Weekly Commentary for the week ending September 27, 2025

Weekly Market Update: Stocks React To Cautious Fed Commentary

Market Overview

Major U.S. stock indexes closed the week lower, influenced by hawkish commentary from Federal Reserve officials that tempered investor expectations for further interest rate cuts. The Nasdaq Composite saw the largest decline, dropping 0.65%, while the Russell 2000 Index recorded its first weekly loss since early August. The S&P Mid-Cap 400 and S&P 500 Indexes also fell, whereas the Dow Jones Industrial Average remained largely unchanged. Within the S&P 500, the energy sector outperformed, rising alongside oil prices following President Donald Trump’s call for European Union nations to halt purchases of Russian oil and gas. Most other sectors experienced declines.

The cautious sentiment was driven by remarks from Fed officials signaling a slower approach to monetary policy easing. On Tuesday, Fed Chair Jerome Powell highlighted the economy’s “challenging situation,” citing near-term upside inflation risks and downside labor market risks, while noting that “equity prices are fairly highly valued.” St. Louis Fed President Alberto Musalem and Atlanta Fed President Raphael Bostic also expressed concerns about persistent inflation, cautioning against further policy easing.

Inflation and GDP Updates

The Bureau of Economic Analysis (BEA) reported that August’s core personal consumption expenditures (PCE) price index, the Fed’s preferred inflation measure, rose 0.2% month-over-month, in line with estimates and July’s revised figure. On a year-over-year basis, the index increased 2.9%, consistent with July. Personal spending and income exceeded expectations, rising 0.6% and 0.4%, respectively.

The BEA’s third estimate for second-quarter GDP growth showed the U.S. economy expanded at an annualized rate of 3.8%, up from the prior estimate of 3.3%, driven primarily by stronger consumer spending. This growth rate significantly exceeds the U.S. trend growth of 1.5% to 2.0%.

Business Activity

S&P Global’s Flash U.S. Manufacturing PMI for September fell to 52.0 from 53.0 in August, slightly above consensus estimates of 51.9. The Services PMI also declined to 53.9 from 54.5, aligning with expectations. Despite the slowdown, both readings remain above 50, indicating continued expansion. Businesses’ expectations for output over the next 12 months reached a four-month high. According to Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, third-quarter PMI data suggest the U.S. economy is growing at a 2.2% annualized rate.

Housing Market Recovery

The housing market showed signs of improvement. The Census Bureau reported that August new single-family home sales surged over 20% from July to a seasonally adjusted annual rate (SAAR) of 800,000, surpassing expectations of 650,000—the highest level since January 2022. Existing home sales, reported by the National Association of Realtors, remained stable at a SAAR of 4 million, slightly above estimates of 3.96 million. The median existing home price rose 2% year-over-year to $422,600, marking 26 consecutive months of annual price increases.

Treasury Yields and Rate Expectations

U.S. Treasuries posted negative returns, with short- and intermediate-term yields rising while long-term yields held steady. Declining expectations for rate cuts, fueled by stronger-than-expected economic data and hawkish Fed commentary, drove the yield increases. Bond prices and yields move inversely.

Economic Resilience

Recent economic data underscore a robust U.S. economy. Second-quarter GDP growth was revised to 3.8%, surpassing forecasts of 3.3%. Consumer spending, which accounts for roughly 70% of economic growth, rose 2.5%, exceeding expectations of 1.7%. August personal income and real personal spending both increased by 0.4%, outperforming forecasts of 0.3% and 0.2%, respectively. The Atlanta Fed’s GDP Now model projects third-quarter GDP growth at 3.9%, supported by consumption growth of 3.4%. The Bloomberg Economic Surprise Index also indicates a recent uptick in positive economic surprises.

Labor Market and Inflation Outlook

The labor market shows signs of stabilization. Weekly initial jobless claims fell below expectations last week, suggesting that the post-Labor Day spike was an anomaly. The upcoming October 3 nonfarm jobs report will provide further clarity. On inflation, August PCE data showed headline inflation at 2.7% and core inflation at 2.9% year-over-year, in line with forecasts but above the Fed’s 2.0% target. Inflation is expected to rise gradually, particularly in goods, due to tariff-related price pressures, though cooling services inflation may offset this. The Fed’s next interest rate decision on October 30 will hinge on these trends.

Key Risks

- Market Overextension: The S&P 500 has risen over 30% since April without a significant pullback. With October historically volatile and third-quarter earnings season approaching, a correction is possible, though a severe downturn is unlikely given economic strength.

Government Shutdown Risk: A potential U.S. government shutdown looms on October 1 if Congress fails to pass funding measures. While historical shutdowns have caused short-term economic slowdowns followed by quick recoveries, related headlines could increase market uncertainty.

Portfolio Positioning

The U.S. economy remains resilient, supported by strong consumer spending, but near-term risks like a potential government shutdown or market correction warrant caution. Investors should:

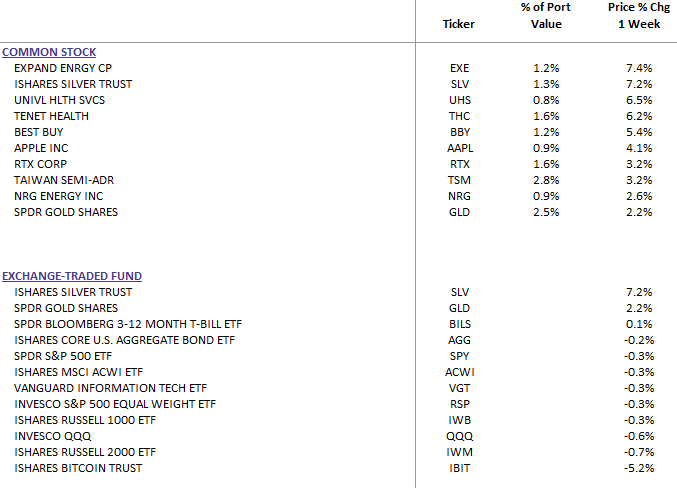

- Diversify Investments: Maintain overweight positions in U.S. large-cap and mid-cap stocks across growth and value sectors (e.g., technology, consumer discretionary, financials, health care) and include U.S. investment-grade bonds for stability, (BILS - three-to-12-month treasuries). Gold & Silver responds well during uncertain times.

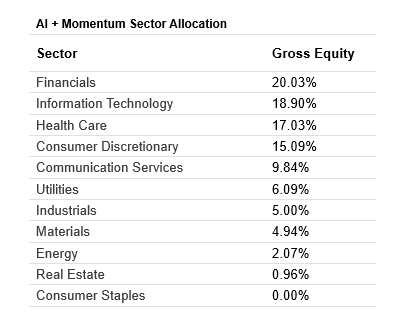

Our AI Target Sector Allocation below is based on AI momentum sector trend analysis and AI news analysis.

- Reassess Cash Holdings: With markets potentially facing a correction, consider opportunities to deploy cash into equities or bonds to align with long-term goals, as cash typically underperforms other asset classes over time.

The Week Ahead

Key economic releases include PMI, labor market, and housing data, which will provide further insight into economic trends.

DBS Long Term Growth Top Ten and Benchmark Weekly Performance:

The top performers exhibit the benefit of having a diversified portfolio.

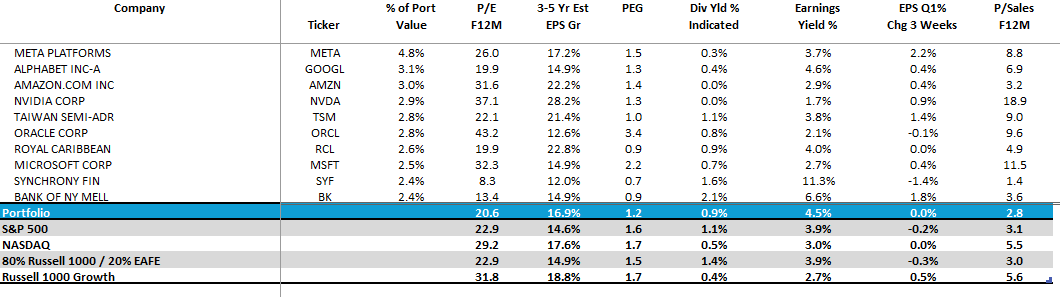

DBS Long Term Growth Portfolio Top Ten Holdings and Valuation Statistics: