Weekly Commentary for the week ending July 19, 2025

Markets Continue to Climb, Supported by Solid Economic Data:

Key Takeaways

- Stock markets advanced, with the S&P 500 and Nasdaq hitting new record highs, up ~1% and ~7-8% year-to-date, respectively, driven by strong corporate earnings and favorable economic data. The Russell 2000 gained, while the Dow and S&P Midcap 400 dipped.

- Consumer inflation rises modestly in U.S.: June CPI rose 0.3% month-over-month and 2.7% year-over-year, driven partly by tariffs, though offset by lower car prices. Core CPI ticked up to 2.9%.

- Retail sales rebounded: June sales rose 0.6%, beating forecasts, signaling robust consumer spending despite tariff-driven price increases.

- Solid corporate earnings bolster stocks: Q2 earnings season started strong, with 86% of early S&P 500 reporters beating forecasts, led by financials like JPMorgan Chase and consumer names like Netflix.

- Tariffs remain a concern, with average U.S. import tariffs at 20.6%, but their impact on inflation and growth is limited so far. Investors await the August 1 tariff deadline.

- Outlook: Volatility may rise in August/September due to tariff updates and seasonal trends, but Fed rate cuts, a new tax bill, and trade clarity could support markets by year-end.

Markets Climb with Strong Earnings and Economic Data

The S&P 500 and Nasdaq Composite Index reached new records last week, supported by solid corporate earnings and generally favorable economic data. The S&P 500 gained ~1%, up over 26% since April 8 lows, while both indices are up 7-8% year-to-date. The small-cap Russell 2000 also rose, though the Dow Jones Industrial Average and S&P Midcap 400 ended slightly lower. Financial markets have been buoyed by robust economic readings and corporate performance, helping investors navigate ongoing uncertainties.

Consumer Inflation Heats Up in U.S.

- CPI: June’s Consumer Price Index rose 0.3% month-over-month, the largest increase in five months, up from May’s 0.1%. Year-over-year, CPI increased 2.7%, above May’s 2.4% and slightly above the 2.6% forecast. Core CPI, excluding food and energy, rose 2.9% year-over-year, up from 2.8%. Higher tariffs contributed to price increases in household goods, recreational goods, and footwear, though lower car prices provided some offset.

- PPI: Producer Price Index inflation was 2.3%, below the 2.5% forecast and May’s revised 2.7%. Despite tariff hikes, inflation remains contained but may rise to 3.0-3.5% by year-end. We expect a one-time price step-up from tariffs, normalizing toward the Fed’s 2.0% target in 2026.

Retail Sales Signal Consumer Strength

June U.S. retail sales surged 0.6%, surpassing the 0.1% forecast and rebounding from May’s -0.9%. Strong spending in autos, auto parts, apparel, and food services reflects resilient consumer demand, despite tariff-related price hikes in home furnishings and appliances. Consumption, ~70% of U.S. GDP, continues to drive economic growth.

Solid Corporate Earnings Bolster Stocks

Q2 earnings season kicked off strongly, with 86% of the 12% of S&P 500 companies reporting beating forecasts, above the 10-year average of 75%. Financials led, with JPMorgan Chase and Citigroup reporting better-than-expected Q2 results, citing strong trading revenues and capital markets activity. Consumer-facing companies like PepsiCo, United Airlines, and Netflix also surpassed forecasts. Despite lowered expectations (from 11% to 5% annual growth), Q2 earnings are on track to exceed estimates, with full-year growth likely in the mid-to-high single digits. Potential rate cuts and tariff clarity could drive double-digit earnings growth in 2026.

In company-specific news, NVIDIA rallied after the Trump administration permitted sales of its H2O AI chips to China, boosting its market cap past $4 trillion in early July.

Corporate Bonds Outperform Treasuries

Intermediate- and long-term U.S. Treasury yields were stable, while short-term yields dipped amid speculation about Federal Reserve Chair Jerome Powell’s future, sparked by reports of President Trump’s plan to replace him. The move was quickly reversed after Trump clarified he would not remove Powell. Investment-grade corporate bonds outperformed Treasuries, with issuance meeting expectations and largely oversubscribed.

Are Markets Ignoring Tariffs? Not Entirely

Tariffs remain a key concern, with the U.S. pushing the trade deadline to August 1. Average U.S. import tariffs have risen from 2.4% to 20.6%, the highest since 1910, generating $27 billion in June Treasury revenues. However, inflation and consumption have held up due to:

- Tariff costs absorbed by exporters, corporations, or consumers.

- Inventory stockpiling ahead of tariff hikes.

- Lower oil prices ($60-$70 WTI crude), reducing costs for consumers and businesses.

Positive trade developments include deals with the U.K. and Vietnam, a framework with China, and negotiations with Indonesia, India, and the EU. Relaxed export restrictions (e.g., NVIDIA’s AI chip sales) and alternative supply chains (e.g., Apple’s rare earth magnet deals) may mitigate tariff impacts and diversify trade.

Outlook: Climbing Walls of Worry in H2 2025

Markets have overcome early 2025 tariff fears, supported by resilient economic data and strong earnings. However, volatility may increase in August/September due to the tariff deadline and seasonal trends. Higher tariffs could raise prices and cool consumption if costs are less absorbed.

Looking toward year-end, we expect:

- Stabilizing inflation as tariff impacts normalize.

- Fed rate cuts, supporting growth, despite Trump’s criticism of Powell.

- U.S. tax bill stimulus, boosting economic activity.

- Trade clarity, enhancing market confidence.

We recommend investors use pullbacks to position for 2026 growth, favoring U.S. large- and mid-cap stocks in technology, consumer discretionary, financials, and health care.

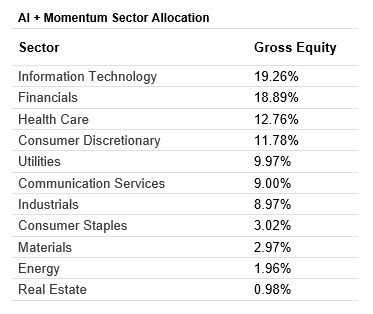

Our AI Target Sector Allocation below is based on AI momentum sector trend analysis and AI news analysis.

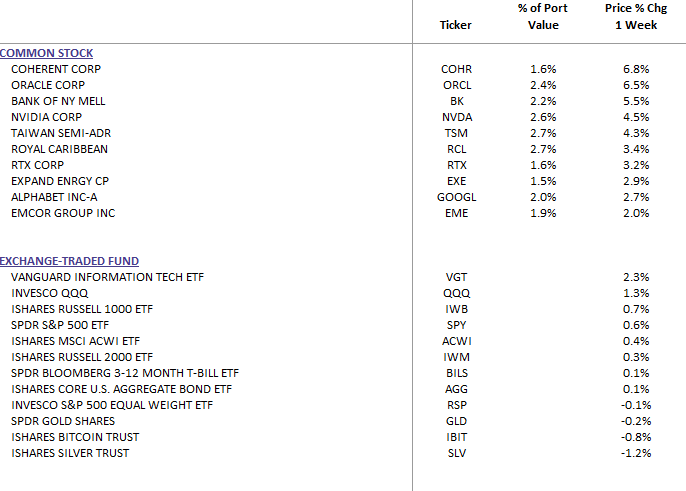

DBS Long Term Growth Top Ten and Benchmark Weekly Performance: