Weekly Commentary for the week ending May 10, 2025

Weekly Market Commentary – May 10, 2025

Markets cooled off this week following a strong rally in late April. U.S. equities ended mostly lower, pausing after the S&P 500 posted a nine-day winning streak and briefly climbed above levels seen before the early-April tariff shock. Despite the dip, breadth remained healthy, with the S&P Equal Weight Index outperforming the cap-weighted benchmark by 87 basis points — a sign that gains were not just concentrated in mega-caps.

Sector performance was mixed. Big Tech lagged, with Alphabet (GOOGL) sliding nearly 7% on news that the DOJ may push for divestitures in its ad business. Biotech, railroads, and homebuilders also underperformed. On the flip side, industrials, banks, credit cards, machinery, and select consumer names like apparel and dollar stores outpaced. Notably, LYFT surged 31.6% after beating on multiple key metrics, while Disney jumped 14.5% thanks to strength in its Entertainment and Experiences segments.

Bond markets saw a mixed tone, with the yield curve flattening amid renewed inflation concerns. Treasury yields edged higher on the long end following a weak $25B 30-year bond auction. The dollar gained against most major currencies except the British pound. Commodities had a strong showing — gold rallied 3.1% and oil climbed 4.7%, despite OPEC+ signaling increased output.

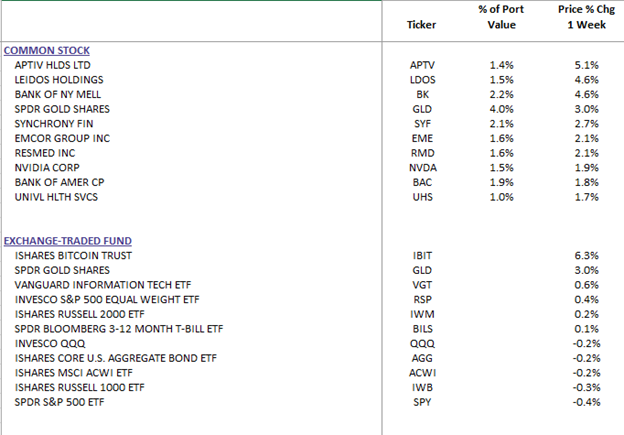

WealthTrust DBS Long Term Growth Top 10 Holdings

Drivers of Market Action

The week’s decline came in the wake of high expectations and a flurry of macro headlines. Key among them was a new trade framework between the U.S. and U.K. The agreement modestly reduces tariffs on U.K.-made autos and eliminates duties on steel and aluminum, while maintaining a universal 10% tariff on most other goods. While not a game-changer economically — given the U.K.'s relatively small share of U.S. trade — the agreement signaled that de-escalation is possible.

Meanwhile, attention is turning toward U.S.–China trade relations. Talks are set to resume this weekend, with the U.S. reportedly considering reducing tariffs on Chinese goods to around 50–54%. While no sweeping deal is expected, even a partial rollback would be market-friendly. That said, tensions remain high, as the EU prepares countermeasures if U.S. negotiations falter, and Japan’s request for exemptions was rejected.

The Federal Reserve held interest rates steady at 4.25%–4.50%, in line with expectations. The updated statement flagged rising risks of both inflation and unemployment, with Chair Powell offering few clues on a potential June cut. Fed officials remain cautious, reiterating that they haven’t yet seen tariff impacts in the economic data, but acknowledge those shocks may still be coming. Markets are now pricing in less than 70 basis points of easing in 2025, down from earlier expectations.

Economic data was mixed but generally constructive. ISM Services rose to 51.6 in April, with new orders hitting a four-month high. However, input prices climbed, and business activity moderated. Jobless claims declined slightly, while the NY Fed’s latest survey showed increasing inflation uncertainty and softening labor expectations.

Earnings Wrap-Up

Q1 earnings are winding down with year-over-year growth tracking at 13.4%. Macro uncertainty and tariffs affected select sectors, but many companies delivered better-than-feared results. Notables included AMD (+4.1%) beating and guiding higher, despite China-related chip headwinds. Lyft's standout quarter helped it gain 30%+, while DNUT plunged nearly 37% following disappointing guidance related to its McDonald's partnership rollout. SMCI and SHOP both fell despite meeting or exceeding top-line expectations, as outlooks or segment results disappointed.

Outside earnings, notable headlines included Apple exploring AI-enhanced search, also affecting Alphabets(GOOGL) decline while potential chip rule rollbacks benefiting Nvidia and others, and reports that Warner Bros. Discovery may consider a breakup.

Looking Ahead

Next week is packed with key data, including April CPI on Tuesday, followed by PPI, Retail Sales, and Industrial Production on Thursday, and Housing Starts and Consumer Sentiment on Friday. These will be closely watched for clues on inflation trends and consumer resilience. Earnings season continues with reports from Walmart, Applied Materials, Cisco, and Deere, among others.

Bottom Line

While this week’s pullback reflects digesting strong gains and resurfacing macro risks, market sentiment remains supported by signs of easing trade tensions, resilient services activity, and improving corporate results. However, persistent tariff uncertainty, sticky inflation, and Fed caution are likely to keep volatility elevated in the near term. Investors should remain selective, with a continued preference for quality in equities and short-term treasury bonds to manage risk.