Weekly Commentary for the week ending December 27, 2025

Good morning, and welcome to this week's market commentary on December 27, 2025. As we wrap up a holiday-shortened trading week—with markets closed on Christmas and volumes light post-holiday—the major U.S. indexes managed to log solid weekly gains amid subdued activity. This quiet but positive tone caps off what has been a remarkably resilient year for equities, with the S&P 500 eyeing the psychologically significant 7,000 level in the final sessions ahead.

Let's start with the performance recap. The S&P 500 dipped fractionally on Friday, closing at approximately 6,930 after touching a fresh intraday high near 6,946. Despite the minor pullback, the broad index posted weekly gains of around 1.4%, marking its fourth advance in five weeks. The Dow Jones Industrial Average ended nearly flat at about 48,711 but also notched weekly upside, while the Nasdaq Composite slipped 0.1% on the day yet contributed to the broader positive momentum. All three majors remain at or near record highs, reflecting ongoing investor optimism despite thin liquidity.

This week's action was classic year-end behavior: low volume, minimal catalysts, and a focus on positioning for 2026. Traders returned from the Christmas break to a market buoyed by recent economic resilience, including a stronger-than-expected Q3 GDP revision to 4.3% annualized growth. Initial jobless claims also surprised to the downside, dipping to 214,000 for the latest week, signaling a labor market that's cooling but not cracking. These data points reinforced the "soft landing" narrative that's dominated much of 2025.

Sector leadership showed some rotation. Materials and energy outperformed as commodity prices held firm, while consumer discretionary lagged slightly. Tech shares provided underlying support, with names like Nvidia gaining on AI-related developments, reminding us that the Magnificent Seven and broader innovation themes continue to drive returns. Year-to-date, the S&P 500 is up nearly 18%, the Nasdaq around 22%, and the Dow about 15%—impressive figures in a year marked by tariff turbulence earlier on and occasional AI valuation concerns.

Turning to fixed income and commodities, precious metals stole the show once again. Gold surged to new all-time highs above $4,500 per ounce—in fact, hitting intraday peaks near $4,580—on its way to a staggering 70%+ gain for the year, the best since the 1970s oil crisis era. Silver was even better, topping $76 and doubling in value over 2025. These rallies reflect persistent safe-haven demand amid geopolitical uncertainties, central bank buying, and a weaker dollar environment. Meanwhile, oil prices softened, with WTI crude dipping toward $57 per barrel, pressured by ample supply and muted demand signals.

Bond yields remained range-bound, with the 10-year Treasury hovering around 4.14%. The Fed's December decision to cut rates by 25 basis points—to a 3.50%-3.75% target range—marked the third reduction of the year, bringing total easing to 75 basis points in 2025 following a fuller percentage point in 2024. However, the updated dot plot signaled caution ahead: policymakers now project just one additional cut in 2026, down from prior expectations of more aggressive easing. This hawkish tilt reflects divided views within the FOMC, with some members emphasizing lingering inflation risks and robust growth.

Portfolio Actions to Consider for the Year Ahead

- Maintain exposure to innovation and AI, but spread risk—with balanced growth/value.

- Broaden to small-cap, mid-caps, cyclicals, and certain international/emerging markets for reasonable valuations and earnings momentum.

- Use bonds for income and stability—maintain duration neutrality amid attractive yields.

- Review excess cash as yields decline—consider deploying to high-quality bonds or equities based on goals and tolerance.

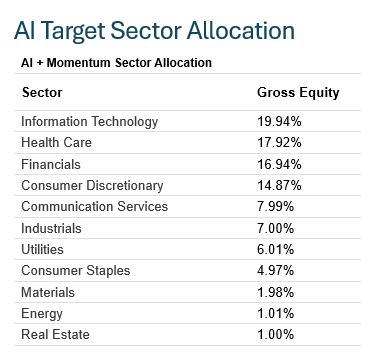

The AI + Momentum Sector Allocation strategy leverages artificial intelligence to dynamically optimize portfolio weights across U.S. equity sectors, combining predictive analytics with momentum signals to target outperforming areas while maintaining broad diversification. This AI-driven approach aims to enhance risk-adjusted returns by rotating toward high-momentum sectors amid evolving AI themes.

Our strategies continue to benefit from targeted exposure to overweight sectors—particularly Information Technology, Health Care, Financials, and Consumer Discretionary—combined with strategic allocations to Gold and Silver, which have provided additional performance tailwinds in the current environment.

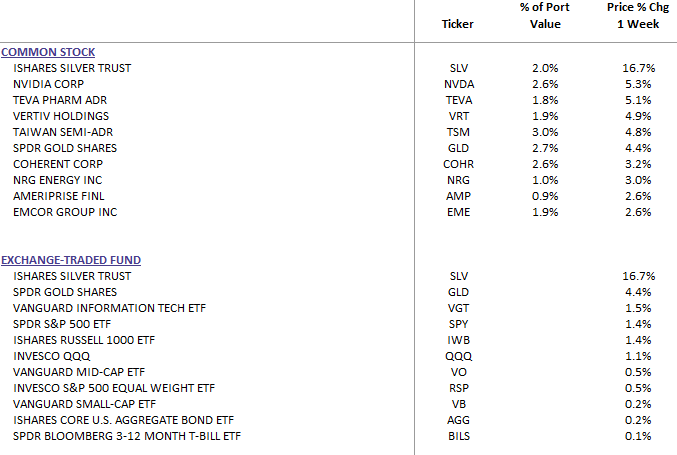

DBS Long Term Growth Top Ten and Benchmark Weekly Performance:

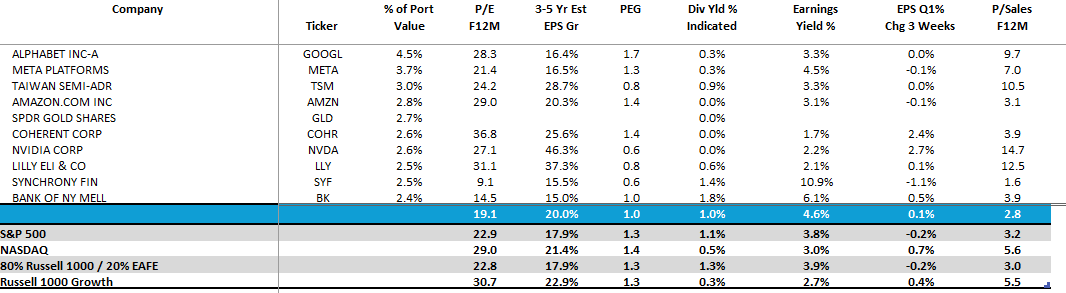

DBS Long Term Growth Portfolio Top Ten Holdings and Valuation Statistics:

Looking ahead to 2026, the outlook remains constructive but nuanced. Strong corporate profits, easier financial conditions, and potential fiscal support under the incoming administration could propel equities higher analysts are already floating S&P targets north of 7,000 to 7,700. Yet risks abound with persistent inflation above 2%, labor market softening (unemployment edging toward 4.5%), and policy uncertainties, including Fed Chair nominations and trade dynamics. The Santa Claus rally period—spanning the last five trading days of 2025 and first two of 2026—is underway, and history suggests it often portends positive January performance.

In summary, markets are ending 2025 on a high note, with records intact and momentum favoring the bulls. Precious metals have been the standout asset class, while equities demonstrate remarkable staying power. As we head into the new year, stay vigilant on incoming data—particularly jobs and inflation reads—that could sway the Fed's path. Position defensively where needed, but the underlying trend supports measured optimism.