Weekly Commentary for the week ending January 24, 2026

We have wrapped up, what turned out to be, another volatile yet ultimately range-bound week for U.S. equities.

Let's start with the scoreboard. After a rollercoaster ride, the major indices ended the week nearly flat to slightly lower. The Dow Jones Industrial Average finished down about 0.5-0.6% for the week, closing around the 49,000 level after some sharp daily swings. The S&P 500 was down roughly 0.4-0.5%, hovering near 6,900-6,916 by Friday's close. The Nasdaq Composite actually eked out a small gain of about 0.2%, showing a bit more resilience in tech despite the broader caution.

The week featured dramatic daily moves. Early in the week—particularly around January 20—markets sold off sharply, with the Dow dropping nearly 870-900 points in one session and the S&P falling over 2%. That pressure came from renewed geopolitical and trade concerns, specifically President Trump's comments threatening tariffs tied to issues over Greenland and broader European trade dynamics. It triggered a broad risk-off move, pushing Treasury yields higher temporarily and sending investors into safe havens like gold, which hit fresh all-time highs.

But then came the reversal. By mid-to-late week, particularly around January 21-22, stocks staged a strong rebound as those tariff threats eased. Reports emerged of a potential framework deal or de-escalation on the Greenland/Europe front, and the tone shifted markedly. The Dow surged nearly 600-650 points in one session, the S&P jumped over 1%, and the Nasdaq led with gains around 0.9-1.2% on those recovery days. It was classic whipsaw action—big down day, big up day—leaving us basically where we started by Friday.

Sector performance told an interesting rotation story. Energy was a standout, up nearly 3% for the week, helped by firmer oil prices amid ongoing global supply questions. Basic materials also performed well, up around 2.8%. On the flip side, financial services lagged, and we saw pressure in parts of tech—most notably Intel, which plunged about 17-18% after a disappointing outlook despite otherwise decent results. That single name weighed noticeably on the broader Nasdaq and semiconductor space.

Otherwise, the earnings season has already kicked off, with around 80-81% of the early reporters in the S&P 500 beating profit estimates so far, similar to the rate seen in the last earnings season. However, the release calendar will intensify this week, with high-profile mega-cap technology companies – Meta, Apple, Tesla and Microsoft – all due to report. We expect these results to provide the latest litmus test of the translation of heavy AI investment into revenue growth and profits. Markets have shown signs of a rotation away from some of these names this year, with the "Magnificent 7" stocks broadly flat to mixed on the year so far—in some cases lagging significantly—in contrast to better performance from other large-cap companies and significantly lagging small-cap stocks. Still, the technology sector is expected to deliver the strongest earnings growth across the S&P 500 this year, even if the gap with other sectors is seen narrowing.

Zooming out to the bigger picture, markets are still digesting a mix of resilient economic data and policy uncertainty. The IMF's January 2026 World Economic Outlook Update kept global growth projections steady at around 3.3% for this year, describing the economy as "steady amid divergent forces." U.S. growth remains supported by solid consumer and corporate activity, though fiscal dynamics are mixed with some looser policy expected in certain areas.

On the Fed front, expectations have clearly shifted toward patience. Virtually all economists in recent polls expect the Federal Reserve to hold rates steady at the current 3.50%-3.75% range at the upcoming January 27-28 meeting—and quite possibly well beyond. Many now see no cuts until at least June, if then, given the strength in growth and lingering inflation watchfulness. That's a notable pivot from earlier hopes for a more aggressive easing cycle.

Geopolitical headlines remain front and center, with trade rhetoric, European relations, and broader global tensions keeping risk premiums elevated. Gold's continued strength to record levels reflects that caution—investors are hedging against uncertainty even as equities refuse to break lower decisively.

Looking ahead to next week, eyes will be on the Fed meeting itself for any fresh language on the path forward, plus those blockbuster earnings reports from the big tech names, more economic data, and of course any developments on the trade/geopolitical front. Volatility isn't going away anytime soon, but the underlying resilience of the U.S. economy—and the still-solid earnings backdrop—continues to provide a floor under stocks.

For long-term investors, this kind of choppy environment often rewards discipline—staying invested through the noise rather than trying to time the swings. Valuations aren't cheap, but corporate earnings growth remains supportive, and AI/productivity themes still have legs even amid the rotation.

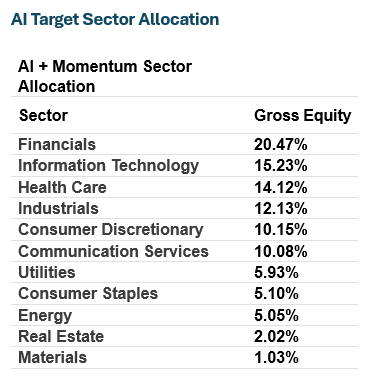

The AI + Momentum Sector Allocation strategy leverages artificial intelligence to dynamically optimize portfolio weights across U.S. equity sectors, combining predictive analytics with momentum signals to target outperforming areas while maintaining broad diversification. This AI-driven approach aims to enhance risk-adjusted returns by rotating toward high-momentum sectors amid evolving AI themes.

A major key to outperformance is not only identifying sectors that are in favor but drilling down to identify the best companies to own within those sectors!

Compared to last week, the top 4 sectors remain Financials, Technology, Healthcare and Industrials.

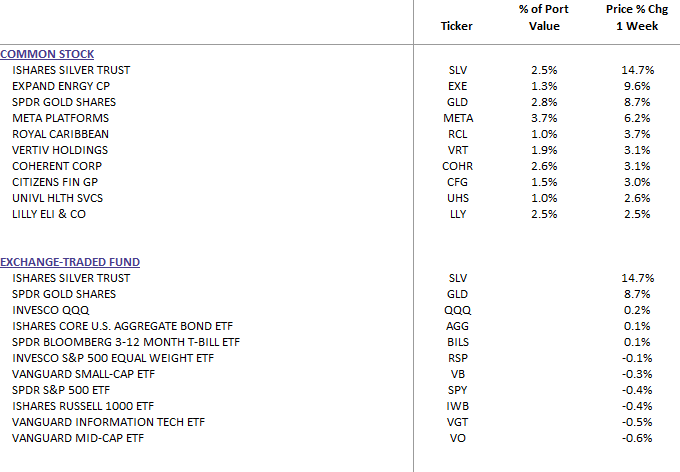

DBS Long Term Growth Top Ten and Benchmark Weekly Performance:

Silver and gold continue to shine, but we are prepared to reduce our exposure when geopolitical risk normalizes.

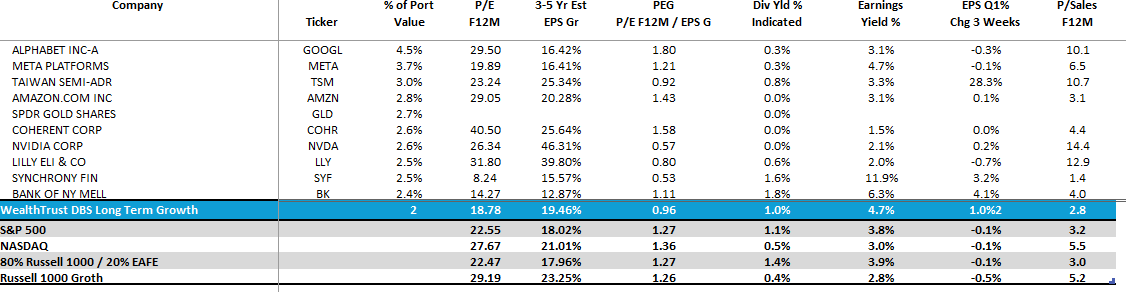

DBS Long Term Growth Portfolio Top Ten Holdings and Valuation Statistics: