Weekly Commentary for the week ending January 17, 2026

Overall Market Performance

The major U.S. indexes wrapped up a volatile week with modest losses, snapping a string of recent record highs seen earlier in January.

- The Dow Jones Industrial Average closed Friday at 49,359, down about 0.17% on the day and posting a small weekly decline.

- The S&P 500 finished just below flat at around 6,940, down roughly 0.06% Friday and ending the week in the red after weighing fresh political commentary and mixed earnings reactions.

- The Nasdaq Composite also slipped 0.06% to 23,515, reflecting some late-week pressure on technology names despite earlier strength in semiconductors.

Overall, the week featured a healthy dose of rotation — away from some richly valued mega-cap tech toward more small-cap. mid-cap, cyclical and value-oriented sectors — which many analysts view as a constructive development for broader market participation heading deeper into 2026. We believe rotation will eventually return to our mega-cap tech holdings.

Key Highlights from the Week

Earnings season kicked off with a bang, particularly in the financial and semiconductor spaces. Taiwan Semiconductor (TSM) delivered blowout results and guided for significantly higher capital spending in the U.S. (between $52–56 billion), reinforcing confidence in the ongoing AI infrastructure buildout. This helped chip stocks rebound mid-week after earlier softness.

Bank earnings showed resilience, though credit-sensitive names faced some pressure amid ongoing commentary from Washington about consumer lending practices.

On the economic data front, initial jobless claims came in better than expected at 198,000 for the week ending January 10 — a nice drop that signals continued labor market stability. Manufacturing indicators like the Empire State Index surprised to the upside as well.

However, the mood was tempered by persistent geopolitical noise and renewed discussion around Federal Reserve independence. President Trump's recent comments on Fed policy, credit card rates, and various international matters kept traders on edge, contributing to the late-week pullback.

Treasury yields climbed to 4-month high, adding some headwind for growth stocks, while gold and silver continued their impressive run to fresh records — a classic sign of diversification demand amid policy uncertainty.

Broader Market Themes

We're seeing early signs of the much-discussed broadening of the rally. While the "Magnificent Seven" tech giants have dominated headlines for years, more economically sensitive areas — including industrials, financials, and smaller caps — showed relative strength this week. The Russell 2000 small-cap index has enjoyed one of its strongest January starts in years.

The market seems to be pricing in a resilient U.S. economy with GDP growth potentially tracking around 2–3% for 2026 (with some nowcasts even higher for Q4 2025). Corporate earnings remain a key pillar of support, with analysts expecting continued year-over-year profit growth in the high single digits.

That said, valuations are elevated, and policy risks — from tariffs and spending changes to questions about Fed leadership — remain in play. The Fed itself is widely expected to hold rates steady at its late-January meeting (currently in the 3.5–3.75% range), with any further easing likely pushed to later in the year.

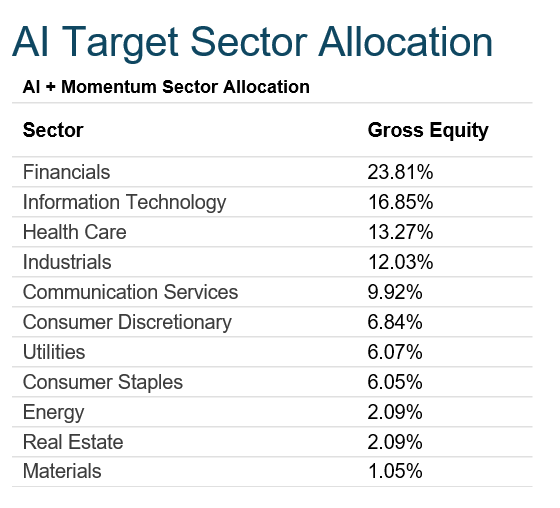

The AI + Momentum Sector Allocation strategy leverages artificial intelligence to dynamically optimize portfolio weights across U.S. equity sectors, combining predictive analytics with momentum signals to target outperforming areas while maintaining broad diversification. This AI-driven approach aims to enhance risk-adjusted returns by rotating toward high-momentum sectors amid evolving AI themes.

A major key to outperformance is not only identifying sectors that are in favor but drilling down to identify the best companies to own within those sectors!

Compared to last week, Technology went from the 3rd. to the 2nd, Industrials made a strong move from the 6th. to 4th, while financials maintained their strong hold on 1st.

I believe the recent uptick in industrial stocks is partly attributable to the announcement of 30 new manufacturing facilities being constructed across the U.S., signaling renewed investment in domestic production and supply chain resilience.

Looking Ahead

Next week brings the start of more meaningful earnings flow, plus key data like preliminary PMIs and final Michigan consumer sentiment. Volatility could remain elevated as the market digests policy headlines and positions for the rest of Q1.

The bottom line: Despite the week's modest retreat, the underlying trend remains bullish as long as economic resilience holds, and earnings continue to deliver. Rotation and broadening participation are healthy developments that could help ease some valuation concerns.