Weekly Commentary for the week ending June 28, 2025

Weekly Market Commentary: Markets Rally to New Highs

Welcome to this week's market commentary, where we unpack the key drivers behind the recent rally in stock markets, which saw the S&P 500 and Nasdaq Composite hit fresh all-time highs. We'll explore the critical catalysts fueling this surge, assess the outlook for continued momentum, and offer insights on how investors can position their portfolios, so let’s dive in.

Key Takeaways

- Market Performance: The S&P 500 (+3.44%) and Nasdaq Composite (+4.25%) closed at record highs, with the Dow Jones Industrial Average, S&P Midcap 400, and Russell 2000 all up over 2.5% for the week. Year-to-date, the S&P 500 and Nasdaq are up approximately 5%, with gains of 24% and 33% respectively since April 8 lows.

- Rally Drivers: Easing geopolitical tensions, dovish Federal Reserve signals, progress on U.S.-China trade deals, and strong mega-cap technology performance are propelling markets higher.

- Looking Ahead: Near-term momentum is strong, but potential volatility from ongoing trade negotiations, tax policy updates, and softening economic data looms. Pullbacks may present buying opportunities.

Three Drivers of the Summer Rally

1. Easing Geopolitical Tensions and Falling Oil Prices

De-escalation in Middle East tensions has been a key tailwind. Following U.S. airstrikes on Iran’s nuclear facilities on June 21-22, Iran’s limited retaliation avoided oil infrastructure and the Strait of Hormuz, a critical passageway for 20% of global oil. Consequently, WTI crude oil prices fell 13% last week to $65 per barrel from a June high of $75. Lower oil prices ease inflationary pressures, support consumer spending during the summer driving season, and bolster market sentiment, contributing to equity gains.

2. Dovish Federal Reserve and Economic Data

The Federal Reserve’s June 17-18 meeting projected two rate cuts in 2025, targeting a long-term fed funds rate of 3.0%, below the current 4.25%-4.5%. Dovish comments from Fed officials, including Vice Chair Bowman, suggest cuts could come sooner, with futures markets raising the probability of a July cut from 14.5% to 19% (CME Fed Watch). May’s PCE inflation data showed a modest uptick: core PCE rose 0.2% month-over-month and 2.7% year-over-year, slightly above April’s 0.1% and 2.6%, while headline PCE was in line at 0.1% month-over-month and 2.3% year-over-year. However, weaker data—declining personal income and spending, softer retail sales, and a drop in consumer confidence (labor market differential at its narrowest since March 2021)—supports a dovish outlook. Falling Treasury yields (2-year at 3.75%, 10-year below 4.3%) reflect this shift, benefiting equities.

3. Mega-Cap Technology Surge and Trade Progress

Mega-cap technology stocks continue to lead, with tech, communication services, and consumer discretionary sectors outperforming the S&P 500’s 24% gain since April 8. First-quarter earnings showcased robust revenue and earnings growth, driven by AI and infrastructure investments, despite tariff uncertainties. Reports of a new U.S.-China trade deal and Commerce Secretary Lutnick’s comments on imminent deals with 10 trading partners further boosted sentiment. However, the U.S. ending trade talks with Canada over a digital services tax introduced some uncertainty. In tech, standout performers included NVDA (+9.7%) and META (+7.5%), reinforcing growth sector momentum.

Economic and Business Updates

- Business Activity: S&P Global’s June Flash U.S. Composite PMI dipped to 52.8 from 53.0, reflecting modest growth. Manufacturing output rose for the first time since February, offsetting a slower services sector. Rising input costs, driven by tariffs, remain a concern.

- Business Investment: Durable goods orders surged 16.4% in May, led by commercial aircraft, with non-defense, non-aircraft orders up 1.7%, signaling a rebound in business investment.

- Housing Market: Existing home sales rose 0.8% to 4.03 million annually, but high mortgage rates kept activity sluggish. New home sales fell 13.7% to 623,000, the lowest since October.

- Consumer Sentiment: The University of Michigan’s June Consumer Sentiment Index jumped 16% to 60.7, with inflation expectations dropping from 6.6% to 5%, partly due to softened tariff concerns.

Can the Rally Continue?

The market’s momentum is fueled by positive trade developments, dovish Fed signals, and tech strength, but risks remain:

- Trade and Tariffs: While U.S.-China and potential EU deals are supportive, the breakdown of U.S.-Canada talks and possible new tariffs could spark volatility.

- Tax Bill Uncertainty: The Senate’s reconciliation bill faces delays after rejected provisions, with a tentative SALT deal but no firm timeline.

- Economic Softness: Weaker consumer confidence, housing data, and rising unemployment (expected at 4.3% in June) suggest cooling growth.

Despite these risks, the fundamental backdrop for equities remains intact. Investors can use pullbacks to rebalance, focusing on:

- U.S. Equities: Overweight large- and mid-cap stocks, balancing growth (tech, communication services) with value (healthcare, financials).

- International Equities: Underweight relative to U.S. holdings.

- Bonds: Favor Short Term & 7-10 year U.S. Treasuries and investment-grade bonds, given expected rate cuts.

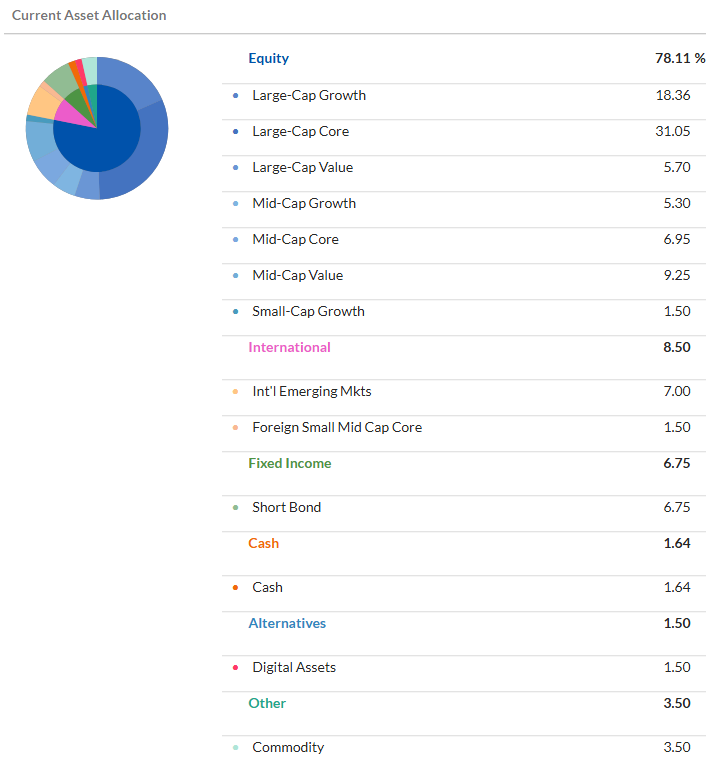

DBS Long Term Growth Current Asset Allocation:

Week Ahead: Key Data

- Monday: Chicago PMI (9:45 ET), Dallas Fed Index (10:30 ET)

- Tuesday: ISM Manufacturing (10:00 ET), May JOLTS (10:00 ET)

- Wednesday: June ADP Payrolls (8:15 ET, expected: 120K)

- Thursday: June Nonfarm Payrolls (8:30 ET, expected: 125K, unemployment at 4.3%)

Conclusion

The summer rally, driven by easing geopolitical risks, a dovish Fed, trade progress, and tech sector strength, has pushed markets to new highs. While trade, tax, and economic uncertainties may cause volatility, pullbacks offer opportunities to add quality investments. Stay tuned for next week’s commentary as we track these evolving trends.

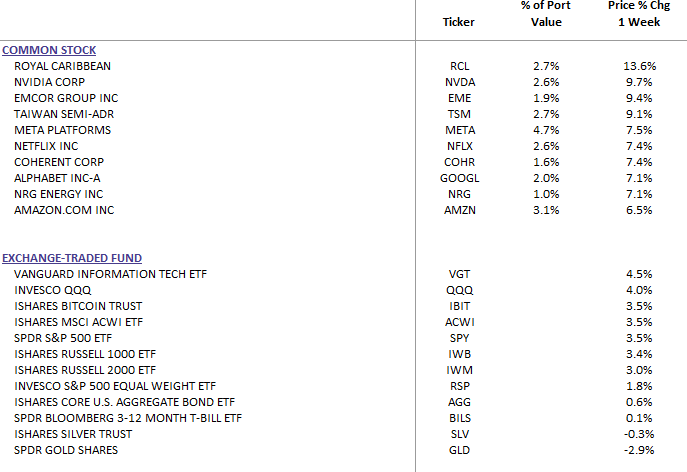

DBS Long Term Growth Top 10 and Benchmark Performances: