Weekly Commentary for the week ending December 20, 2025

Weekly Market Commentary: December 20, 2025

As we close out the last full trading week of an eventful year, U.S. stocks finished mixed amid lingering AI-related concerns early in the week, followed by a strong rebound driven by cooler inflation data and robust earnings from key semiconductor players. Markets showed resilience, with technology leading the late-week recovery. Let's break it down.

U.S. Equities: Mixed Finish with Late-Week Rebound

U.S. stock indexes finished the last full trading week of the year mixed. The Russell 2000 Index performed worst, declining 0.86%, followed by the Dow Jones Industrial Average, which shed 0.67%. The S&P Midcap 400 and S&P 500 indexes both finished little changed, while the Nasdaq Composite added 0.48%.

Equities started the week broadly lower in what was partially a continuation of the prior week’s tech-stock weakness, as ongoing concerns around valuations and spending in the artificial intelligence (AI) space helped drag major indexes down. Some mixed economic data also appeared to weigh on sentiment early on.

However, indexes reversed course toward the end of the week, supported in part by an encouraging inflation report as well as strong earnings results from semiconductor manufacturer Micron Technology that seemed to help shift AI-related sentiment positively. Micron's blowout results—reporting adjusted EPS of $4.78 versus estimates of $3.95 and revenue of $13.64 billion beating $12.84 billion expectations—highlighted surging demand for high-bandwidth memory in AI applications, providing a catalyst for tech's rebound.

Year-to-date through this week, major indexes have delivered strong gains: the Nasdaq up more than 20%, the S&P 500 around 16%, and the Dow about 13%. December trading has been volatile, with no clear Santa Claus rally yet, but the late rebound keeps seasonal upside in play.

Economic Backdrop: Mixed Jobs Signals and Cooler Inflation

Jobs data delivered mixed signals. The Bureau of Labor Statistics released delayed reports showing U.S. employers added 64,000 jobs in November, ahead of estimates for around 45,000 and rebounding from a 105,000 loss in October (largely due to a 162,000 drop in federal government jobs). Gains were led by health care (46,000) and construction (28,000), while manufacturing continued to shed positions. The unemployment rate rose to 4.6% in November, the highest in over four years, though partly due to workers re-entering the labor force.

Later in the week, inflation unexpectedly cooled: Headline CPI slowed to 2.7% year-over-year in November (below estimates for 3.1%), while core CPI eased to 2.6%, the slowest since early 2021. Shelter inflation dropped to 3%, it's lowest since August 2021. Caveats remain due to government shutdown-related data collection issues, including assumptions for missing October figures, which may overstate the slowdown. Nonetheless, the print was positively received, boosting risk assets.

Elsewhere, S&P Global's Flash Composite PMI showed U.S. business activity growth slowing to a six-month low of 53.0 in December, with moderated expansion in both manufacturing and services, alongside intensified price pressures and pulled-back business confidence.

Fixed Income and Commodities: Treasuries Steady, Gold Near Records

U.S. Treasuries advanced modestly following the prior week's Federal Reserve rate cut (bringing the fed funds range to 3.50%-3.75%), with yields generally decreasing across maturities. Municipal bonds were stable but underperformed Treasuries, while high-yield sentiment firmed post-CPI despite early equity weakness.

Gold continued shining, trading near record levels around $4,335 per ounce amid safe-haven demand. Oil prices faced weekly declines on supply glut concerns.

Outlook: Constructive into 2026 with Broadening Leadership

As the year winds down, delayed employment and inflation reports provided key insights amid data fog from the shutdown. While warranting skepticism, they reinforce a constructive outlook: moderating inflation, stabilizing labor market, and easier Fed policy supporting risk assets.

CPI unexpectedly cooled, but the inflation debate is far from settled—distortions may mean clearer reads in coming months, with base case for rangebound pressures above 2% in early 2026.

The labor market appears stuck in a slow lane but showing stabilization signs, with private-sector gains healthy and expectations for modest job growth ahead.

The Fed maintains a bias to cut, providing justification for shallower easing in 2026 amid solid growth.

Heading into the new year, slightly looser policy, modest fiscal support, and steady growth—combined with elevated tech valuations and improving earnings elsewhere—set the stage for broadening market leadership. AI remains a tailwind, but rotation toward cyclicals, mid-caps, value, and small cap equities could gain momentum.

Portfolio Actions to Consider for the Year Ahead

- Maintain exposure to innovation and AI, but spread risk—neutral tech weighting with balanced growth/value.

- Broaden to small-cap, mid-caps, cyclicals, and certain international/emerging markets for reasonable valuations and earnings momentum.

- Use bonds for income and stability—maintain duration neutrality amid attractive yields.

- Review excess cash as yields decline—consider deploying to high-quality bonds or equities based on goals and tolerance.

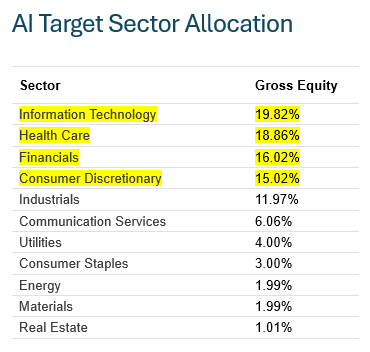

As indicated below, the top four sectors to overweight continue to be Technology, Health Care, Financials & Consumer Discretionary.

Our AI Target Sector Allocation below is based on AI momentum sector trend analysis and AI news analysis.

Please remember, our strategy's methodology attempts to identify sectors to overweight that are in favor and more importantly to identify individual equities for purchase within those sectors.

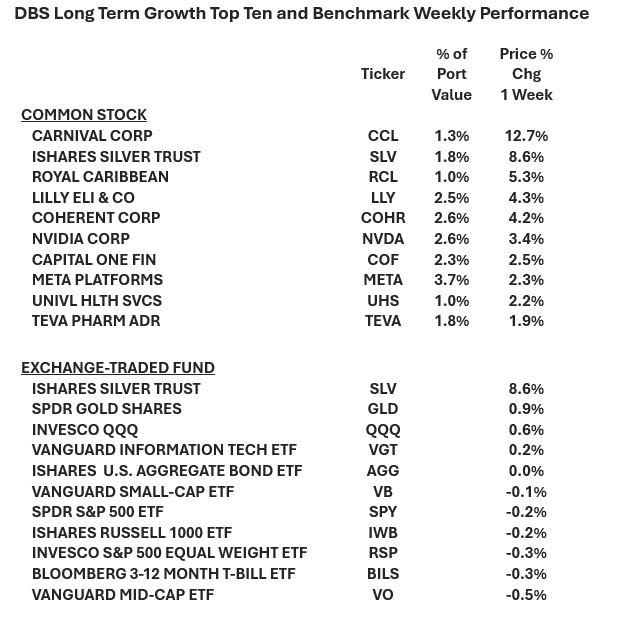

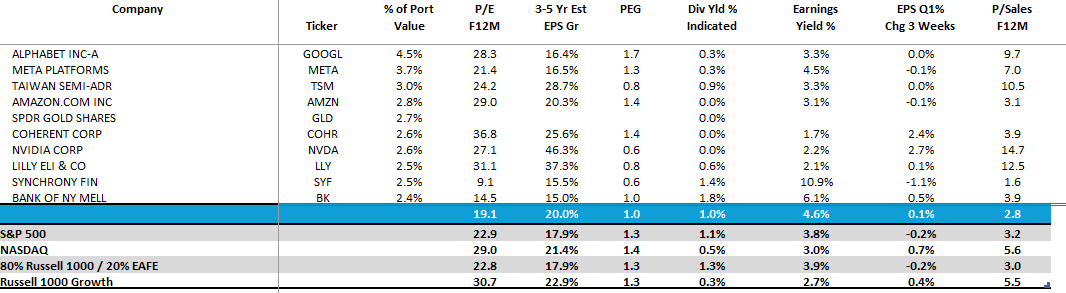

DBS Long Term Growth Portfolio Top Ten Holdings and Valuation Statistics:

The Week Ahead

The holiday-shortened week features revised third-quarter GDP and consumer confidence data.