Weekly Commentary for the week ending October 18, 2025

The market rally is showing signs of weariness, yet strong quarterly bank earnings provide initial support.

U.S. stocks advanced this week, rebounding from a sharp sell-off the prior Friday, when the S&P 500 Index experienced its worst day since April. The week was marked by volatility, with markets starting positively after U.S. and China representatives signaled a de-escalation in trade tensions. Dovish comments from Federal Reserve officials and deal announcements in the artificial intelligence (AI) sector further supported early-week gains in stock indexes.

Earnings Season Kicks Off

Earnings season began in earnest on Tuesday, with major banks like JPMorgan Chase, Citigroup, and Wells Fargo reporting better-than-expected third-quarter results. As of Friday morning, approximately 12% of S&P 500 companies had reported, with 86% beating consensus earnings estimates, according to FactSet. This strong performance helped buoy investor sentiment throughout the week.

Regional Banking Concerns

On Thursday, stocks relinquished some gains after two regional banks disclosed issues with loans tied to allegations of fraud. Coupled with recent bankruptcies of a subprime auto lender and an auto parts company, these developments raised concerns about rising credit market risks and the health of the regional banking sector. The CBOE Volatility Index (VIX), a measure of expected market volatility over the next 30 days, surged to its highest level since April on Thursday, reflecting heightened investor unease.

Federal Reserve Signals and Economic Indicators

Powell and Fed Officials on Rate Cuts

Federal Reserve Chair Jerome Powell, speaking on Tuesday, reiterated the central bank’s focus on downside risks to employment, signaling that additional short-term interest rate cuts are likely this year. This stance was echoed by Fed officials Christopher Waller and Stephen Miran, who supported further rate reductions despite inflation remaining above the Fed’s target. The Fed’s Beige Book, released Wednesday, reported stable economic activity with mixed regional conditions: steady employment, rising wages, declining consumer spending, and increasing prices. Notably, more employers reported reducing headcounts through layoffs and attrition.

Treasury Yields and Bond Markets

U.S. Treasuries posted positive returns as yields declined across most maturities. The benchmark 10-year U.S. Treasury note yield fell to its lowest level since October 2024 on Thursday, driven by banking concerns, the ongoing federal government shutdown, and dovish Fed commentary. Municipal bonds advanced amid strong investor demand, with T. Rowe Price traders noting robust absorption of new issuances. Investment-grade corporate bonds outperformed Treasuries, though regional bank bonds underperformed on Thursday.

Key Market Headwinds

After a 35% rally in the S&P 500 without a significant pullback, markets may be due for a pause. Three primary concerns could challenge the rally:

1. Trade Tensions and Tariffs

Ongoing U.S.-China trade tensions, particularly around tariffs, remain a source of uncertainty. While the administration’s threat of 100% tariffs on Chinese goods has softened, with President Trump acknowledging their unsustainability and confirming a meeting with Chinese President Xi later this month, risks persist. The upcoming Consumer Price Index (CPI) released on October 24 is expected to show headline inflation rising to 3.1% annually, up from 2.9% last month, partly due to tariff-related pressures. However, stabilizing tariff rates could moderate inflation in 2026.

2. U.S. Government Shutdown

The U.S. government shutdown, now in its third week, continues to weigh on markets. Repeated failed Senate votes to fund the government through November 21 have raised concerns about economic disruption. The 2018 shutdown, lasting 35 days, reduced quarterly GDP growth by 0.4%, according to the Congressional Budget Office. Despite strong U.S. economic growth—projected at 3.9% for Q3 by the Atlanta Fed’s GDP Now tracker—prolonged shutdowns could disrupt key agencies like the TSA and air-traffic control, impacting economic data transparency and market stability.

3. Regional Banking Sector Risks

Concerns emerged around the credit quality of regional banks, with Zions Bank and Western Alliance reporting loan fraud losses tied to specific investment funds. While the KRE regional banking index saw a sharp pullback, larger banks and consumer finance firms show little evidence of widespread credit deterioration. Five of the eight S&P 500 diversified banks reporting Q3 earnings beat expectations, and default rates remain low. If these issues remain isolated, the sector’s weakness may be short-lived, but investors will likely monitor the space closely as the economic cycle matures.

Market Signals and Outlook

Market weariness is evident in several indicators:

- VIX Volatility Index: The VIX climbed above 20, up from the mid-teens, signaling increased investor caution.

- Market Swings: The S&P 500 logged its first 2% single-day drawdown since April on October 10, with larger intraday swings.

- Safe-Haven Demand: U.S. Treasury yields, particularly the 2-year yield, hit their lowest level since 2022, reflecting a flight to safety amid uncertainty.

Despite these challenges, a deep or prolonged bear market seems unlikely. Supportive factors include:

- Federal Reserve Policy: Continued rate cuts are expected to ease borrowing costs.

- Tax Policy: The upcoming U.S. tax bill is likely to support capital expenditures and R&D spending.

- Corporate Earnings: Q3 earnings are exceeding expectations, with 85% of reported S&P 500 companies posting positive surprises. Full-year 2025 earnings growth is projected at 10.5%, with 2026 potentially reaching 13%, broadening beyond tech and AI sectors.

Portfolio Positioning

Investors can navigate volatility with three strategies:

- Rebalancing: Realign portfolios to strategic allocations.

- Diversifying: Reduce concentration in high-flying sectors like tech and AI, reallocating to sectors with catch-up potential.

- Opportunistic Investing: Prepare a list of quality investments to capitalize on pullbacks, complementing dollar-cost averaging with targeted purchases.

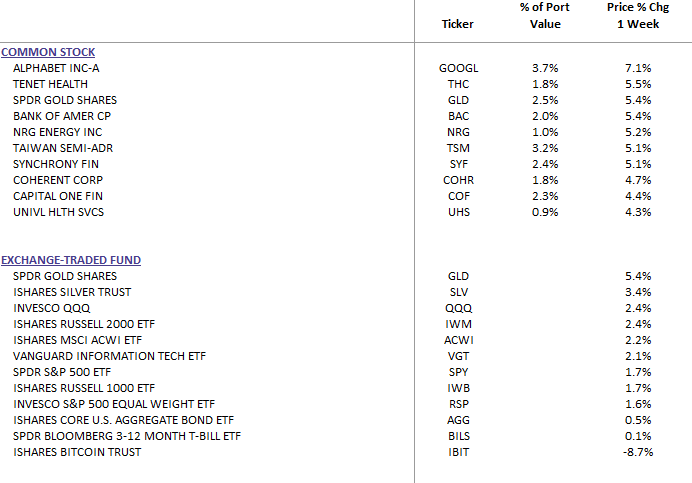

Early last week, we began to selectively reduce our exposure to technology and sold our Bitcoin positions while gathering cash/short term treasuries, in order to take advantage of any market volatility.

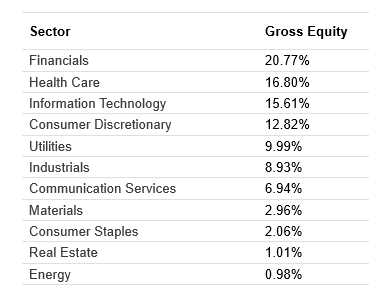

Our AI Target Sector Allocation below is based on AI momentum sector trend analysis and AI news analysis

As illustrated, information technology has drifted down from 18.07% in our previous week's Target Sectors Allocation.

The Week Ahead

Key economic releases include CPI inflation, S&P PMI, consumer sentiment, and home sales. The government shutdown may delay some government-sourced data. Markets may remain choppy, but sound economic fundamentals suggest pullbacks are opportunities to rebalance, diversify, and add quality investments.

DBS Long Term Growth Top Ten and Benchmark Weekly Performance:

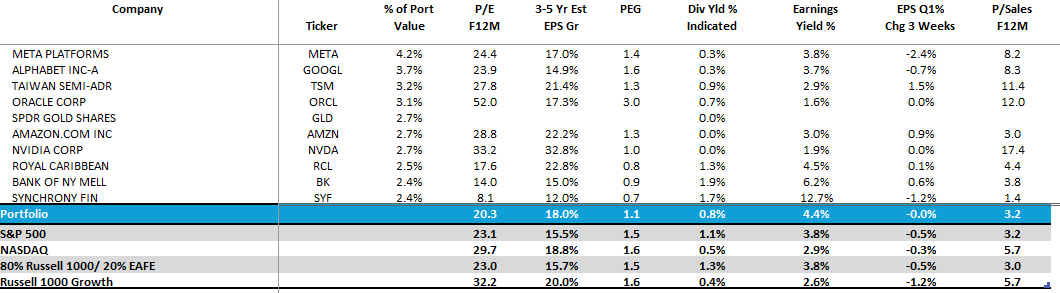

DBS Long Term Growth Portfolio Top Ten Holdings and Valuation Statistics: