Weekly Commentary for the week ending July 26, 2025

Weekly Market Commentary: Global Markets Update - July 26, 2025

Key Takeaways

- Trade Deals Boost Sentiment: New trade agreements with Japan, Indonesia, and the Philippines, alongside progress toward a U.S.-EU deal, reduced uncertainty ahead of the August 1 tariff deadline, propelling U.S. stocks to record highs.

- U.S. Markets Surge: The S&P 500 and Nasdaq hit all-time highs for the second consecutive week, with the Dow up 1.26%. Value stocks slightly outperformed growth stocks.

- Mixed Earnings Results: Alphabet’s strong earnings and AI optimism lifted tech stocks, while Tesla’s disappointing report led to a 4.12% weekly decline.

- Economic Signals: U.S. business activity accelerated, driven by services (PMI 55.2), though manufacturing weakened (PMI 49.5). Housing sales fell 2.7%, with record-high prices amid high mortgage rates.

- Bond Market Dynamics: U.S. Treasuries posted modest gains, and investment-grade corporate bonds outperformed as spreads tightened. Bank loan issuance hit a historic high.

- Outlook: A packed week of earnings, Fed policy, and economic data may introduce volatility, but solid fundamentals and trade clarity support cautious optimism.

Market Performance

U.S. stocks climbed steadily, supported by trade deal optimism and robust earnings. The S&P 500 rose 1.5% to 6,389, the Nasdaq gained 1.0% to 21,108, and the Dow advanced 1.3% to 44,902. Small- and mid-cap indexes (S&P Midcap 400 and Russell 2000) each rose over 0.9%. The MSCI EAFE index surged 1.6%, reflecting global trade optimism. Treasuries saw modest gains, with the 10-year yield steady at 4.38%. Oil prices fell 1.5% to $65.04 per barrel.

Trade Developments: Clarity Emerges

Trade negotiations gained momentum ahead of the August 1 deadline set by President Trump for 30% tariffs on European goods. Deals with Japan ($550B U.S. investment, tariffs cut from 25% to 15%), Indonesia, and the Philippines, alongside progress with the EU, U.K., Vietnam, and China, eased market concerns. While tariff rates are rising, worst-case scenarios appear avoided, enabling better corporate planning.

Economic Highlights

- Business Activity: S&P Global’s flash PMI showed U.S. business activity at a seven-month high (54.6), driven by services (PMI 55.2). Manufacturing PMI fell to 49.5, signaling contraction.

- Housing Market: Existing home sales dropped 2.7% in June to 3.93M annually, with median prices hitting a record $435,300 due to high mortgage rates and low supply.

- Labor and Consumer Spending: Initial jobless claims declined, and June retail sales exceeded expectations, indicating resilient consumer demand despite inflation concerns.

Corporate Earnings

Second-quarter earnings are outperforming, with 83% of S&P 500 companies beating estimates by 7%. The expected earnings growth rate rose to 5.5%. Alphabet’s 4.38% stock gain followed strong results and AI-driven optimism, while Tesla’s 4.12% drop reflected weaker-than-expected earnings. The Magnificent Seven are projected to grow earnings by 14%, outpacing the broader S&P 500’s 3%.

Federal Reserve and Policy

The Fed faces pressure to cut rates, with the ECB having reduced rates by 2% versus the Fed’s 1% over the past year. Fed independence concerns are rising as Jerome Powell’s term nears its end. The FOMC is expected to hold rates steady this week, but a September cut is possible if trade clarity improves. One to two cuts are anticipated in H2 2025, with further easing in 2026.

Risks and Sentiment

Meme stock activity signals rising speculative froth, but broader sentiment (AAII survey) remains below euphoric levels. Valuations are high (S&P 500 P/E at 22x), making earnings critical for further gains. Late summer seasonality and upcoming events (earnings, Fed meeting, jobs report) could spark volatility.

Investment Recommendations

- Equities: Favor U.S. large- and mid-cap stocks, particularly in technology. financials, health care, and consumer discretionary.

- Bonds: Short Term and 7-10 Year Treasuries offer value.

- Strategy: Avoid speculative investments, prioritize quality and diversification. View tactical pullbacks as buying opportunities.

The Week Ahead

Key events include the FOMC rate decision, Q2 GDP estimate, nonfarm payrolls, PCE inflation, and earnings from Microsoft, Meta, Apple, and Amazon. These could test the market’s low-volatility streak.

Bottom Line: Trade clarity and solid fundamentals support an upward trend, but volatility risks loom. Stay diversified and opportunistic.

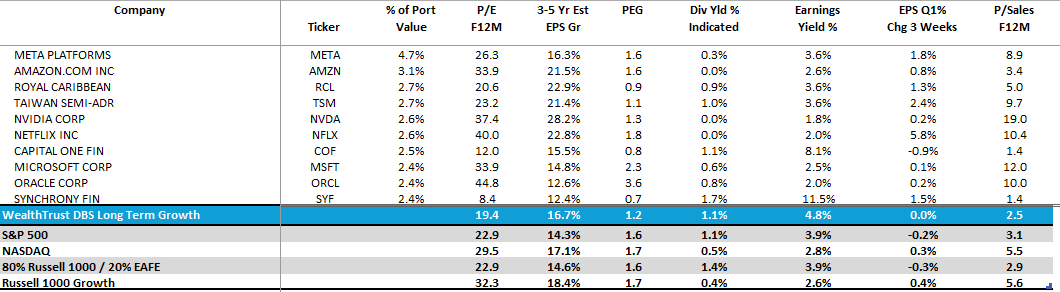

DBS Long Term Growth Portfolio Top Ten Holdings and Valuation Statistics.

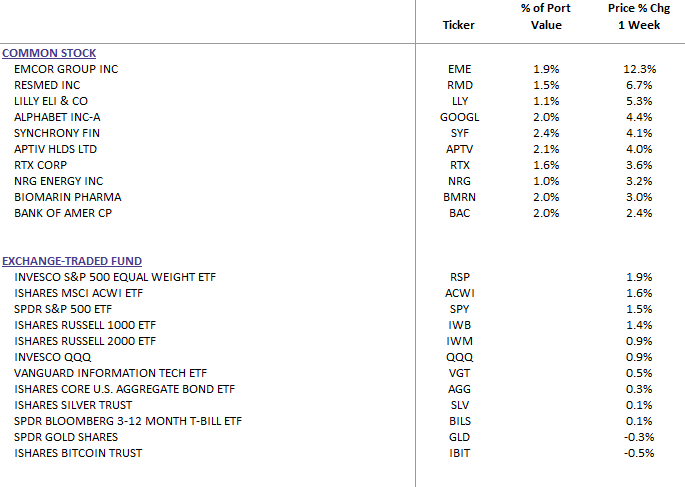

DBS Long Term Growth Top Ten and Benchmark Weekly Performance: