Weekly Commentary for the week ending May 16, 2025

Weekly Market Wrap: Trade Thaw Fuels Market Rally

Key Takeaways

- Trade Relief Sparks Gains: U.S.-China trade talks in Switzerland secured a 90-day tariff reduction (U.S. tariffs cut from 145% to 30%, China from 125% to 10%), driving a stock market surge, with the S&P 500 up 5.3% and Nasdaq up 7% for the week.

- Economic Data Mixed: April’s CPI rose 0.2% monthly (2.3% yearly, lowest since Feb 2021), PPI fell unexpectedly, retail sales grew 0.1%, but consumer sentiment hit a near three-year low at 50.8, with inflation expectations spiking.

- Market Dynamics: Tech led with NVIDIA (+16%) and Tesla (+17.3%); apparel, semis (+10.2%), and banks outperformed, while managed care (UNH -23.3%) and precious metals lagged. Treasuries weakened, with 10Y yields at 4.5%.

- Tariff Trajectory: Tariffs are trending toward 10%-15% on average, likely causing temporary inflation but not a recession, with growth-supportive policies expected later in 2025.

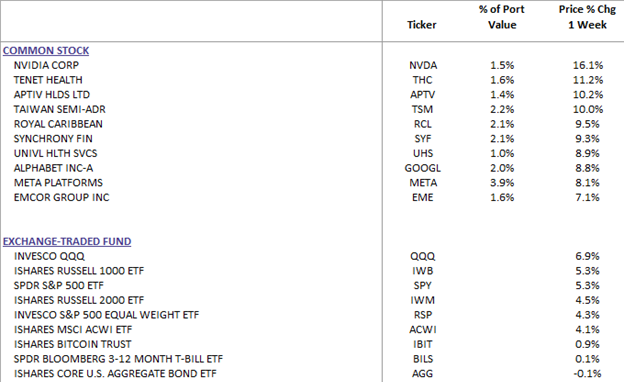

WealthTrust DBS Long Term Growth Performance Top 10 Holdings

Trade De-escalation Drives Rally

Last week’s U.S.-China trade talks in Switzerland yielded a 90-day tariff reduction, slashing U.S. tariffs on Chinese imports to 30% (including a 20% fentanyl-related tariff) and Chinese tariffs on U.S. goods to 10%, with eased restrictions on rare-earth minerals. This rollback from April’s 145% U.S. and 125% China tariffs propelled the S&P 500 (now 3% off its February peak) and Nasdaq (5% from December high) higher, marking their third up week in four. Street economists raised U.S. growth forecasts, cut inflation projections, and boosted soft landing expectations from 37% to 61%, per BofA’s Fund Manager Survey.

The AI sector soared, with NVIDIA’s deal for $18K GB300 Blackwell units with Saudi Arabia’s Humain though Meta’s delayed “Behemoth” AI model raised concerns about AI capex sustainability. The U.S. eased AI-chip trade restrictions, further boosting tech sentiment. Tariff-exposed stocks, high-beta names, retail favorites, apparel, semis (+10.2%), banks, and cruise lines outperformed, while managed care (UNH -23.3%), precious metals miners, grocers, and China tech lagged.

Our Take: The tariff reductions align with a 10%-15% average U.S. tariff scenario, reducing recession risks but sustaining volatility as negotiations continue. China’s 13% share of U.S. imports and 7% of exports (vs. U.K.’s 2% and 4%) underscore the deal’s significance. However, the 16% effective tariff rate—highest since 1937—keeps uncertainty elevated, with Walmart warning of imminent price hikes.

Economic Data: Resilience Meets Sentiment Slump

April’s economic data showed resilience amid trade uncertainty. Headline CPI rose 0.2% monthly and 2.3% yearly (down from 2.4%, the lowest since Feb 2021), with core CPI at 2.8% yearly, below consensus. PPI unexpectedly fell (headline -0.5%, core -0.4%), signaling easing inflation pressures. Retail sales grew 0.1% (below 0.3% expected), with March revised to 1.7%, but the control group dipped 0.2%, reflecting caution. Jobless claims held steady at 229,000. Corporate updates from Mastercard, Visa, and Walmart (+1.6%) highlighted robust spending, with Walmart’s Q1 comps up 4.5% and Q2 guidance at 3.5%-4.5%. Cisco’s AI equipment orders surpassed $1T, and JPMorgan noted early May card spending suggests a 0.5% rise in May retail sales.

However, May’s preliminary Michigan Consumer Sentiment index fell to 50.8, the second lowest since 1952, with year-ahead inflation expectations at 7.3% (highest since Nov 1981) and 5-10Y expectations at 4.6% (highest since Jan 1991). Pre-deal survey timing may skew results, but soft data, like the NFIB small business optimism drop, signal tariff-driven caution. Walmart noted tariff costs will raise prices this month, and American Eagle scrapped FY guidance due to macro uncertainty.

Our Take: Hard data resilience (5.1% yearly retail sales growth, strong wages, solid balance sheets) supports the consumer-driven economy, but soft sentiment and tariff costs may delay broader impacts. Businesses absorbing costs or front-loading inventory could mask the effects until May. Growth-supportive policies and ~50 bp of Fed rate cuts expected by year-end (down from 68 bp) should counter risks, though Fed officials, including Powell, emphasize patience as trade policy effects unfold.

Navigating Policy and Market Volatility

U.S. stocks rebounded from a 19% drop (Feb-Apr), with tech (+8.14%), consumer discretionary (+7.72%), communication services (+6.55%), and industrials (+5.53%) leading sectors, while healthcare (+0.26%) and real estate (+0.90%) trailed. Treasuries weakened, with 2Y yields near 4% and 10Y at 4.5%. Gold fell 4.7% (worst week since Jun 2021), while WTI crude rose 1.6% and Bitcoin futures gained 0.6%. Corporate highlights included Charter’s $34.5B Cox acquisition, Dick’s Sporting Goods’ $2.5B Foot Locker deal, Qatar Airways’ $96B Boeing order, and UnitedHealth’s DoJ probe over Medicare fraud. M&A activity and a thawing IPO market signaled optimism, but Meta’s AI delay and Deere’s tariff-hit guidance tempered AI and industrial enthusiasm.

Policy risks loom large. The 2017 Tax Cuts and Jobs Act expires at year-end, and the reconciliation bill stalled in the House Budget Committee over deficit concerns, jeopardizing passage before Memorial Day. Trump’s push for trade deals with Japan, South Korea, and the EU, alongside his Middle East tour’s AI focus, added positive signals, but the 16% effective tariff rate and fiscal hawk resistance cloud the outlook. Markets expect limited Fed easing, with volatility subdued (VIX and MOVE Index below pre-Liberation Day levels).

Investment Focus: Stay diversified by adding selected oversold tariff specific international stocks, rebalance portfolios to align with long-term goals and overweight U.S. large- and mid-cap stocks, prioritizing quality to leverage U.S. economic strength. Overweight short term & intermediate bonds. Disciplined strategies will help investors navigate tariff, tax, and policy uncertainties while capitalizing on growth opportunities.

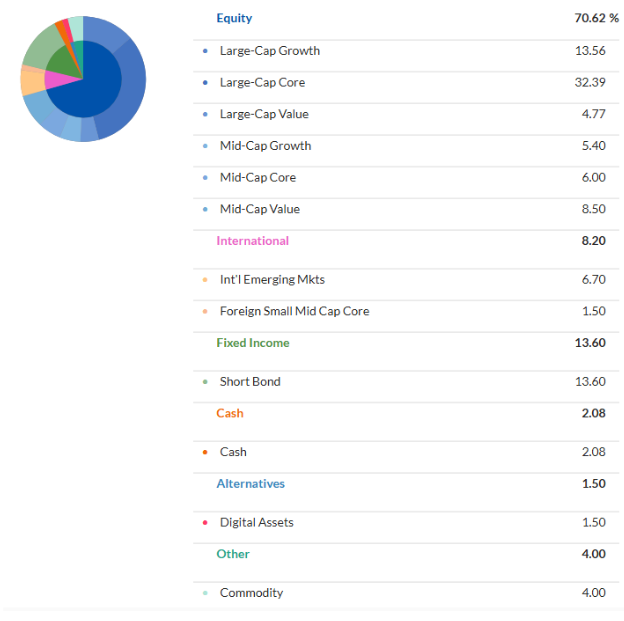

Current Asset Allocation for the WealthTrust DBS Long Term Growth Strategy