Weekly Commentary for the week ending November 22, 2025

Rude Awakening After the Quiet

Despite a string of generally solid corporate earnings and a delayed-but-better-than-feared September jobs report, U.S. equities closed the week firmly in the red. The sell-off felt less about any single disappointing headline and more about a collective pause for breath after one of the steepest and steadiest rallies in modern memory. Two intertwined anxieties dominated trading-floor conversations: whether stock valuations—especially in technology—had run too far ahead of fundamentals, and whether the trillions of dollars being poured into artificial intelligence infrastructure will ever generate the profits needed to justify the spending.

The damage was most pronounced in large-cap growth and technology names. The tech-heavy Nasdaq Composite fell the most among major indexes, while the S&P Midcap 400 and Russell 2000 held up relatively better but still posted losses. By Friday’s close, the benchmark S&P 500 sat roughly 4.4% below the all-time high it printed in late October. A sharp intraday rebound on Friday—fueled partly by dovish comments from New York Fed President John Williams—trimmed what had threatened to become an even uglier weekly decline.

NVIDIA: Good News That Somehow Felt Like Bad News

If there was a single moment that crystallized the week’s uneasy mood, it came on Thursday. NVIDIA—the largest company in the S&P 500 by market cap and the undisputed poster child of the AI boom—reported record quarterly revenue that handily beat estimates, along with fourth-quarter guidance that also topped consensus. Demand for its data-center GPUs remains insatiable.

Markets initially cheered: the S&P 500 opened more than 1% higher. Then the sentiment flipped. By the close, NVIDIA shares were down 3%, dragging the broader market with them. Traders could point to no obvious negative catalyst in the earnings release itself. The reversal appeared to be a resumption of the profit-taking and skepticism that had already weighed on AI-related names in the days leading up to the report.

Beneath the surface, two subtle concerns seem to be gnawing at investors:

- Growth, while still torrid, is expected to decelerate from the triple-digit year-over-year rates seen in recent quarters to merely “very strong” in 2026 and beyond. For a market that had priced in perpetual exponential expansion, even a modest slowdown feels like disappointment.

- The sheer scale of capital expenditure across the tech ecosystem is starting to raise eyebrows. Companies are borrowing, issuing equity, and shifting toward more asset-heavy business models to fund AI build-out. Margin compression and balance-sheet leverage are no longer hypothetical risks—they’re showing up in credit-default-swap spreads (Oracle’s widened noticeably this week) and in forward guidance commentary.

None of this means the AI investment thesis is broken. Near-term demand signals remain robust, and the leading players continue to post earnings growth that few other sectors can match. But the margin of safety has clearly narrowed, and the market is no longer willing to award unlimited valuation multiples.

Labor Market Data Finally Arrives—Six Weeks Late

Thursday also brought the long-delayed September employment report, a casualty of the longest government shutdown on record. Nonfarm payrolls surprised to the upside at +119,000—far better than the sub-50,000 prints seen over the summer and well above subdued expectations. Revisions, as usual, went the other way, and the separate household survey showed the unemployment rate ticking up to 4.4%, its highest since 2021.

The October employment report has been canceled entirely, and the November report won’t land until December 16—six days after the Fed’s next policy decision. The October CPI reading is also missing in action. In short, policymakers are being asked to calibrate monetary policy with one hand tied behind their back.

The December Rate-Cut Rollercoaster

Market-implied odds of a December rate cut have been on a wild ride: near 100% in late October, down to 30% early last week, then rebounding to roughly 70% by Friday after John Williams struck a dovish tone.

The October FOMC minutes revealed a committee that is increasingly uncomfortable with the idea of cutting rates aggressively while core inflation remains stuck around 3%—well above the 2% target—and the labor market, while cooling, is hardly screaming for help. Several participants worried aloud that further easing could risk re-anchoring inflation expectations higher.

Longer term, we still believe the Fed will continue to bring the policy rate lower as it unwinds the post-pandemic tightening cycle. But the terminal rate may stop closer to 3.25%–3.50% than the sub-3% level currently priced into the curve. That modest hawkish tilt represents a potential headwind for the most interest-rate-sensitive corners of the equity market (small caps, real estate, utilities), even if stronger growth compensates elsewhere.

Bonds Catch a Bid, Credit Holds Its Breath

Falling Treasury yields provided a tailwind for fixed income. The 10-year note ended the week around 4.35%, down roughly 15 basis points from its recent peak. Investment-grade corporates generated modestly positive returns but lagged Treasuries on the week. High-yield bonds gave back ground, with lower-quality issues bearing the brunt of equity-related risk-off sentiment.

It Was Quiet…

For months, the market had enjoyed an almost eerie calm. From the April 2025 lows, the S&P 500 had rallied a remarkable 40% with barely a 2% drawdown along the way—one of the smoothest advances on record. Volatility, as measured by the VIX, spent weeks pinned below 15.

That calm has now been shattered. November has already delivered multiple 1%+ daily swings, and the S&P 500 is down more than 3% month-to-date. In movie terms, we’ve gone from the suspenseful quiet-before-the-storm scene to sudden loud orchestral stabs.

Yet history suggests volatility spikes are normal—especially after such a concentrated, momentum-driven advance. The 2020–2021 recovery, the 2017 run-up, and the late-1990s tech boom all featured similar periods of complacency followed by sharp, sentiment-driven volatility.

We do not view the current pullback as the start of a protracted bear market. Fundamentals—earnings growth, consumer balance sheets, and (for now) labor-market resilience—remain supportive. Instead, this feels like a healthy sentiment reset and an opportunity for capital to rotate into the many areas of the market that have been left behind during the AI-fueled melt-up. We continue to maintain a healthy balance of liquidity is our strateties in order to take advantage of buying opportunities due to this volatility.

Diversification Is Back in Fashion

The so-called Magnificent Seven mega-cap tech cohort is down roughly 6% in November (market-cap weighted), creating a meaningful performance gap with the other 493 names in the S&P 500. Sector leadership has started to broaden: health care, materials, and energy have held up relatively well or even posted gains while tech has sold off.

Mid-cap U.S. equities developed international small- and mid-caps, and emerging-market stocks all trade at meaningful valuation discounts to U.S. large-cap growth and offer exposure to a global economy that appears to be reaccelerating. Maintaining exposure to the AI theme through high-quality large-cap innovators still makes sense, but complementing it with broader diversification looks increasingly prudent.

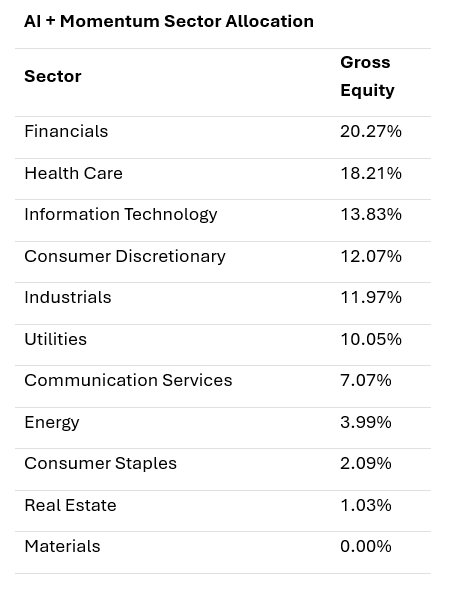

Our AI Target Sector Allocation below is based on AI momentum sector trend analysis and AI news analysis.

The Bottom Line

Cash currently earns a nominal yield of around 4%, but with inflation running near 3%, the real return is less than 1%. For investors with appropriate time horizons and risk tolerance, the recent dip may represent an attractive re-entry point or an opportunity to rebalance toward undervalued areas.

Volatility is rarely comfortable, but it is normal—and often healthy. The three-year bull market that began in late 2022 remains intact in our view, and we continue to expect it will extend into 2026, supported by still-accommodative financial conditions and healthy corporate profits.

The Week Ahead

A lighter data calendar awaits, with housing starts, existing home sales, and the Conference Board’s consumer-confidence index on tap. More importantly, the gradual resumption of government economic reports (delayed by the shutdown) should start to give markets and policymakers clearer visibility in the weeks ahead.

Until next week—stay diversified and keep perspective. Markets rarely move in straight lines for long.

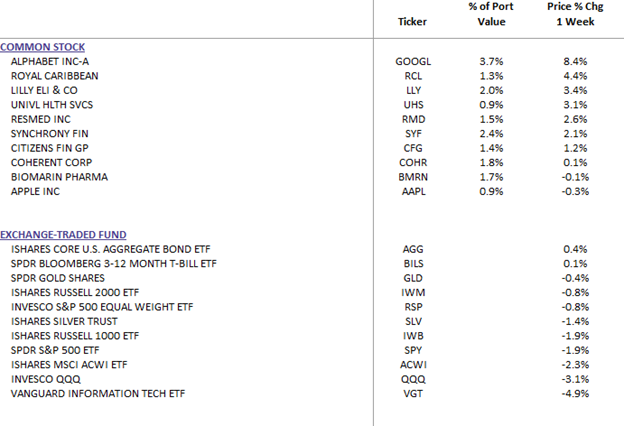

DBS Long Term Growth Top Ten and Benchmark Weekly Performance:

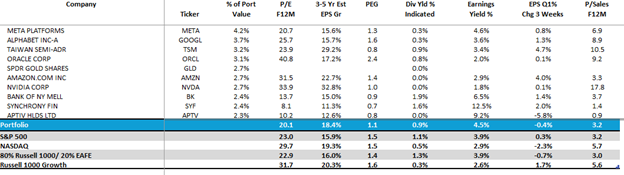

DBS Long Term Growth Portfolio Top Ten Holdings and Valuation Statistics: