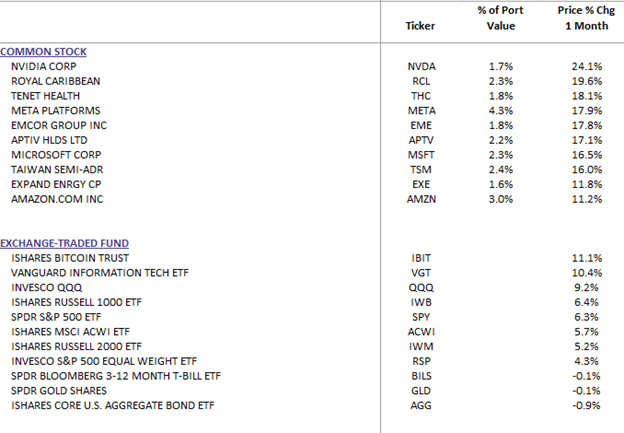

WealthTrust DBS Top 10 Monthly Performers

Outlook: May’s rally defied the “sell in May” adage, with historical data showing positive 12-month returns after a 5%+ May gain (six occurrences since 1980). However, rising yields and tariff risks could drive volatility. Investors should stay diversified, favoring US large- and selected International stocks, and balance tech with financials and healthcare. Monitor nonfarm payrolls, ISM PMI, and trade developments in June.