Weekly Commentary for the week ending December 06, 2025

Today we’re recapping a week that saw most major U.S. stock indexes climb to fresh all-time highs, even as the tech-heavy Nasdaq bucked the trend.

Overall, the market was supported by the Federal Reserve’s third consecutive interest-rate cut and commentary from central bank officials that many investors viewed as less hawkish than they had feared. The small-cap Russell 2000 led the way with a 1.19% gain, followed by the Dow Jones Industrial Average, up 1.05%. The S&P Midcap 400 rose more modestly, while the S&P 500 actually ended the week slightly lower after a sharp pullback on Friday.

The Nasdaq Composite dropped 1.62%, pressured by renewed worries about technology-stock valuations and questions over whether the massive spending on AI infrastructure will deliver the expected returns. Those concerns came into sharp focus after Oracle, a recent AI darling, reported quarterly revenue that missed consensus estimates even though earnings beat estimates on Wednesday and then guided for a big jump in capital spending.

Let’s start with the Fed. On Wednesday, as widely expected, the Federal Open Market Committee cut its target range for the federal funds rate by 25 basis points to 3.50%–3.75%. This marked the third straight meeting with a cut. What caught the market’s attention, though, was the dissent: for the first time in six years, three policymakers voted against the move—two wanted to hold rates steady, and one preferred a 50-basis-point cut.

The policy statement also included language that has historically signaled a pause, saying officials will “carefully assess incoming data” to determine the extent and timing of any additional adjustments.

Fed Chair Jerome Powell’s press conference delivered a somewhat mixed message but ultimately came across as less hawkish than some had anticipated. He noted that the current fed funds rate is now “within a broad range of estimates of its neutral value” and that policymakers are “well positioned to wait and see how the economy evolves.” At the same time, he highlighted “significant downside risks” to the labor market and struck a cautious tone on employment, even warning that negative nonfarm-payroll readings are possible.

The Fed also announced it will begin purchasing shorter-term Treasury securities as needed to maintain ample reserves in the banking system. While this is largely a technical adjustment to support money-market liquidity, some investors interpreted it as a form of policy easing.

Labor-market data added to the mixed picture. Thursday’s jobless claims jumped to 236,000—the highest since early September—though continuing claims fell sharply. Job openings in October edged higher to 7.67 million, but layoffs rose and the quits rate hit its lowest level since 2020, suggesting workers are less confident about changing jobs.

Treasury yields showed a clear split: shorter-term yields fell, especially after the Fed announcement, while longer-term yields rose. Investment-grade corporate bonds outperformed Treasuries, and new issues were generally oversubscribed. High-yield bonds, however, saw some weakness earlier in the week.

In our view, the post-Fed rally wasn’t really about the widely expected 25-basis-point cut. Instead, investors took encouragement from the less hawkish tone on the policy outlook, Powell’s caution on the labor market, and the Fed’s decision to start buying Treasury bills. Markets are now pricing in roughly two 25-basis-point cuts in 2026, and the dollar softened as a result.

Looking ahead, we believe the Fed is nearing the end of its easing cycle, but there is still room for one or two more cuts in 2026, likely bringing the fed funds rate down to the 3.00%–3.50% range. A weak labor market—especially early next year—could make the case for additional easing. We’ll get the delayed November nonfarm payrolls report on Tuesday, with consensus looking for a modest 50,000 increase. Further sluggish readings would argue for more cuts, given the Fed’s heightened sensitivity to downside risks.

That said, inflation remains well above the 2% target and is expected to stay there through 2026. The Fed will need to be careful that too much easing doesn’t reignite price pressures.

For investors, the key takeaways are:

Yields on cash and very short-term investments—such as money-market funds, CDs, and Treasury bills—have already declined notably, and we expect them to continue drifting lower over the coming year. This development feels particularly urgent in an environment where inflation remains near 3%, pushing the real return on these cash-like holdings close to zero.

The 10-year Treasury yield has risen from its 2025 low of around 4% to roughly 4.2% today. We see limited scope for a big rally in government bonds from here. Instead, we expect the 10-year yield to remain rangebound between 4.0% and 4.5% through much of 2026, given the end of the easing cycle, persistent inflation, and ongoing concerns about the federal debt trajectory.

For those with longer time horizons and moderate risk tolerance, we continue to favor equities over bonds. Diversified portfolios of domestic and certain international stocks look attractive right now.

In the U.S., we continue to favor large-cap equities to preserve exposure to the continuing AI investment cycle. At the same time, the recent shift away from mega-cap technology stocks toward other sectors and market-cap ranges emphasizes the importance of diversification and opens the door to broader market leadership.

Asset Allocation for 2026:

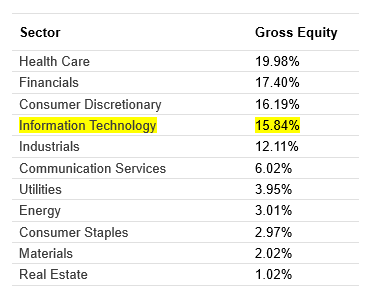

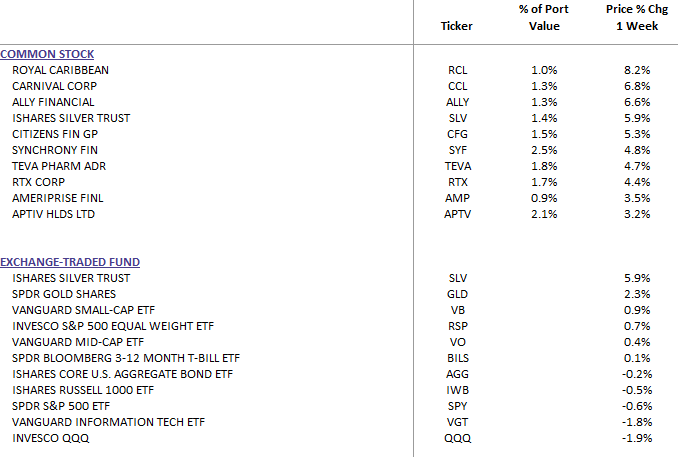

We view mid-cap & small-cap stocks as especially attractive especially due to their underperformance vs. their large cap relatives, offering the potential to capitalize on the solid economic growth and somewhat lower borrowing costs we anticipate for 2026. In recent weeks, we've already increased our allocation into Mid and Small companies utilizing two ETFs, the Vanguard Small Cap, Symbol VB: and the Vanguard Mid Cap, Symbol: VO. Our increased exposure to the financial, healthcare & the consumer discretionary sectors the last few months while recently reducing our exposure to the technology sector as highlighted in the AI Target Sector Allocation below has helped improve our strategies performance. Also, not quite ready to pull the plug on our gold and silver allocations which have been very supportive during the last few years.

Our AI Target Sector Allocation below is based on AI momentum sector trend analysis and AI news analysis.

AI Target Sector Allocation

Please remember, our strategy's methodology attempts to identify sectors that are in favor and more importantly to identify individual equities for purchase within those sectors.

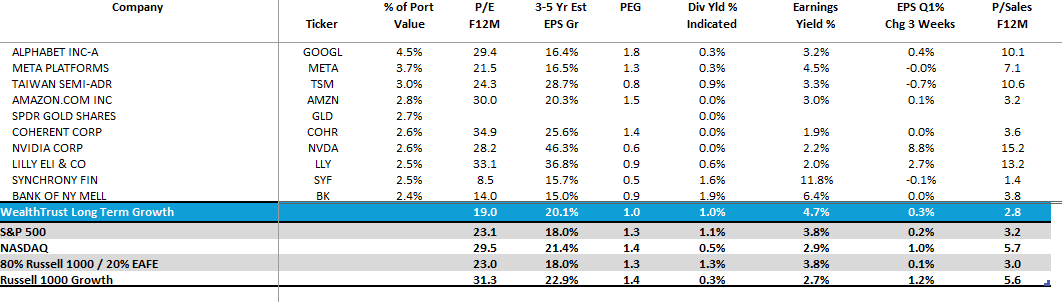

DBS Long Term Growth Top Ten and Benchmark Weekly Performance:

DBS Long Term Growth Portfolio Top Ten Holdings and Valuation Statistics: