Weekly Commentary for the week ending June 14, 2025

Weekly Market Commentary: June 14, 2025

Key Takeaways

- Economic Resilience: Despite uncertainties in tariffs, trade, and geopolitics, US economic data in 2025 has been robust, with strong GDP growth, a stable labor market, and contained inflation.

- Catalysts to Watch: Trade negotiations, a potential US tax bill, and geopolitical tensions, particularly in the Middle East, are critical factors for the second half of 2025, though their market impact is typically short-lived.

- Investment Strategy: Volatility presents opportunities to acquire quality investments at better prices. Diversification and broadening leadership remain key themes.

Fundamental Data: First Half of 2025

Economic Growth

US GDP growth has remained above trend. Q1 was soft due to inventory spikes, but Q2 is projected to exceed 3%, driven by 1.7% annual household consumption. Despite weak consumer sentiment, actual consumption holds steady, supported by contained inflation and a resilient job market.

Labor Market

The labor market remains robust, with unemployment at 4.2%, well below the long-term average of 5.5%. Job growth is cooling, but low hiring and firing indicate companies are retaining talent. Wage gains of 3.9% outpace inflation, boosting real wages and supporting consumer spending.

Inflation

May CPI (2.4%) and PPI (2.6%) came in below consensus, far from 2022 peaks (CPI 9%, PPI 18%), nearing the Fed’s 2.0% target. Tariffs have not yet impacted prices, likely due to inventory buildup during the 90-day pause. However, geopolitical tensions drove oil prices up 5-7% last week, though such spikes are typically short-lived. The US, a net petroleum exporter, is less vulnerable to oil shocks.

Market Performance

The S&P 500, down nearly 20% from mid-February highs, has since rebounded over 20%, reflecting solid economic data and moderated tariff expectations. Volatility is expected as investors digest upcoming catalysts.

Key Catalysts for H2 2025

1. Tariff and Trade Negotiations

- US-China Framework: A new trade agreement reduces tariffs on Chinese exports from 145% to 55% (10% reciprocal, 20% fentanyl-based, 25% existing). China will restore rare-earth licenses for six months, while the US eases restrictions on Chinese jet engines. This resets negotiations but leaves uncertainty.

- July 9 Deadline: The 90-day pause on Non-Chinese trading partners may extend if "good faith" is shown, though tariffs remain at 10%. Higher tariffs (10%+ on China, select sectors) are likely, potentially raising goods prices and slowing growth. However, the US’s service-driven economy (70% of GDP) mitigates broader impacts. Companies may offset costs via inventories, supply chain diversification, or absorption.

2. Geopolitical Tensions

Israel’s airstrikes on Iran’s nuclear facilities and military leadership triggered a risk-off response, with Iran’s drone and missile retaliation escalating tensions. The US denied involvement, though Trump supported the action and urged nuclear talks. Oil prices spiked, raising concerns about the Strait of Hormuz. Historically, geopolitical shocks have short-lived market impacts, with the US less exposed than global markets. Balanced portfolios can offset volatility via energy and commodity gains (our allocations to gold and silver continue to benefit our overall performance)

3. US Tax Bill and Fed Policy

- Tax Bill: The Senate’s July 4 tax bill, likely extending the Tax Cuts and Jobs Act, may include stimulative measures like accelerated capital-expenditure deductions, boosting corporate spending in 2026.

- Fed Outlook: With the fed funds rate at 4.25%-4.5% above inflation (2.5%-3.5%), one to two rate cuts are expected in H2 2025 if economic or labor data softens..

Weekly Highlights

Geopolitical Developments

Israel’s "Rising Lion" operation targeted Iran’s nuclear sites and IRGC leadership, killing Hossein Salami. Netanyahu vowed to continue until the threat is eliminated, potentially for weeks. Iran’s retaliation intensified Friday, with the IDF reporting widespread attacks. The oil market’s 13.0% WTI surge reflects fears of supply disruptions, though analysts doubt Iran will fully close the Strait of Hormuz.

Trade Updates

US-China talks in London reaffirmed the Geneva consensus, with China opening rare-earth exports (six-month licenses) and the US allowing 55% tariffs and Chinese students’ return. Trump hinted at higher auto tariffs but suggested extending the July 9 deadline. Negotiations with India and others face hurdles.

Economic Data

- CPI/PPI: Below-consensus May data (CPI 2.4%, PPI 2.6%) suggests room for Fed rate cuts.

- Jobless Claims: Initial claims slightly high, continuing claims at a November 2021 peak, possibly seasonal.

- Consumer Sentiment: UMich’s 60.5 beat expectations (53.0), with inflation expectations falling (year-ahead: 5.1%, five-year: 4.1%).

- NFIB Optimism: Rose, ending a four-month decline, though uncertainty persists. The NFIB Small Business Optimism Index is a monthly measure of the sentiment and economic outlook of small business owners in the United States

Sector Performance

- Outperformers: Energy (+5.73%), Healthcare (+1.25%), Utilities (+0.20%), Consumer Discretionary (+0.08%), Technology (-0.08%), Real Estate (-0.23%).

- Underperformers: Financials (-2.61%), Industrials (-1.60%), Consumer Staples (-1.14%), Communication Services (-0.82%), Materials (-0.50%).

Looking Ahead

- FOMC (June 17-18): Rates likely unchanged, with Powell emphasizing data-driven policy.

- Economic Calendar: Empire manufacturing (Monday), retail sales, industrial production, NAHB sentiment (Tuesday), housing starts, jobless claims (Wednesday), Philly Fed manufacturing (Friday). Markets closed for Juneteenth (Thursday).

- Earnings: Kroger, Lennar, Darden Restaurants, Jabil, CarMax.

- Geopolitics: Trump attends G7 summit (June 15-18). US-Iran nuclear talks in Oman are suspended.

Portfolio Positioning

Economic resilience supports selective opportunities despite volatility:

- Equities: Overweight US large- and mid-cap stocks.

- Bonds: Value in 1 year and 7–10-year investment-grade bonds (yields ~4.4%).

- Strategy: Use volatility to add quality investments. Diversification and dollar-cost averaging are key for long-term goals.

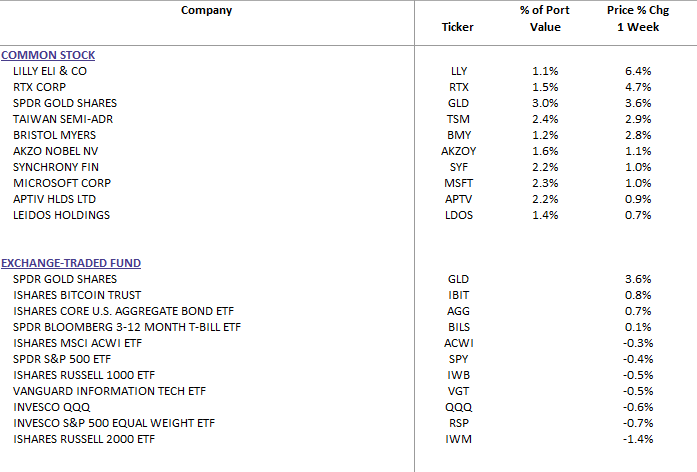

DBS Long Term Growth Top Ten Holdings and Index Performers