Weekly Commentary for the week ending November 15, 2025

Markets Close Mixed as a Result of a Rotation from AI and Growth Stocks .

U.S. equities ended the week on a mixed note. The Dow Jones Industrial Average and S&P 500 posted modest weekly gains, while the Nasdaq Composite, S&P MidCap 400, and Russell 2000 all finished in the red. The divergence reflected a continued rotation out of growth-oriented names—particularly in technology and artificial intelligence—that have powered the bull market to repeated all-time highs.

Through Thursday, stocks were broadly lower as investor concerns mounted over elevated valuations and intensifying scrutiny of AI capital spending. Mega-cap tech leaders, long the market’s growth engine, faced profit-taking and skepticism about near-term returns on massive data center and infrastructure investments.

Friday brought a volatile but ultimately constructive session. With few major headlines, dip-buyers stepped in, allowing the Dow and S&P 500 to erase weekly losses and close higher. The Nasdaq, however, remained under pressure, underscoring the ongoing shift in market leadership.

Overall, we view these evolving dynamics in mega-cap technology as critical to monitor. That said, the core AI narrative remains robust: these leaders have consistently delivered strong earnings growth and forward guidance while reaffirming ambitious capex plans. Still, with expectations and valuations stretched entering reporting season—and following a ~55% Nasdaq surge from April lows—a healthy sector reset strikes us as both natural and constructive.

Government Shutdown Ends After 43 Days—But Economic Scars Linger

In a major positive development, the longest U.S. government shutdown on record officially ended late Wednesday, November 14, when President Donald Trump signed a bipartisan spending bill funding federal operations through January 30, 2026.

The 43-day impasse had furloughed or forced unpaid work on roughly 1.4 million federal employees, disrupted critical programs, and delayed key economic data releases. While the reopening removes a significant market headwind, the aftershocks will be felt for weeks—if not months.

Key Implications of the Reopening:

The Congressional Budget Office (CBO) estimates the shutdown shaved approximately 1.5 percentage points from Q4 real GDP growth. Pre-shutdown consensus had U.S. growth tracking 2.5%–3.0% annualized; we now expect 1.0%–1.5%. A mechanical rebound should follow in Q1 2026 as backpay circulates and operations normalize—but the recovery may be uneven, particularly if healthcare costs rise sharply for millions.

Fed Rhetoric Turns Hawkish—December Cut Odds Plunge

Monetary policy remained a central focus, with several Federal Reserve officials striking a cautiously restrictive tone during the week.

- Atlanta Fed President Raphael Bostic: Labor market signals “ambiguous”; inflation risks outweigh case for aggressive easing. Current policy is “marginally restrictive”—prefers steady rates until inflation clearly trends to 2%.

- St. Louis Fed President Alberto Musalem: “Proceed with caution.”

- Cleveland Fed President Beth Hammack: Policy must “remain somewhat restrictive” given persistent inflation pressures.

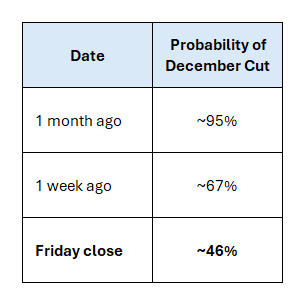

Market pricing shifted sharply. According to the CME FedWatch Tool:

Rate-sensitive small-cap stocks bore the brunt, with the Russell 2000 down 1.83% for the week—its third straight weekly decline.

Fixed Income: Treasuries Slide, Munis Outperform

U.S. Treasuries delivered negative total returns as yields ticked higher across the curve. The benchmark 10-year Treasury note continued to trade in a tight ~10 basis point range around 4.10%—a level it has held since the Fed’s October rate cut.

Municipal bonds, by contrast, outperformed. Traders reported robust demand for new issues following the Veterans Day holiday closure, with most deals oversubscribed. Supply had been light during the shutdown; the post-reopening pipeline was met with strong institutional and retail interest.

High-yield corporates advanced early in the week on favorable earnings and idiosyncratic catalysts but gave back gains amid deteriorating macro sentiment.

November has seen a clear sector rotation. Year-to-date through October, technology had been the undisputed leader. But in the first half of November:

- Underperformers: Information Technology, Communication Services

- Outperformers: Health Care, Energy, Materials

The Nasdaq 100 is up nearly 55% from its April 8 lows—a historic rally that left valuations stretched and sentiment overheated. Several structural shifts in mega-cap tech are now commanding attention:

1. Capital Structure Transformation

Historically cash-rich, balance-sheet-light giants are issuing record debt to fund AI infrastructure:

- Oracle: Aggressive borrower to expand cloud/AI capacity

- Meta, Google, Microsoft: Multi-billion-dollar bond issuances in 2025

- Interest expense risk rises if Fed delays cuts

2. From Asset-Light to Asset-Heavy

The pivot to physical infrastructure (industrials) is profound:

Industry estimates suggest AI-related capex could exceed $500 billion in 2026 across hyperscalers and chipmakers.

This shift threatens:

- Margin compression (higher depreciation, power costs)

- Free cash flow erosion

- Return on invested capital (ROIC) pressure

3. Earnings & Guidance: Still Strong—But Expectations Were Sky-High

Q3 results from AI leaders exceeded estimates and guidance reaffirmed aggressive capex. But the bar was extraordinarily high. Any hint of deceleration—or simply meeting rather than crushing numbers—triggered selling.

Our View: A Healthy Reset, Not a Regime Change

We remain constructive on the long-term AI secular growth story. Fundamentals are intact:

- Enterprise adoption accelerating

- Cloud hyperscalers reporting 30%+ AI revenue growth

- Chip demand (NVIDIA, TSMC) sold out through 2026

But valuation gravity is real. After a three-year bull run concentrated in seven stocks, portfolio rebalancing into year-end is natural.

Bull markets typically end in one of two ways:

- Aggressive Fed tightening → See either reducing or maintaining rates

- Recession → Too many positive economic developments

Thus, we view the current pullback as consolidation within a bull market—not the start of a bear phase.

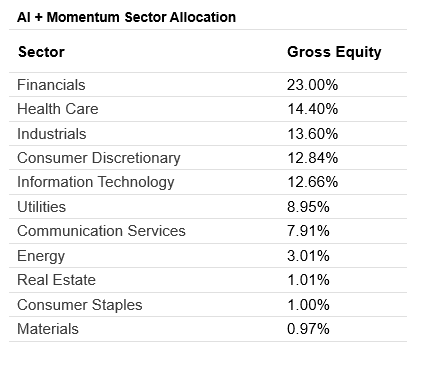

Portfolio Positioning: Reduce exposure to Information Technology & Communication Services and increase exposure to Financials, Healthcare, Inductrials & Consumer Discrestioary.

Search out companies that have not participated this years rally to invest in, utilizing any excess liquidity developed in the last few weeks. (Deploy our liquid assets such as Cash and Short Term Treasuries).

Our AI Target Sector Allocation below is based on AI momentum sector trend analysis and AI news analysis

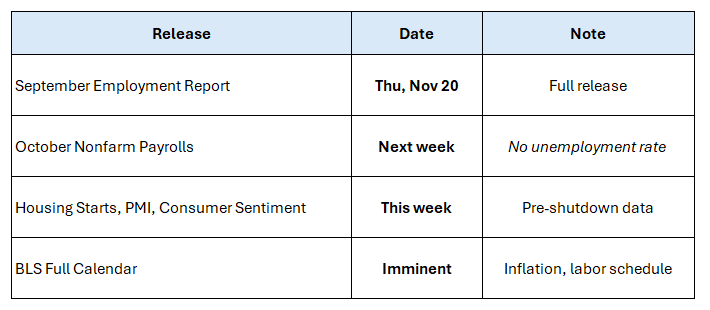

The Week Ahead: Data Resumes, Gradually

With the government reopened, economic data flow will normalize—but expect gaps and revisions:

Final Word

The end of the government shutdown is unequivocally positive—but the economy lost momentum in Q4, and Fed rate cut expectations have been sharply repriced. Meanwhile, the AI/tech complex is undergoing a necessary breather after an extraordinary run but we remain positive on it's long term investment theme..

This is not the end of the bull market. It is a rotation within it.

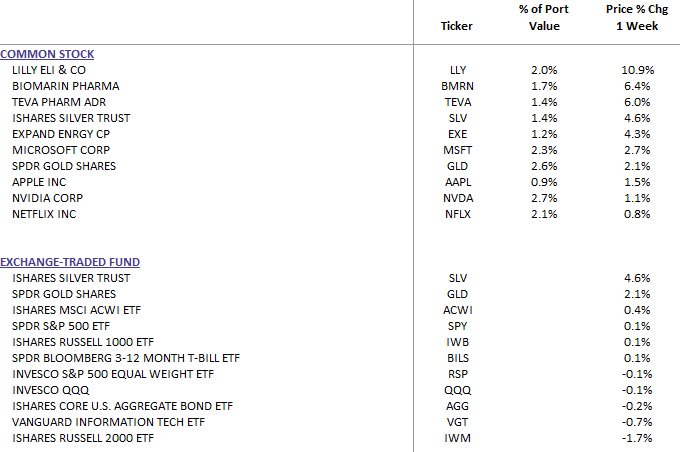

DBS Long Term Growth Top Ten and Benchmark Weekly Performance:

DBS Long Term Growth Portfolio Top Ten Holdings and Valuation Statistics: