Weekly Commentary for the week ending April 19, 2025

Key Takeaways

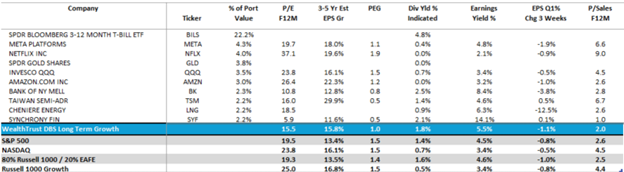

U.S. equities were mostly lower last week, with the S&P 500 down 1.4% and Nasdaq falling 2.6%, marking their third decline in four weeks. Year-to-date, the S&P 500 is down 10.2%, and Nasdaq is off 15.7%. Our WealthTrust Long Term Growth Strategy is down approximately 7% YTD while our WealthTrust Conservative Growth & Income 50/50 Strategy & WealthTrust Total Return 70/30 Strategy are down approximately 3.5% and 5% respectively..

Tariff uncertainty, particularly a 245% tariff hike on select Chinese imports, pressured markets, alongside new semiconductor export restrictions impacting tech stocks like NVIDIA (-8.5%). Fed Chair Powell noted tariffs could boost inflation and slow growth, signaling patience on rate cuts. Bonds offered relief, with the 10-year Treasury yield dropping 0.16% and the U.S. Aggregate Bond Index up 1%. Positive breadth was seen in the equal-weight S&P ETF (+0.42%).

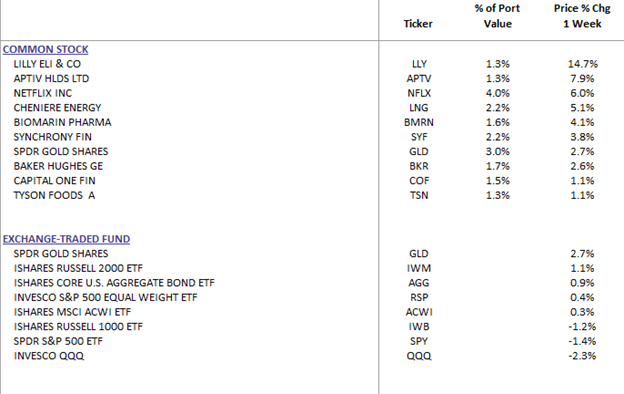

WealthTrust Long Term Growth Portfolio Weekly Top 10

WealthTrust Long Term Growth Valuations Show Significant Positive Statistical Comparisons to Various Indexes!

Portfolio Positioning

Market pullbacks are normal, with 2–3 per year that are common during uncertainty. Long-term investors should avoid market timing. Instead:

- Stay Diversified: Balanced portfolios with bonds, equal-weight equities, and defensive sectors can mitigate volatility.

- Rebalance: Use dips to add quality investments in outperforming sectors like Energy and Financials or oversold sectors such as travel, auto parts etc...

Our WealthTrust Strategies have significant liquidity to accomplish the above buy rebalance scenario.

Below, we analyze tariff scenarios, sector performance, and portfolio strategies amid ongoing trade tensions and mixed economic signals.

Market Movers: Tariffs, Tech, and Fed Policy

Trade tensions dominated, with the White House escalating tariffs on Chinese imports to 245%—far above the expected 145%—prompting China to vow retaliation. U.S.-EU trade talks stalled, though progress was noted with Japan. NVIDIA fell 8.5% after announcing a $5.5 billion charge due to U.S. export license requirements for its H20 AI chips. Fed Chair Powell emphasized tariffs’ inflationary and growth-dampening effects, while President Trump’s push for immediate rate cuts raised questions about Fed independence. Bonds strengthened, with a steepening yield curve and the U.S. Aggregate Bond Index up 1%. The Dollar Index fell 0.6%, while Bitcoin futures (+1.2%), gold, and WTI crude oil (+6.2%) gained.

Sector and Asset Performance

Weakness hit semiconductors, software, apparel, hotels, cosmetics, managed care, agriculture, and insurance brokers. Technology (-3.66%), Consumer Discretionary (-3.23%), and Communication Services (-2.95%) underperformed. Strength emerged in Real Estate (+3.88%), Energy (+3.22%), Consumer Staples (+1.98%), Utilities (+1.88%), Materials (+0.35%), Financials (-0.05%), Industrials (-0.31%), and Healthcare (-1.16%). The equal-weight S&P ETF rose 0.42%, signaling positive market breadth.

Economic and Corporate Highlights

March retail sales rose 1.4% month-over-month, driven by auto sales, but housing starts missed forecasts. Earnings were mixed: TSMC beat expectations despite tariff concerns, while Goldman Sachs, Bank of America, and Citigroup reported strong results. UnitedHealth missed and lowered guidance, impacting managed care. NVIDIA plans U.S.-based AI supercomputer production, while Apple shifts production to India and Vietnam. Netflix set ambitious targets, Pfizer halted an obesity drug, and Intel neared a deal to sell Altera to Silver Lake. Eli Lilly surged on positive GLP-1 data. Citi cut its 2025 S&P 500 forecast, citing tariffs, inflation, and consumer strain, but Goldman Sachs and Deutsche Bank noted low systematic positioning, potentially capping downside risk.

Tariff Scenarios and Impacts

Scenario 1: Moderate Tariffs (Higher Probability)

- Tariffs: Average U.S. tariffs at 10–15%, with elevated rates on China, autos, steel, and aluminum. Negotiations may lower some rates.

- Inflation: Core CPI could rise to 3.5–4% from 2.4%, peaking this year and easing in 2026 (FOMC March 2025 projections).

- Growth: Growth slows to ~1% annualized, with a possible negative quarter but no recession (2018 Fed model).

- Federal Reserve: Likely on hold until H2 2025, with 2–3 rate cuts (FOMC March outlook). Markets price in 4 cuts (CME FedWatch, April 17, 2025).

- Markets: S&P 500 earnings growth in low- to mid-single digits, with flat returns (~10% above current levels). Bond yields range-bound at 4.0–4.5%. Equal-weight S&P 500 may outperform tech-heavy index.

Scenario 2: High Tariffs (Lower Probability)

- Tariffs: Average U.S. tariffs near 25%, with high rates on China and key sectors.

- Inflation: Core CPI could hit 5%.

- Growth: Recession likely, with negative growth.

- Federal Reserve: 4–5 rate cuts, starting sooner.

- Markets: S&P 500 could enter a bear market, that is when the S&P 500 is down 20%+ from highs. 10-year yields may fall below 4.0% as investors seek safety.

Offsetting Factors

- Fiscal Policy: Proposed tax reform and deregulation could boost sentiment and provide stimulus.

- Monetary Policy: Fed rate cuts in 2025 could lower borrowing costs, supporting spending.

- Corporate Adaptation: Innovation and productivity gains may emerge over time.

These suggest 2026 could see improved growth despite near-term volatility.

Weekly Market Stats (as of April 17, 2025)

- Dow Jones: 39,142 (-2.7% week, -8.0% YTD)

- S&P 500: 5,283 (-1.5% week, -10.2% YTD)

- Nasdaq: 16,286 (-2.6% week, -15.7% YTD)

- 10-yr Treasury Yield: 4.33% (-0.1% week)

- Bonds (U.S. Agg ETF): $97.87 (+0.9% week, +2.2% YTD) Source: FactSet

The Week Ahead

Key releases include April PMI Composite, March building permits, home sales, durable goods orders, and jobless claims. Earnings from Tesla, Alphabet, Amazon, Boeing, and Merck are due.