Weekly Commentary for the week ending September 20, 2025

Weekly Market Commentary, Fed Resumes Rate Cuts: Uncertainty Ahead

Market Overview

Major U.S. stock indexes reached record highs this week, buoyed by the Federal Reserve’s decision to lower short-term interest rates for the first time since December 2024. The Russell 2000 Index, representing small-cap stocks sensitive to interest rate changes, surged 1.96%. The Nasdaq Composite gained 2.21%, while the S&P 500 and Dow Jones Industrial Average rose 1.22% and 1.05%, respectively. The Fed’s 25-basis-point rate cut, coupled with expectations for further easing, fueled optimism, though rising long-term Treasury yields and trade developments added complexity to the market narrative.

Federal Reserve’s Rate Cut and Outlook

The Fed’s two-day policy meeting concluded Wednesday with a widely anticipated 25-basis-point (0.25%) cut to its policy rate, marking the first reduction in nine months. New Fed Governor Stephen Miran dissented, advocating for a larger 50-basis-point cut. The decision was driven by concerns over a softening labor market, with the Fed noting that “job gains have slowed” and “downside risks to employment have risen.” The average three-month run rate for private nonfarm payrolls slowed to 29,000, a level often seen before recessions, and job openings fell below the number of unemployed Americans for the first time in nearly a decade (excluding the pandemic).

The Fed’s Summary of Economic Projections signaled more aggressive easing ahead, with most policymakers expecting an additional 50 basis points of cuts by year-end—doubling June’s projections. Expectations for 2026 and 2027 also increased, though 40% of FOMC members forecast no further cuts at the October or December meetings. Fed Chair Jerome Powell emphasized a data-dependent approach, noting that “forecasters are a humble bunch” amid uncertainties like trade policy shifts. Markets are pricing in a 90% chance of cuts in both upcoming meetings, reflecting optimism for continued easing.

Economic Data: Retail Sales and Housing

August retail sales rose 0.6% month over month, exceeding estimates of 0.2% and matching July’s upwardly revised figure. This marked three consecutive months of gains, signaling resilient consumer spending, which represents 70% of the economy. The Atlanta Fed’s GDP model tracks a robust 3.3% annualized growth for Q3. However, housing data disappointed: August housing starts fell 8.5% to a seasonally adjusted annual rate of 1.31 million, below estimates of 1.37 million. The National Association of Home Builders’ Housing Market Index remained at 32 in September, missing expectations for improvement, though sales expectations for the next six months rose due to lower mortgage rates.

Treasury Yields and Bond Market

U.S. Treasuries saw negative returns as long- and intermediate-term yields rose, while short-term yields held steady. T. Rowe Price traders attributed this to anticipation of the Fed’s rate cut and Powell’s hawkish post-meeting comments. The 10-year Treasury yield traded at the lower end of the expected 4%–4.5% range for 2025.

Trade Developments

A Friday call between Presidents Trump and Xi Jinping made headlines, with Trump announcing progress on U.S. ownership of TikTok and further trade negotiations. These developments suggest a potential easing of trade policy uncertainty, which could support economic growth, though tariff-related inflation risks remain a concern.

Equity Market Outlook

The combination of falling interest rates and potential tax cuts creates a supportive environment for U.S. growth over the next 12 months. We continue to favor large- and mid-cap stocks, particularly in quality and cyclical sectors like technology, consumer discretionary, financials, and health care, which could benefit from lower rates and broader market leadership. However, volatility could rise around key data releases due to elevated index levels and mixed economic signals.

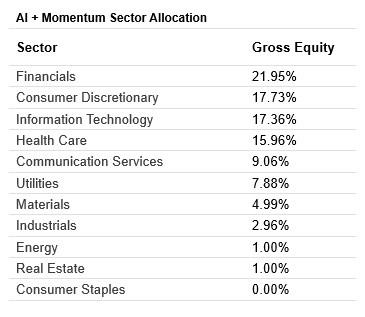

Our AI Target Sector Allocation below is based on AI momentum sector trend analysis and AI news analysis.

Risks to Monitor

Two factors could disrupt the Fed’s easing path: a reacceleration in employment, reducing the need for cuts, or a spike in inflation driven by tariffs. While tariff costs have so far been absorbed by U.S. firms, faster pass-through to consumers could complicate the Fed’s efforts to balance inflation and employment goals.

The Week Ahead

Key releases include PCE inflation, consumer trends, housing data, economic growth updates, and PMI data, which will shape expectations for the Fed’s next moves.

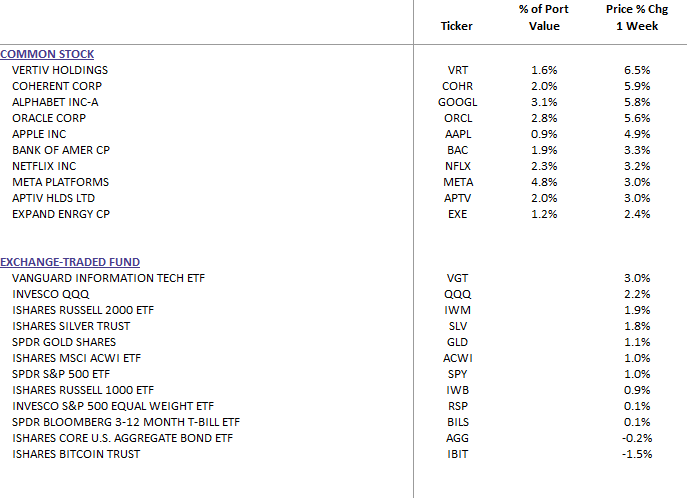

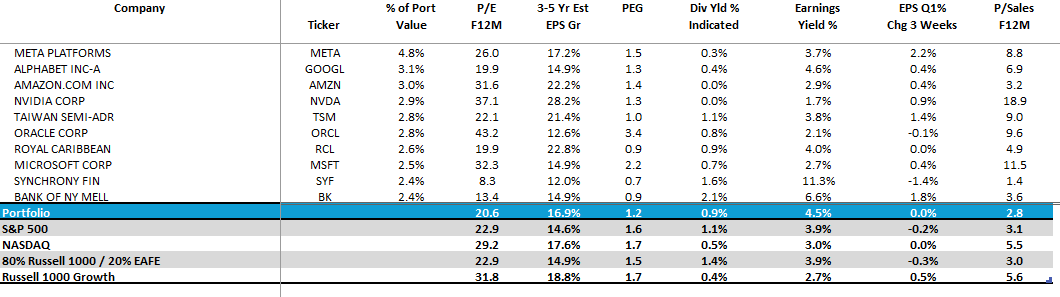

DBS Long Term Growth Top Ten and Benchmark Weekly Performance:

Top 10 Equity Review WealthTrust DBS Long Term Growth Portfolio