Weekly Commentary for the week ending July 5, 2025

Weekly Market Commentary: Expectations For The Second Half.

- Despite significant volatility, stock markets closed the first half of 2025 at all-time highs, with the S&P 500 and Nasdaq each up over 6% year-to-date.

- Policy uncertainty is likely to intensify as the July 9 tariff pause expiration nears, but resilient economic fundamentals provide a supportive backdrop for equity markets.

- The Federal Reserve is expected to resume its easing cycle this fall, though rising deficit concerns may keep Treasury yields within a 4%–4.5% range.

- Three key themes—slower but positive economic growth, U.S. equities catching up to international markets, and rangebound Treasury yields—shape our outlook, offering opportunities in U.S. large- and mid-cap stocks and selective bond exposures.

First Half Recap: A Volatile Recovery

The first half of 2025 tested investors’ resilience. U.S. tariffs announced in April, which raised the effective tariff rate from 2.3% to over 25%, triggered a near-20% S&P 500 decline amid recession fears. Subsequent de-escalation of trade tensions, including a U.S.-Vietnam agreement reducing tariffs to 20% (down from 46%), alongside robust economic data, fueled a recovery. By June’s end, the S&P 500 and Nasdaq hit record highs. June’s nonfarm payrolls rose by 147,000, surpassing the 118,000 forecast, while the unemployment rate dropped to 4.1%, and initial jobless claims fell to a six-week low of 233,000. Job openings climbed to 7.8 million in May, driven by gains in accommodation, food services, finance, and insurance sectors, signaling labor market strength despite tariff headwinds.

Three Key Themes for the Second Half

1. Slower Growth, Same Direction

Economic growth slowed in 2025 due to tariff uncertainty, but recent progress in trade negotiations has alleviated some concerns. The effective tariff rate, now approximately 15%, remains elevated compared to prior years and could rise further if the July 9 tariff pause expires without resolution. Higher tariffs are likely to increase consumer prices in the second half, as companies deplete inventories and pass costs to consumers, potentially eroding household purchasing power and compressing corporate profit margins. Despite these pressures, economic data remains resilient. June’s labor market strength, coupled with a 7.8 million job openings figure in May, underscores a healthy, albeit moderating, labor market. The proposed One Big Beautiful Bill (OBBB) aims to extend the 2017 tax cuts and introduce new breaks for tips, overtime pay, and seniors, potentially laying the groundwork for growth re-acceleration in 2026. Moderate fiscal stimulus and anticipated monetary easing should support economic and earnings growth.

Nonfarm payroll growth has slowed compared to 2023–2024 averages but remains positive in 2025, reflecting economic resilience. Source: FactSet, Bureau of Labor Statistics.

2. U.S. Stocks Play Catch-Up

For over a decade, U.S. equities outperformed international markets in 12 of the past 15 years, driven by stronger economic growth. In the first half of 2025, however, international stocks took the lead, particularly in Europe, where expansionary fiscal policy in Germany and deeper ECB rate cuts boosted equities. A 10%+ decline in the U.S. dollar (DXY index) amplified international returns, fueled by slowing U.S. growth and concerns about the dollar’s global dominance. Looking ahead, U.S. corporate profits are expected to outpace international peers, supported by AI-driven innovation and a more accommodative policy environment. Higher U.S. bond yields compared to Japan and much of the eurozone, along with the dollar’s reserve currency status, suggest near-term dollar support. Over the long term, however, the dollar’s 15-year uptrend may soften, reinforcing the need for global diversification.

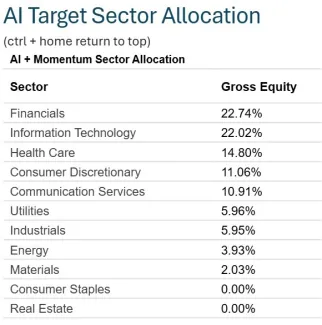

Portfolio Opportunity: Slightly underweight international developed large-cap stocks in favor of U.S. large- and mid-cap stocks, which are poised to benefit from stronger earnings growth. Maintain strategic allocations to international markets for diversification, but U.S. equities offer greater near-term potential given current valuations and earnings momentum. Recommend maintain a balanced approach while tilting market exposure across financials, health care, and technology.

The AI Target Sector Allocation below is a combination of sector trend momentum and AI news analysis for individual equities within the sectors.

3. Yields Rangebound as Fed Prepares to Ease

We expect 10-year Treasury yields to remain within a 4%–4.5% range, with potential for temporary deviations. The Federal Reserve held rates steady in June, awaiting clarity on tariff-related inflationary and economic impacts. Updated projections indicate two rate cuts in 2025 (unchanged from March) and one in 2026 (down from two), signaling a cautious easing cycle. Tariff-driven stagflation risks—higher inflation paired with slower growth—pose challenges, but we anticipate rate cuts resuming in September, exerting downward pressure on yields.

Futures markets project two Fed rate cuts in the second half, starting in September. Source: CME Fed Watch.

Portfolio Opportunity: Underweight fixed-income investments, particularly international bonds (due to lower yields). Within U.S. investment-grade bonds, focus on short term plus seven- to 10-year maturities to lock in higher yields while minimizing exposure to deficit-driven risks affecting longer-term bonds, such as 30-year maturities.

Global Markets Weekly Update

- U.S. Markets: The S&P 500 and Nasdaq achieved record highs for the second consecutive week, with smaller-cap indexes leading gains (S&P MidCap 400: +2.85%, Russell 2000: +3.52%, Dow: +2.3%). Trading was subdued ahead of the Independence Day holiday, with markets closing early Thursday and all day Friday.

- Policy Developments: The Trump administration’s reconciliation bill narrowly passed the Senate and House, while a U.S.-Vietnam trade deal and ongoing negotiations ahead of the July 9 tariff deadline remained in focus. President Trump’s comments on trade talks with other partners underscored the urgency of resolving tariff uncertainties.

- Economic Data: June’s 147,000 nonfarm payrolls exceeded expectations, unemployment dropped to 4.1%, and job openings rose to 7.8 million in May. Manufacturing PMI remained in contraction at 49%, a slight improvement from May’s 48.5%, while services PMI rebounded to 50.8%, driven by stronger business activity and new orders. The Prices Index, at 67.5%, indicated persistent price pressures.

- Bonds: Treasuries were largely unchanged, with yields ticking higher after the strong jobs report. Investment-grade and high-yield bonds posted gains, supported by positive equity market sentiment and an active issuance calendar. High-yield market sentiment remained firm, with new issues oversubscribed.

The Week Ahead

Key economic releases include the NFIB small business index and consumer credit data, which will shed light on small business sentiment and consumer spending trends, critical indicators of economic momentum.

Conclusion

The second half of 2025 presents challenges, including tariff uncertainty and potential inflationary pressures, but resilient economic data, easing trade tensions, and anticipated monetary and fiscal support provide reasons for cautious optimism. Investors should tilt portfolios toward U.S. large- and mid-cap stocks, maintain balanced sector exposure across financials, health care, and technology, and focus on U.S. investment-grade bonds in the seven- to 10-year maturity range. A well-diversified portfolio with opportunistic tilts can help investors navigate market volatility, capitalize on opportunities, and stay aligned with long-term financial goals.

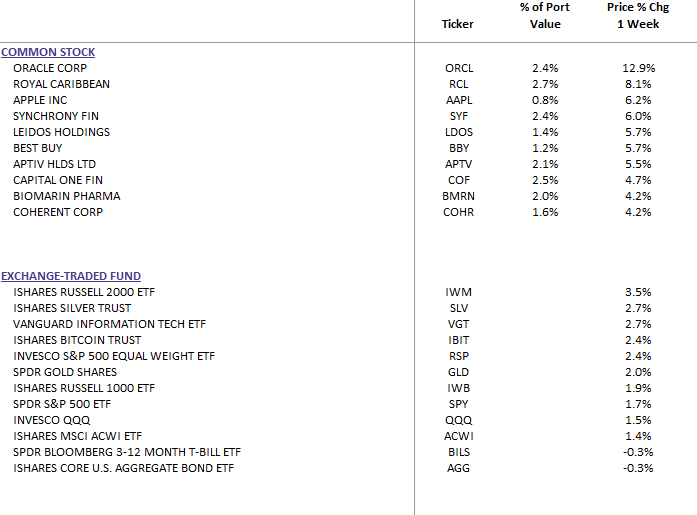

DBS Long Term Growth Top 10 and Benchmark Performances: