Weekly Commentary for the week ending August 9, 2025

Weekly Market Commentary: U.S. Nasdaq Composite Hits Record High

Market Recap: Equities Rebound, Nasdaq Shines

U.S. equity markets roared back this week, shaking off last week’s sell-off with gusto. The Nasdaq Composite stole the show, closing at an all-time high, fueled by a tech-sector surge. The S&P 500 and Russell 2000 followed suit with solid gains, up 2.4% and performing strongly, respectively, while the S&P Midcap 400 trailed with a 0.63% increase. The rally was driven by robust corporate earnings, positive stock-specific catalysts, and growing expectations for Federal Reserve rate cuts, though new tariffs added a layer of complexity.

Key Drivers

Equities: Tech Takes the Lead

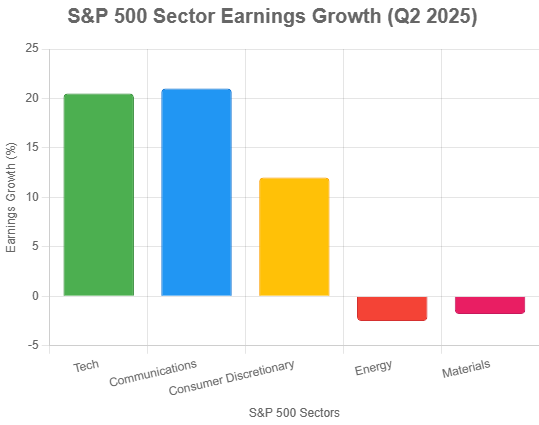

The Nasdaq’s record-breaking run was powered by standout performances in technology and consumer discretionary stocks. Apple jumped 13.33% after announcing a $100 billion investment in U.S. manufacturing over the next four years, on top of a prior $500 billion commitment. This move, reportedly securing exemptions from the Trump administration’s 100% semiconductor tariffs, boosted sentiment and supported broader market gains. Corporate earnings also impressed, with 82% of S&P 500 companies beating estimates by an average of 8.5%. As a result, Q2 earnings growth forecasts soared to 9.7%, up from 3.8% at quarter-end. Tech and communications sectors led with over 20% year-over-year growth, while energy and materials lagged, representing less than 5% of the S&P 500’s market cap.

Trade Policy: Tariffs Kick In

The Trump administration’s new tariffs took effect on August 7, with rates rising from a 10% baseline to as high as 50% for some partners. India faced a punitive 50% tariff due to its Russian oil purchases, while Switzerland saw 39% levies after failed negotiations. However, exemptions for U.S.-based semiconductor production softened the blow of the 100% chip tariff. Markets reacted calmly, as several major trading partners secured preemptive deals, easing fears of widespread disruption.

Monetary Policy: Rate Cut Buzz Grows

Expectations for a September Fed rate cut surged, with the CME Fed Watch tool signaling a 90% probability by Friday. San Francisco Fed President Mary Daly hinted at policy adjustments if the labor market weakens further and inflation stays tame. President Trump’s nomination of Stephen Miran, seen as favoring looser policy, to temporarily fill a Fed Board vacancy added to the narrative. However, with PCE inflation at 2.6% (above the Fed’s 2% target) and the fed funds rate at 4.3%, the Fed’s flexibility is limited.

Economic Data: Services Slow, Labor Softens

The ISM Services PMI dipped to 50.1% in July, missing estimates of 51.3% and barely signaling expansion. The employment index contracted for the second straight month, and the prices index hit 69.9%, the highest since October 2022, reflecting tariff-driven cost pressures. In contrast, the S&P U.S. Services PMI climbed to 55.7%, driven by tech and financial services demand.

Labor market data showed cracks. Initial jobless claims rose to 226,000 for the week ended August 2, up from 219,000, while continuing claims hit 1.97 million, a near four-year high. On a brighter note, Q2 labor productivity grew at a 2.4% annualized rate, beating estimates, and kept unit labor costs at 1.6%, offsetting 4.2% wage growth.

Fixed Income: Yields Rise, Munis Shine

U.S. Treasury yields climbed, with the 10-year yield at 4.28% after weaker demand at a $42 billion 10-year note auction (bid-to-cover ratio: 2.35 vs. 2.57 average). Still, yields remain below July’s 4.5% peak, and we expect them to stay in the 4%-4.5% range. Municipal bonds outperformed, driven by strong cash flows and heavy issuance, while investment-grade corporate bonds posted gains despite a brief dip after the ISM data. High yield bonds rebounded, supported by a solid macro backdrop.

Outlook and Positioning

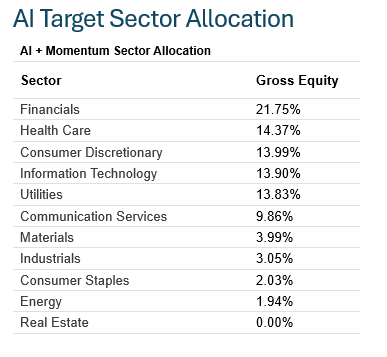

- Overweight U.S. large-cap and mid-cap stocks, favoring technology, consumer discretionary, financials, and healthcare.

- Underweight international developed-market large-caps, but maintain global exposure given the dollar’s pullback.

- Extend duration in U.S. investment-grade bonds (7-10 years) to capture yields and potential price gains.

- Focus on quality to weather volatility from economic softening or trade uncertainties.

With valuations stretched, earnings growth is key to sustaining equity gains. Pullbacks could offer buying opportunities.

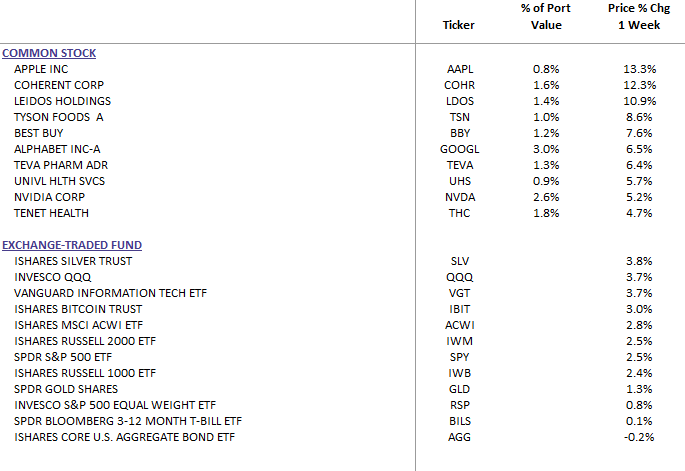

DBS Long Term Growth Top Ten and Benchmark Weekly Performance:

Our AI Target Sector Allocation below is based on AI momentum sector trend analysis and AI news analysis.

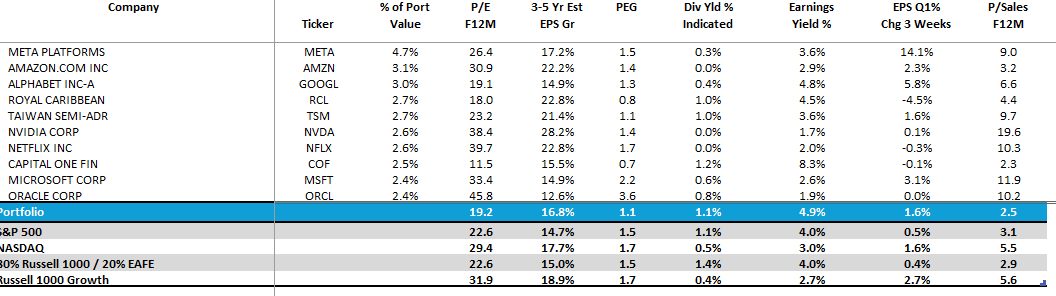

DBS Long Term Growth Portfolio Top Ten Holdings and Valuation Statistics.

The Week Ahead

Expect inflation, retail sales, and consumer sentiment data to shape views on the Fed’s next moves and economic health.