Weekly Commentary for the week ending December 06, 2025

Major U.S. stock indexes kicked off December on a constructive note, extending the post-election rally into a third straight week of gains. Light trading volumes (typical for the holiday-shortened week) didn’t stop buyers from stepping in, buoyed by growing confidence that the Federal Reserve will deliver a rate cut at its December 17-18 meeting.

For the week, the tech-heavy Nasdaq Composite rose +0.91%, the small-cap Russell 2000 climbed +0.84%, the Dow Jones Industrial Average added +0.5%, and the S&P 500 posted a more modest +0.3%. Year-to-date through Thursday’s close, the S&P 500 is now up a robust 16.8%, while the Nasdaq has gained an impressive 22.1%, the DBS Long Term Growth Portfolio is up approximately 24%..

A Tale of Two Economies: Manufacturing Contracts, Services Hold Firm

The week’s economic calendar painted the now-familiar picture of a bifurcated U.S. economy.

- Manufacturing activity contracted for the ninth straight month in November, with the ISM Manufacturing PMI slipping to 48.2 from 48.7. New orders, employment, and supplier deliveries all weakened, while input prices continued to rise at an accelerating pace.

- In contrast, the much larger services sector expanded at its fastest pace since February, with the ISM Services PMI ticking up to 52.6. Notably, the prices-paid component dropped sharply to 65.4 — the lowest since April — suggesting some easing of service-sector inflation pressures.

Labor Market: Mixed Signals Continue

Private-sector payrolls surprised to the downside on Wednesday when ADP reported a 32,000 decline in November jobs — the largest drop since March 2023 and a sharp reversal from October’s revised +47,000 gain. Challenger, Gray & Christmas also reported 71,288 announced job cuts in November, pushing the 2025 year-to-date total to roughly 1.17 million — the highest since the pandemic year of 2020.

Yet weekly initial jobless claims unexpectedly plunged 27,000 to 191,000 — the lowest level since September 2022 — reminding us that layoffs remain historically low even as hiring slows.

Inflation Steady, Consumer Sentiment Improves Modestly

Friday brought the delayed September PCE inflation data (original release postponed due to the October government shutdown). Both headline and core PCE rose a benign 0.3% and 0.2% month-over-month, respectively, with year-over-year rates holding steady at 2.8%. October PCE data remain unscheduled.

The preliminary December University of Michigan Consumer Sentiment index rose 2.3 points to 53.3, driven largely by better personal-finance expectations. One-year inflation expectations fell from 4.5% to 4.1% — the lowest since January and the fourth consecutive monthly decline.

Fixed Income: Treasuries Lag as Yields Rise

U.S. Treasuries posted negative total returns as yields climbed across most maturities (bond prices and yields move inversely). The 10-year Treasury yield ended the week at 4.14%, up roughly 10 basis points. Municipal bonds also declined but outperformed Treasuries on steady demand despite heavy new issuance.

High-yield bonds, however, generated solid gains on improved liquidity and a firmer macro backdrop.

Three Things We’re Watching Into Year-End and 2026

With only a few weeks left in 2025, three catalysts stand out:

- The December 17–18 FOMC Meeting Markets assign roughly 85% odds of a 25 bp rate cut (per CME Fed Watch as of Dec 4). Investors will also receive updated economic projections and the closely watched “dot plot.” We expect the Fed to continue normalizing policy toward a neutral fed funds range of 3.0–3.5% in 2026 — not because a recession is imminent, but to remove restrictive policy while the economy is still growing near trend. History shows equities tend to perform well when the Fed is easing into a resilient economy.

- The November Employment Report (December 16) This will be the first complete jobs report since the government shutdown began in early October. Consensus expects only +38,000 nonfarm payrolls (well below September’s +119,000), with the unemployment rate ticking up to 4.5% and wage growth slowing to 3.6% y/y. Real wage growth should remain positive, supporting consumer spending.

- Will Santa Claus Visit Wall Street Again? The traditional “Santa Claus rally” — the last five trading days of the year plus the first two of January — has delivered positive S&P 500 returns 73% of the time since 1980, with an average gain of 1.1%. Seasonality, year-end rebalancing flows, and generally upbeat investor sentiment could provide tailwinds.

Portfolio positioning from an asset class perspective:

Heading into the new year, we maintain a pro-risk stance with an emphasis on broader diversification:

- U.S. large-cap equities remain a core, driven by continued leadership in AI, technology, and high-quality growth compounders.

- U.S. mid-cap stocks offer attractive cyclical exposure and meaningful catch-up potential, especially in an environment of falling interest rates and steady economic growth.

- U.S. small-cap equities have the same characteristics as mid-cap and should also benefit from the falling interest rate theme.

- From a style perspective, we remain roughly a core blend. We expect mega-cap tech and AI-related growth themes to extend their leadership, while value and cyclical segments should benefit from lower rates, improving manufacturing activity, and a rotation into undervalued areas of the market.

After a powerful advance from the April 2025 lows — the S&P 500 is up roughly 38% with only one modest 5% pullback in November — seasonal tailwinds, year-end optimism, and typical rebalancing flows could provide one more push higher to close out the year.

Portfolio positioning from a sector positioning perspective:

Our AI Target Sector Allocation below is based on AI momentum sector trend analysis and AI news analysis.

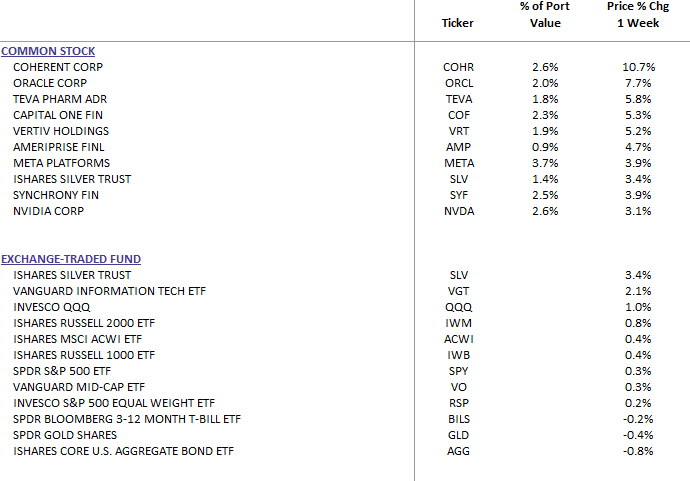

DBS Long Term Growth Top Ten and Benchmark Weekly Performance:

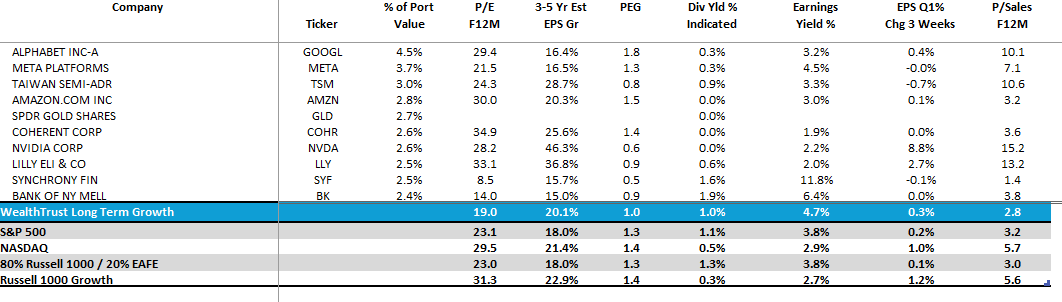

DBS Long Term Growth Portfolio Top Ten Holdings and Valuation Statistics:

The Week Ahead

Key releases include November JOLTS job openings, Q3 nonfarm productivity & unit labor costs, and the December FOMC meeting (Dec 17–18).