Weekly Commentary for the week ending February 7, 2026

Let's start with the headline that dominated Friday's session and likely the weekend headlines: the Dow Jones Industrial Average officially closed above 50,000 for the first time in history. The blue-chip index surged over 1,200 points (about 2.5%) on Friday alone, finishing at 50,115.67. This milestone came after a volatile week and marks a significant psychological barrier broken, reflecting resilience in more traditional, cyclical parts of the economy.

The broader market also staged a strong rebound. The S&P 500 jumped nearly 2% on Friday to close at 6,932.30, marking its best single-day gain since May. The tech-heavy Nasdaq Composite rose 2.2% to 23,031.21, recovering some ground after getting hit harder earlier in the week.

But the week as a whole told a more nuanced story. Despite the Friday rally, the S&P 500 ended slightly lower — down about 0.1% — while the Nasdaq posted a 1.8% decline, marking its fourth straight weekly loss. The Dow, however, bucked that trend with a solid 2.5% weekly gain, highlighting a clear rotation underway: money moving out of some high-flying tech names and into more economically sensitive, cyclical stocks.

What drove this rollercoaster? Early in the week, markets faced a classic risk-off environment. Concerns mounted over massive AI-related capital spending by Big Tech — with announcements like Amazon's plans to pour about $200 billion into AI infrastructure in 2026 (a roughly 50-60% jump from prior levels) and Alphabet guiding toward $175-185 billion (nearly double its 2025 spend) — weighed heavily. These figures far exceeded many analyst expectations and rippled through software and related sectors. Fears that these enormous outlays could pressure near-term profitability, combined with some softer labor data, triggered a three-day sell-off, particularly in tech and discretionary stocks.

Thursday saw the Dow drop about 600 points, the S&P down 1.2%, and Nasdaq off 1.6%, with Bitcoin briefly dipping below $64,000 amid the broader risk aversion.

Then came the sharp reversal on Friday. Tech found its footing — chipmakers like Nvidia led the charge higher — as investors interpreted that heavy AI spending as a long-term bullish signal for infrastructure and semiconductors rather than an immediate negative. Cyclicals benefited from the rotation, and even Bitcoin bounced back above $70,000.

Diving deeper into the technology sector, which has been at the epicenter of this week's drama: despite the recent weakness, the fundamentals remain robust. Earnings for the Information Technology sector are expected to rise around 30% year-over-year in 2026 — the fastest pace among all 11 S&P 500 sectors, well ahead of the broader index's projected 14-15% growth. This strength underscores the ongoing AI-driven momentum and solid demand across cloud, semiconductors, and software.

Yet the pullback we've seen has been driven almost entirely by valuation compression. The forward price-to-earnings (P/E) ratio for the tech sector has declined notably — from highs around the low-to-mid 30s recently to levels closer to 24-25 in recent sessions (with some broader measures still higher but showing meaningful easing). Investors appear to be reassessing how much they're willing to pay for these growth profiles, and two key forces are driving this repricing.

The recent decline in software and technology stocks stems from two main investor concerns tied to AI advancements.

- AI-driven competitive disruption: Fears are growing that legacy business models in legal, marketing, and finance could face faster erosion through intensified competition, margin pressure, or partial obsolescence of established software suites. This has driven broad selling across software stocks, with many valuations now appearing to already reflect significant disruption risk. NVIDIA CEO Jensen Huang recently called the idea that AI will render software obsolete “entirely illogical,” arguing that AI progress relies on extending and integrating with existing software frameworks and tools. While leaders and laggards will emerge over time, distinguishing them now is difficult, suggesting persistent volatility in software and favoring diversified exposure.

- Sharp rise in AI capital expenditure: Alphabet projected 2026 capex of $175–185 billion (~2× prior year), Amazon ~$200 billion, both citing strong demand for AI infrastructure. These investments boost semiconductor revenue and create positive economic effects (jobs, supply chains), yet raise questions about adequate returns given uncertain monetization timelines. Increased debt reliance in historically capital-light models has heightened caution, contributing to the recent contraction in tech valuations as markets assess the scale, timing, and profitability of these large AI commitments.

Note: At WealthTrust, even though we are diversified, we believe that there will be a rotation back into technology once this rotation matures due to the sector's projected 30% earnings growth this year!

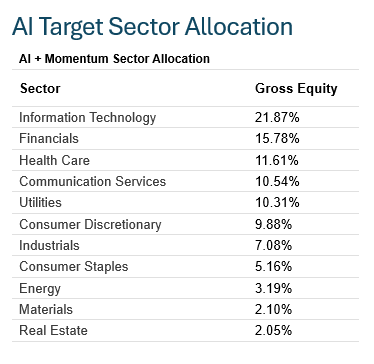

The AI + Momentum Sector Allocation strategy leverages artificial intelligence to dynamically optimize portfolio weights across U.S. equity sectors, combining predictive analytics with momentum signals to target outperforming areas while maintaining broad diversification. This AI-driven approach aims to enhance risk-adjusted returns by rotating toward high-momentum sectors amid evolving AI themes.

* A major key to outperformance is not only identifying sectors that are in favor but drilling down to identify the best companies to own within those sectors!

Looking beyond equities, the economic backdrop remains supportive overall. Recent data shows the U.S. economy expanding solidly, with strong consumer spending and business investment (especially in AI) helping offset some softer spots in the labor market. The Federal Reserve held rates steady in its latest meeting at the 3.5%–3.75% target range, with policymakers noting progress toward the 2% inflation goal but emphasizing data-dependence for any future moves. Market pricing now leans toward a couple of modest cuts possible later in 2026, but nothing aggressive.

This week's action underscores a key theme emerging in 2026: leadership broadening beyond the "Magnificent 7" tech giants that dominated 2023–2025. We're seeing more participation from cyclical sectors, small caps showing relative strength in spots, and even international and emerging markets holding up well amid U.S. policy shifts.

That said, volatility isn't going away. Valuations remain elevated in many areas (even after recent compression in tech), inflation is still somewhat sticky, and geopolitical/trade uncertainties linger. The delayed January jobs report and upcoming inflation data (now pushed back due to earlier disruptions) will be closely watched in the week ahead.

Wrapping up: a week that started shaky but ended on a historic high note. The Dow's 50,000 milestone is a reminder of how far we've come, even as the market digests big shifts in leadership, massive AI infrastructure bets, and evolving competitive dynamics in software and beyond.

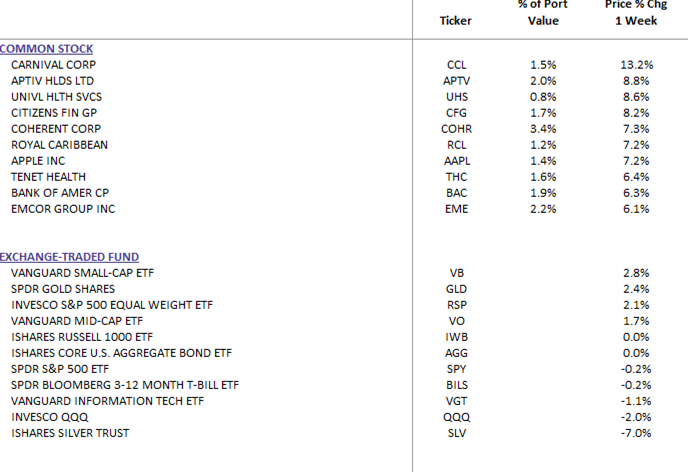

DBS Long Term Growth Top Ten and Benchmark Weekly Performance:

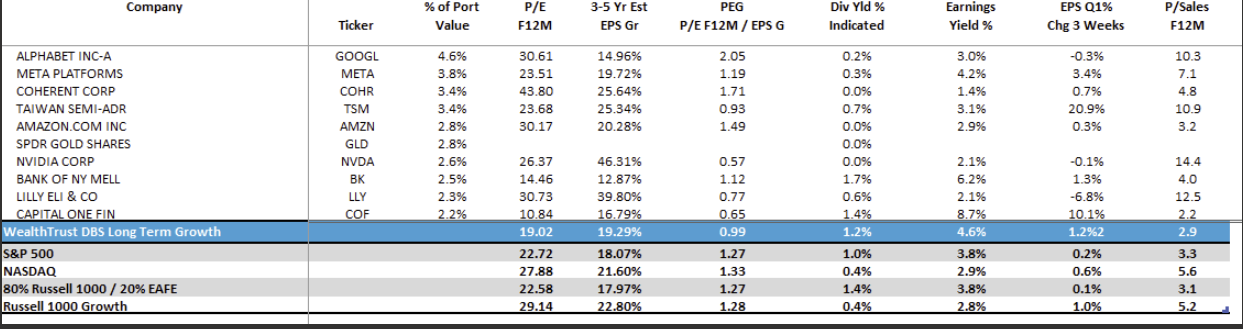

WealthTrust Long Term Growth Portfolio | Top 10 Equity Review