Weekly Commentary for the week ending May 24, 2025

Market Commentary: Navigating Debt, Tariffs, and Yields

Good morning, investors. Last week, markets faced turbulence as equities, bonds, and the dollar retreated amid renewed focus on the U.S. budget deficit, rising debt, and fresh tariff threats. Let’s unpack the key drivers behind this shift and what it means for your portfolio.

First, the U.S. fiscal outlook took center stage. Moody’s joined S&P and Fitch in downgrading U.S. government debt, citing persistent deficits and rising interest costs, now at 3% of GDP—matching highs from the late 1980s. This downgrade, while symbolic, doesn’t trigger forced selling by index funds, as U.S. Treasuries were already in the double-A bucket. However, it highlights a growing debt burden, with the CBO projecting a debt-to-GDP ratio of 150% within a decade. Despite this, history shows bond yields don’t always rise with deficits. For example, yields hit 6% during the 1997–2001 surplus but fell to record lows post-pandemic despite soaring deficits. Economic growth and Fed policy remain the primary yield drivers.

Are high deficits and debt a concern for investors?

The trend raises alarms: ten years ago, the federal deficit stood at $472 billion, about 3% of GDP. By 2019, post-2017 tax cuts and pre-pandemic, it rose to $984 billion, or 4.6% of GDP. Last year, it hit $2 trillion, or 6.7% of GDP. Yet, over this period, the S&P 500 has achieved a 230% return, including dividends.

Speaking of yields, the 30-year Treasury crossed 5%, and the 10-year hit 4.5%, nearing multi-year highs. This partly reflects fiscal concerns but also a global trend—Japanese, German, and U.K. bonds also faced pressure. A weak 20-year Treasury auction added to the noise, signaling investor caution. Yet, we believe this yield spike is self-limiting. Higher yields attract demand, slow inflation, and may prompt lawmakers to rethink spending. For investors, the 1 and 7-to-10-year bond segment looks attractive to lock in yields before potential Fed rate cuts in 2026.

On the legislative front, the House narrowly passed the “One Big Beautiful Bill,” extending 2017 tax cuts and adding new breaks for tips, overtime, and seniors while raising the SALT deduction cap to $40,000. The bill, now in the Senate, is expected to add $3 trillion to the deficit over a decade, with front-loaded tax cuts pushing deficits to 7% of GDP in the next two years. This stimulative policy should support growth but amplifies deficit concerns. Expect Senate revisions, with a final bill targeted for July 4.

Tariff threats also rattled markets. Proposed 50% tariffs on the EU and 25% on Apple reminded investors that trade remains a key driver. The S&P 500, down 2.6% last week after a 20% rally since April, felt the brunt. With tariff pauses expiring in July and August, alongside a looming debt ceiling standoff, volatility may persist. However, history suggests strong rallies like this often led to solid 12-month returns, offering opportunities for timely purchases.

What does this mean for your portfolio? First, diversify. The tariff uncertainty and fiscal noise underscore the need for balanced exposure across asset classes. Second, consider short to intermediate bonds to capture current yields. Third, stay proactive on taxes—current low rates may not last, so explore tax strategies now. Finally, despite the downgrade, U.S. Treasuries remain the world’s safest asset due to unmatched liquidity and market depth. No alternative comes close.

Looking ahead, this week’s consumer confidence and PCE inflation data will provide clues on the Fed’s next moves. While deficits and tariffs are concerning, they’re not immediate threats to the economy. Peak uncertainty may be behind us as trade negotiations progress. Stay focused on diversification, lock in attractive yields, and use market dips to your advantage.

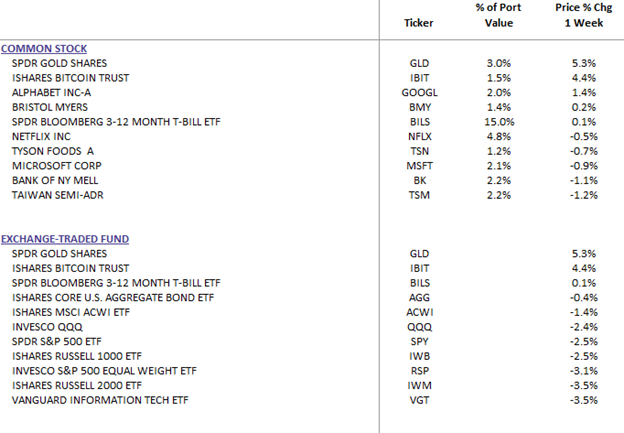

WealthTrust DBS Long Term Growth top 10 Performers.