Weekly Commentary for the week ending January 03, 2026

Introduction - A slow news week! The holiday-shortened week spanning the end of 2025 and the start of 2026 was marked by thin trading volumes and a risk-off tone, as investors locked in gains after another strong year for equities. U.S. markets were closed on January 1 for New Year's Day, with only two full trading sessions (December 31 and January 2). The major indices ended 2025 on a softer note but capped a remarkable third consecutive year of double-digit gains—the longest such streak since 2019-2021. The S&P 500 closed 2025 at approximately 6,845, the Dow at 48,063, and the Nasdaq reflecting tech pressures.

U.S. Equity Performance and Sector Highlights The week saw modest declines amid profit-taking in heavyweight tech stocks, offsetting earlier hopes for a traditional "Santa Claus rally" (the last five trading days of the year plus the first two of the new year). On December 31, the Dow fell 0.63%, the S&P 500 dropped 0.74%, and the Nasdaq declined 0.76%. However, January 2 brought a rebound: chipmakers rallied strongly (Nvidia +2%, Micron and Intel +7% each), boosting semiconductors amid positive AI developments and corporate news. The Dow gained 0.54% to around 48,322, while the S&P 500 rose fractionally to 6,858.

Overall, the abbreviated week was down slightly, but 2025 delivered robust returns: S&P 500 +16.4%, Nasdaq +20.4%, Dow +13%. Broader participation emerged late in the year, with small-caps (Russell 2000 +11%) and international markets outperforming in pockets. AI remained the dominant theme, though mega-cap tech faced rotation pressures.

Macroeconomic and Policy Developments Economic data was light due to holidays, with pending home sales, Chicago PMI, and FOMC minutes from December highlighted. The minutes revealed Fed officials' support for further cuts if inflation moderates, though divisions persist on pace. Markets price in 2-3 quarter-point reductions in 2026, with focus shifting to President Trump's upcoming Fed chair nomination (expected soon) and potential for a more dovish stance post-Powell's term ending in May.

Trump's policies—tariffs, tax cuts, and deregulation—continue to influence sentiment, contributing to 2025's resilience despite early volatility. Labor market indicators remain key, with upcoming jobs data critical amid signs of softening.

Commodities and Global Context Gold retreated from peaks but posted its strongest annual gain in decades (~65%+), closing around $4,300/oz amid safe-haven demand. Oil extended declines (WTI ~$57-58, Brent ~$61), reflecting oversupply and weak demand outlook.

Outlook and Key Risks Wall Street enters 2026 bullish, with consensus S&P 500 targets around 7,500-8,000 (implying 10-17% upside), driven by 12-15% earnings growth, AI productivity, and Fed easing. Bullish calls reach as high as 8,100, citing resilient growth and policy support.

Risks include elevated valuations, tariff impacts, labor weakening, and Fed transitions. Volatility may pick up with earnings season and data releases ahead.

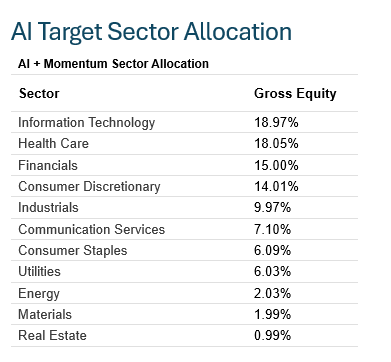

The AI + Momentum Sector Allocation strategy leverages artificial intelligence to dynamically optimize portfolio weights across U.S. equity sectors, combining predictive analytics with momentum signals to target outperforming areas while maintaining broad diversification. This AI-driven approach aims to enhance risk-adjusted returns by rotating toward high-momentum sectors amid evolving AI themes.

A major key to outperformance is not only identifying sectors that are in favor but drilling down to identify the best companies to own within those sectors!

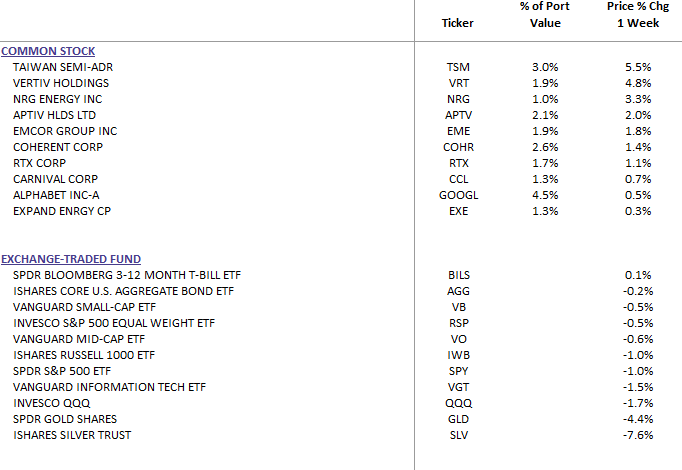

DBS Long Term Growth Top Ten and Benchmark Weekly Performance:

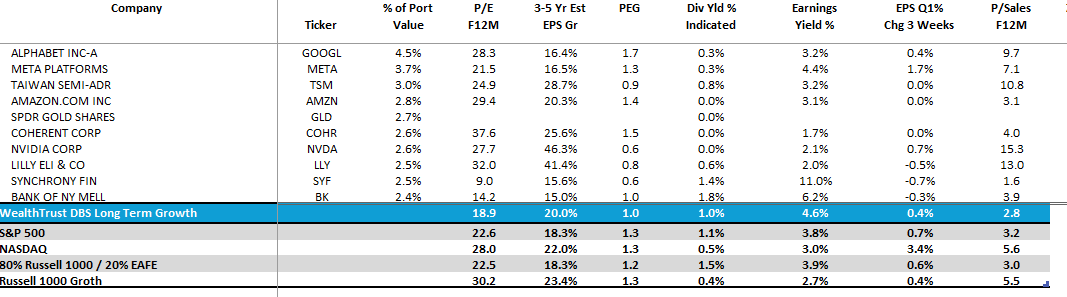

DBS Long Term Growth Portfolio Top Ten Holdings and Valuation Statistics:

As we turn the page to 2026, markets have rewarded patience—focus on quality, diversification, and upcoming catalysts.