Weekly Commentary for the week ending November 29, 2025

Thanksgiving week always feels like the moment the year catches its breath. Markets were closed Thursday; trading floors were half-empty all week, and yet when the dust settled on Friday afternoon, the scoreboard looked remarkably strong. The S&P 500 was lower for November by only (0.6%) but for the week was up by 3.7% . The Russell 2000 — the overlooked kid's brother all year — suddenly sprinted 5.5% in four days. The Nasdaq shook off its early-month wobble and reminded everyone that the AI story still has plenty of chapters left. In short, the last week in November felt like the market said, “Yes, there’s noise, but we’re still climbing.”

Let’s walk through the month together.

The story started with a scare. Mid-October tariff headlines and a government shutdown that delayed almost every major data release had everyone bracing for turbulence. Instead, what finally trickled out was the kind of “Goldilocks-not-dead” data the bond market loves: September retail sales up a sleepy 0.2%, control-group sales actually down a tick, producer prices almost yawningly tame, and weekly jobless claims falling to a seven-month low. Translation: the economy is cooling, but it’s not falling off a cliff. That’s exactly the recipe that keeps a December Fed cut alive (markets are now back above 70% odds after Chair Powell tried to talk them down.

Corporate America, meanwhile, keeps flexing. Third-quarter earnings didn’t just beat the lowered bar — they crushed the bar that existed back in July. Profits grew 11.4% year-over-year, margins are still hanging out near record territory, and analysts have been in a constant game of catch-up, lifting full-year 2025 estimates from 9.5% to 10.9% and already penciling in 14% growth for 2026. That’s the quiet fuel that has allowed the S&P 500 to deliver its third straight double-digit year — about 17.8% so far — even after the April correction that felt like a very difficult near-term experience at the time.

Small caps finally got their moment this week. When rate-cut odds swing, the Russell 2000 swings harder. Five-and-a-half percent in a holiday week is the kind of move that reminds you why lower rates matter more to a highly leveraged regional bank or industrial than they do to a cash-rich mega-cap tech titan.

Overseas, the picture brightened too. European indices hit records on the back of AI and semiconductor strength, and Chinese stocks staged a dramatic late-month rally on fresh stimulus promises and whispers of a U.S.-China thaw. Emerging markets won the month by a mile (+4.2%).

Bonds played their part gently. The 10-year Treasury ended November at 4.08% , and the holiday week was near 4.02%. Nothing dramatic, but every basis point lower is another gift to duration and to anyone refinancing a mortgage (30-year fixed rates have slipped to about 6.4%). Credit spreads widened a hair, yet investment-grade and high-yield still managed small gains — risk appetite never really left the building.

And then there are the six things that, if you zoom out far enough, make 2025 feel like a year to remember rather than regret:

- Stocks just kept working — U.S. large caps up mid-teens, international stocks actually doing better.

- The recession that everyone spent 2024 and early 2025 pricing in never showed up. A tariff-induced Q1 contraction turned into solid rebounds in Q2 and Q3.

- Companies figured out how to make money even with higher input costs — absorbing most of the tariff hit and still expanding margins.

- AI went from buzzword to actual capital spending, actual productivity tailwind, actual earnings driver.

- The Fed pivoted without breaking anything, and inflation — helped by $65 oil — is drifting lower without the economy stalling.

- Fixed-income investors are earning 4%+ on “risk-free” money for the first time in fifteen years. Real yields are positive again.

December now stretches out in front of us like the final lap of a race we’re leading. History says it’s usually a good one: the S&P 500 has averaged a 1% gain in December over the past thirty years and has been positive about 70% of the time. Portfolio managers chase performance, bonuses get spent, sidelined cash finally comes off the sidelines. Last week, we began deploying some of our liquid reserves, adding a significant position in a Mid Cap ETF, VO. We do not believe that the recent volatility has subsided all together and will continue to provide significant buying opportunities in the near future.

Of course, risks haven’t vanished. Valuations are full, services inflation is sticky, and the tariff playbook for 2026 is still being written. But the dominant drivers — growth, earnings, and gradually easier financial conditions — are still pointed in the right direction.

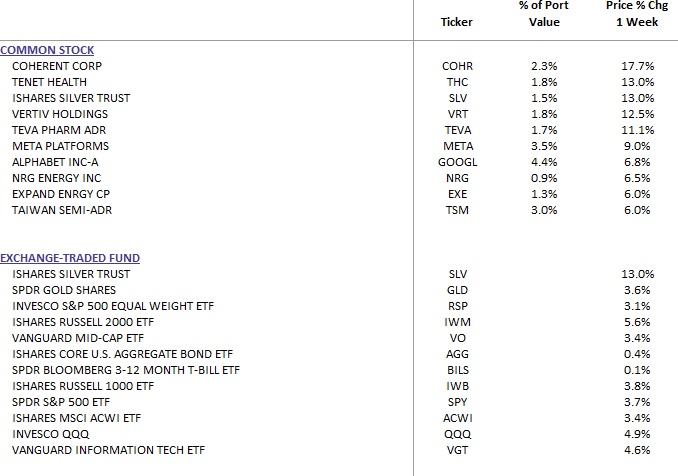

DBS Long Term Growth Top Ten and Benchmark Weekly Performance:

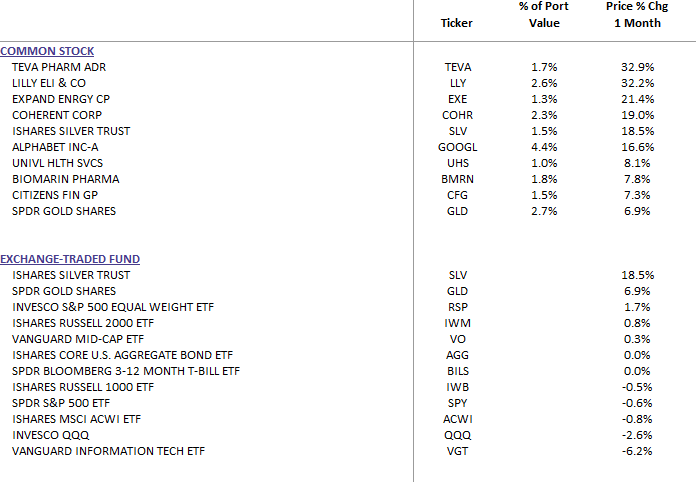

DBS Long Term Growth Top Ten and Benchmark Monthly Performance:

DBS Long Term Growth Performance is up approximately 22.5% Year to Date.

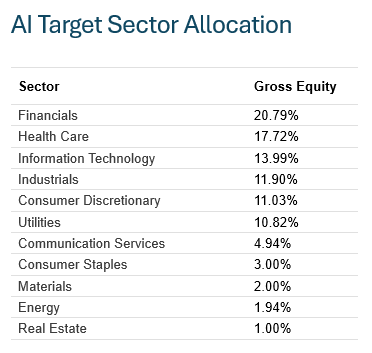

Our AI Target Sector Allocation below is based on AI momentum sector trend analysis and AI news analysis.

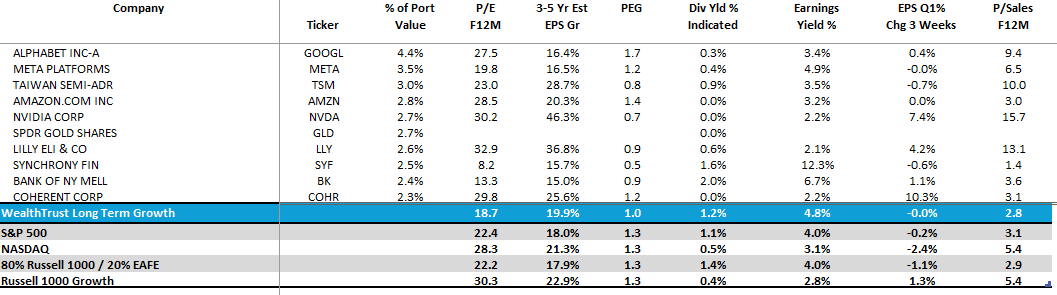

DBS Long Term Growth Portfolio Top Ten Holdings and Valuation Statistics: