Weekly Commentary for the week ending May 3, 2025

Weekly Market Recap: S&P 500 Posts Longest Winning Streak Since 2004 Amid Trade Optimism and Strong Earnings

4-Minute Read | May 3, 2025

U.S. equities soared this week, extending the S&P 500’s nine-day winning streak—its longest since November 2004—and marking its first back-to-back weekly gains since January. The rally, fueled by robust corporate earnings, easing trade tensions, and resilient economic data, helped the index rebound from April’s tariff-induced pullback. The WealthTrust DBS Long Term Growth ETF, WLTG mirrored this momentum, leveraging its active management and diversified exposure to capitalize on market strength.

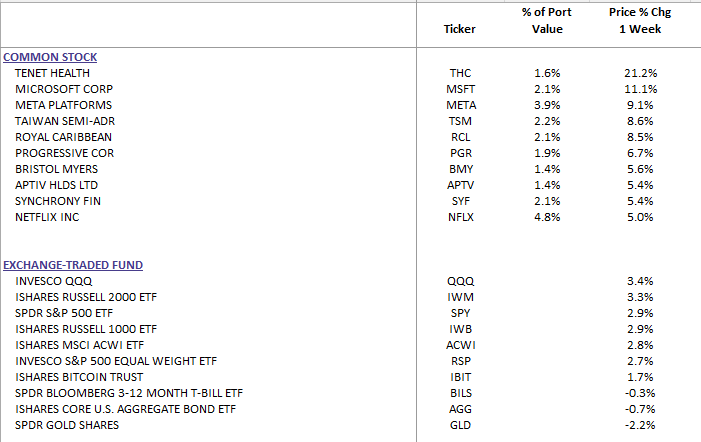

WealthTrust Long Term Growth Portfolio Weekly Top 10 | ETF: WLTG

Market Drivers: Tech Titans and Broad-Based Gains

Mega-cap technology stocks powered the rally, with Microsoft (+11.1%) and Meta (+9.1%) delivering blockbuster earnings, underscoring the durability of AI-driven growth. Amazon (+0.5%) posted solid revenue but flagged tariff pressures, while Apple (+1.9%) disappointed with weaker Services revenue and cautious guidance. Beyond tech, financials (banks, asset managers ousted strong performers like Eli Lilly (+6.9%), Booking (+7.5%), and Caterpillar (+5.6%) also beat expectations. Even heavily shorted stocks rallied, suggesting short covering amplified gains. Laggards included healthcare, energy, and consumer staples, with Energy (-0.65%) notably weak amid falling oil prices.

The S&P 500’s blended Q1 EPS growth reached +12.8%, far exceeding the +7.2% forecast, driven by strong consumer demand, AI investments, and tariff mitigation strategies. However, Q2 guidance softened to 5.8% growth (down from 11.3%), reflecting trade and consumer spending uncertainties.

Macro Environment: Economic Resilience, Hawkish Rates

Economic data painted a mixed picture. April’s nonfarm payrolls surprised at +177,000 jobs (vs. 138,000 expected), and ISM Manufacturing beat forecasts, reducing expectations for imminent rate cuts. The 10-year Treasury yield held at 4.31%, with Treasuries selling off as the dollar strengthened (+0.5% DXY). Gold (-1.7%) and WTI crude (-7.5%, $58.55/bbl.) slumped, the latter after Saudi Arabia signaled tolerance for lower prices. Consumer confidence hit a five-year low, but Q1 personal consumption (+1.8%) and business investment (+21.9%) remained robust despite negative GDP growth (-0.3%).

Trade Tensions: A Thaw in the Air?

Markets cheered signs of de-escalating trade disputes. President Trump granted temporary tariff relief to automakers, while Treasury Secretary Bessent and Commerce Secretary Lutnick adopted constructive tones. Mexico’s President Sheinbaum noted progress in U.S.-Mexico talks, and China’s openness to fentanyl discussions hinted at broader U.S.-China dialogue. While no deals were finalized, these developments fueled optimism, supporting risk assets.

Sector Performance

- Leaders: Industrials (+4.32%), Communication Services (+4.19%), Technology (+4.01%), Financials (+3.60%)

- Laggards: Healthcare (+0.32%), Energy (-0.65%), Consumer Staples (+1.14%)

WLTG Performance: Tactical Edge Shines

The WealthTrust DBS Long Term Growth ETF (WLTG) thrived, with its 75% DBS Core sleeve (equities/ADRs) favoring financials and tech, and its 25% DBS Tactical Edge sleeve dynamically adjusting to capture upside in trending sectors like technology while maintaining exposure to defensive assets like gold ETFs..

What’s Next?

The Fed’s May FOMC meeting headlines next week, with no rate changes expected but focus on Chair Powell’s tone post-blackout. Key data includes ISM Services (Monday), trade balance (Tuesday), and jobless claims (Thursday). The Treasury will issue $125B in new debt, potentially pressuring yields. Earnings from Palantir, Uber, Disney, and others will round out a quieter reporting week.

Outlook: Opportunities Amid Volatility

The S&P 500’s rally (+2.9% weekly, -3.3% YTD) and WLTG’s strength reflect renewed confidence in earnings and trade progress. Yet, with Q1 GDP negative (-0.3%) and inflation risks (PCE Core at 2.8%), volatility remains a factor. Investors should consider rebalancing toward tariff-resilient sectors like financials and healthcare, while monitoring Fed signals and trade developments. As 2026 looms, potential rate cuts and earnings recovery could further bolster markets.

Key Takeaway: Strong earnings and trade optimism have reignited equity markets, with WLTG well-positioned to capture growth. However, macroeconomic uncertainties warrant a balanced approach, blending growth exposure with defensive allocations.