Weekly Commentary for the week ending July 12, 2025

Weekly Market Commentary: Stocks Remain Resilient as Tariffs and New Tax Law Shape Outlook

Key Takeaways

- U.S. stocks hover near record highs, driven by strong energy and industrial sectors, despite new tariff announcements stirring caution.

- The One Big Beautiful Bill Act (OBBBA), signed July 4, extends 2017 tax cuts, adds deductions for tips, overtime, and Social Security, and raises the SALT cap.

- Tariffs on over 20 countries (20%-50%), effective August 1 unless trade deals are reached, may raise prices short-term, with the Federal Reserve likely holding rates until fall, targeting 3%-3.5% by 2026.

One Big Beautiful Bill Act: Tax Breaks, Economic Boost, and Concerns

On July 4, 2025, President Trump signed the One Big Beautiful Bill Act (OBBBA), extending the 2017 Tax Cuts and Jobs Act (TCJA) and introducing new tax breaks and spending cuts. The bill aims to support workers, families, and businesses while funding national priorities.

Key Provisions and Benefits

- Workers: Deductions include up to $25,000 on tip income (e.g., for waiters, drivers), $12,500 on overtime pay (through 2028, for nurses, first responders), and $10,000 on auto loan interest for U.S.-made vehicles (2025–2028). A Social Security income deduction benefits 7.7 million veterans and seniors. These are retroactive for 2025, boosting take-home pay for millions.

- Families: The child tax credit rises permanently from $2,000 to $2,200, with new child savings accounts and expanded school choice for low-income families.

- Small Businesses: A permanent 23% pass-through deduction (up from 20%) aids 26 million entrepreneurs. Full write-offs for equipment, R&D, and new manufacturing facilities (retroactive to January 19, 2025, for projects before 2029) encourage investment. The National Federation of Independent Business (NFIB) calls it a “landmark victory,” predicting stronger local economies.

- SALT Deduction: The state and local tax cap rises from $10,000 to $40,000 (2025–2029), helping high-tax state residents, phasing out above $500,000 income.

- National Priorities: The bill allocates $12.5 billion for air traffic control modernization (praised by Airlines for America), $46 billion for the U.S.-Mexico border wall, $45 billion for migrant detention, $150 billion for defense, and $50 billion for rural hospitals.

Economic and Fiscal Impacts Debt Debate Along Party Lines

The OBBBA’s impact on the national debt has sparked partisan disagreement:

- Republicans: They argue the $3.3 trillion debt increase is manageable, with the Tax Foundation’s 1.2% GDP boost and $1.6 trillion in spending cuts (e.g., Medicaid, SNAP, clean energy credits) showing fiscal discipline. The Heritage Foundation compares these cuts to the 1997 Balanced Budget Act, claiming they mitigate debt growth. Investments in defense and infrastructure (e.g., $12.5 billion for air traffic control) are seen as essential for economic stability, supported by groups like the NFIB and Airlines for America. They also believe that a base line tariff of 10% could potentially reduce the debt. Tariffs increase the cost of imported goods, and the government collects the tariff revenue. For example, if the U.S. imported $3 trillion in goods annually, a 10% tariff could theoretically generate $300 billion per year in revenue. This revenue could be directed toward debt reduction.

- Democrats: They warn that the $3 trillion debt hike (per the Committee for a Responsible Federal Budget, including interest) risks fiscal instability. The Penn Wharton Budget Model notes tax cuts favor the wealthy, limiting stimulus, while cuts to social programs harm low-income households, potentially increasing future costs. The Peterson Institute for International Economics flags higher borrowing costs as markets react.

Tariffs Stir Concerns

With the 90-day tariff pause ending July 9, new tariffs were announced on over 20 countries, effective August 1 unless trade deals are secured. Rates range from 20% (Vietnam, via a July 2 deal) to 50% (Brazil, up from 10%, tied to actions against former President Jair Bolsonaro). Canada faces 35% (up from 25%), with USMCA goods exempt. Most others see 15%-20% tariffs, while a 50% copper tariff spiked U.S. futures prices.

The U.K. holds a 10% rate from a prior deal, suggesting negotiation potential. Tariffs, previously 2.3% in 2024, will rise sharply. Businesses have mitigated costs via stockpiling, but short-term price increases are likely. These should not fuel long-term inflation, and trade deals could ease tensions. Tariffs aim to boost U.S. manufacturing but risk slower growth and higher prices, complicating the Fed’s role.

Federal Reserve’s Balancing Act

Tariffs’ stagflationary risks—slower growth, higher prices—challenge the Fed’s goals of stable prices and strong jobs. With the fed funds rate at 4.3% and PCE inflation at 2.3%, policy is restrictive. A solid job market allows the Fed to wait, but rate cuts are unlikely before fall, with rates projected at 3%-3.5% by 2026 as inflation cools.

Investment Strategy

Despite a slowing economy, tax breaks, deregulation, and future rate cuts should spark growth in 2026-2027. Use market dips to invest in U.S. large- and mid-cap stocks, which are well-positioned. International stocks, boosted by a weaker dollar in 2025, may slow, so trim developed-market holdings. Avoid international and high-yield U.S. bonds due to low yields and tight spreads. Opt for U.S. treasuries and investment-grade bonds, holding short term and 7–10-year duration to lock in yields before rate cuts, with less deficit risk than longer-term bonds.

We recommend tilting your investments towards Financials, Information Technology and Healthcare while maintaining an overall balanced approach in your equity portfolio.

Our AI Target Sector Allocation below is based on AI momentum sector trend analysis and AI news analysis.

AI Target Sector Allocation

AI + Momentum Sector Allocation | |

Sector | Gross Equity |

Financials | 25.05% |

Information Technology | 20.99% |

Health Care | 15.12% |

Consumer Discretionary | 11.10% |

Communication Services | 9.95% |

Utilities | 8.13% |

Industrials | 6.08% |

Energy | 2.08% |

Materials | 1.99% |

Consumer Staples | 0.00% |

Real Estate | 0.00% |

Global Markets Weekly Update

U.S. indexes dipped slightly, with the Nasdaq (-0.1%) outperforming the Dow (-1.0%). Tariff news had a muted impact compared to April. Growth stocks edged out value, and Delta Air Lines’ upbeat 2025 outlook lifted airlines, signaling consumer strength. NVIDIA hit a $4 trillion market cap, bolstering mega-caps. New 25% tariffs on South Korea and Japan, plus the copper tariff, made waves. Fed minutes showed disagreement, with some eyeing cuts by late July, others not until 2026. Treasuries slipped after a mid-week rally, with strong 10-year note demand. Corporate bonds lagged, though new issues were oversubscribed.

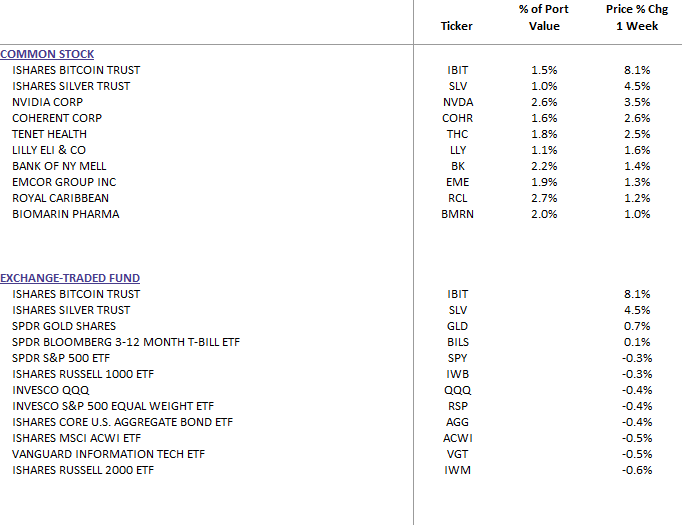

DBS Long Term Growth Top Ten and Benchmark Weekly Performance: