Weekly Commentary for the week ending August 30, 2025

Weekly Market Commentary: U.S. Markets - August 30, 2025

Market Overview

U.S. equity indexes closed the week modestly lower, with light trading volumes as markets approached the Labor Day holiday weekend, marking the unofficial end of summer. U.S. markets will be closed on Monday, September 1, 2025, in observance of the holiday. Small-cap stocks outperformed, with the Russell 2000 Index posting moderate gains and surpassing the S&P 500 for the third consecutive week. The Dow Jones Industrial Average hit a record high midweek but retreated on Friday, ending lower.

Key Economic Developments

NVIDIA Earnings and AI Trends

Much of the week's focus centered on NVIDIA, the world’s most valuable company by market capitalization, which reported earnings after market close on Wednesday. With a $4.2 trillion market cap and an 8% weight in the S&P 500, NVIDIA’s results were highly anticipated. The company delivered a 56% year-over-year revenue increase, exceeding FactSet consensus estimates. Despite a slight pullback in its stock price on Thursday, the results alleviated concerns about the sustainability of the AI-driven rally that has propelled markets to record highs in 2025. Key points include:

- Data Center Performance: NVIDIA’s data center business, a key growth driver, slightly missed lofty estimates, contributing to the muted stock reaction.

- Guidance Outlook: Sales guidance for the next quarter was solid but not as aggressive as in prior quarters. Potential chip sales to China, pending negotiations with the Trump administration, could provide upside.

- AI Infrastructure Demand: Major tech firms like Amazon, Google, Microsoft, and Meta have doubled infrastructure spending to $600 billion over two years, underscoring robust AI demand.

- Economic Impact: AI-related investments, particularly in computer hardware (up 61% annualized) and software (up 26%), significantly contributed to Q2 GDP growth.

Federal Reserve Developments

Concerns about Federal Reserve independence arose following President Trump’s announcement to fire Fed Governor Lisa Cook over alleged mortgage fraud. Cook filed a lawsuit on Thursday to block the move, and the Fed stated it would comply with any court decision. Meanwhile, Fed Governor Christopher Waller reiterated his support for a 25-basis-point rate cut at the September meeting, citing rising labor market risks and slowing economic activity. Waller anticipates further cuts over the next three to six months.

Inflation and GDP

The Bureau of Economic Analysis (BEA) reported that the core PCE price index, the Fed’s preferred inflation measure, rose 0.3% month-over-month in July, consistent with June and consensus estimates. Personal spending and income increased by 0.5% and 0.4%, respectively. The BEA’s second estimate of Q2 GDP growth was revised upward to 3.3% from 3%, driven by stronger business investment and consumer spending.

Consumer Confidence and Labor Market

The Conference Board’s Consumer Confidence Index dipped 1.3 points to 97.4 in August, reflecting concerns about job availability and future income. The Expectations Index fell 1.2 points to 74.8, below the 80 threshold that can signal recession risks. However, jobless claims improved, with new claims dropping to 229,000 for the week ended August 23, and continuing claims falling to 1.954 million for the week ended August 16.

Treasury Market

U.S. Treasuries posted positive returns, with short- and intermediate-term yields declining and long-term yields stable. President Trump’s announcement regarding Fed Governor Cook steepened the yield curve early in the week. Strong demand at Treasury bill auctions further supported the market.

Market Outlook

August marked the fourth consecutive month of equity gains, fueled by AI enthusiasm and expectations of Fed rate cuts. Small-cap stocks, autos, airlines, and homebuilders saw strong gains, with the equal-weighted S&P 500 hitting new highs, indicating broader market participation. At the Jackson Hole conference, Fed Chair Powell highlighted labor market risks, raising the probability of a September 17 rate cut to 85%. The core PCE reading of 2.9% suggests inflation remains manageable, allowing the Fed to prioritize labor market conditions.

Financial conditions are looser than a year ago, supporting economic growth. With anticipated Fed easing through 2026, sectors like manufacturing and housing may recover, and mid- and small-cap stocks, value investments, and cyclicals could gain momentum. However, easier conditions risk speculative excesses, as seen in prior cycles (2000, 2007, 2021). A future Fed tightening cycle could expose vulnerabilities, though this appears unlikely for at least 12–24 months.

Investment Implications

The market outlook remains constructive for the next 12 months, supported by AI tailwinds, rising corporate profits, and potential Fed easing. However, historical seasonal patterns suggest September and October may bring volatility, with wider daily swings and softer returns. These periods often precede strong rebounds, emphasizing the need for investment discipline.

Recommendations

- AI-Exposed Large-Caps: Continue to favor U.S. large-cap stocks with high AI exposure, but consider using pullbacks to allocate to undervalued sectors.

- Mid-Caps and Cyclicals: Mid-cap and cyclical sectors, such as financials and consumer discretionary, offer catch-up potential.

- U.S. dollar weakness: Continue to allocate to Gold, & Silver

- Portfolio Diversification: A market cooldown could provide opportunities to rebalance and diversify portfolios for the next phase of the cycle.

As autumn approaches, investors should prepare for potential volatility while capitalizing on opportunities in a broadening market. Maintaining discipline and a diversified approach will be key to navigating the seasonal shift.

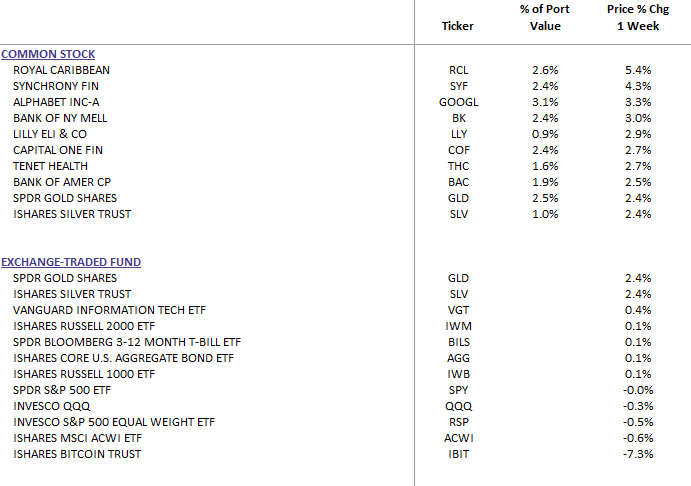

DBS Long Term Growth Top Ten and Benchmark Weekly Performance:

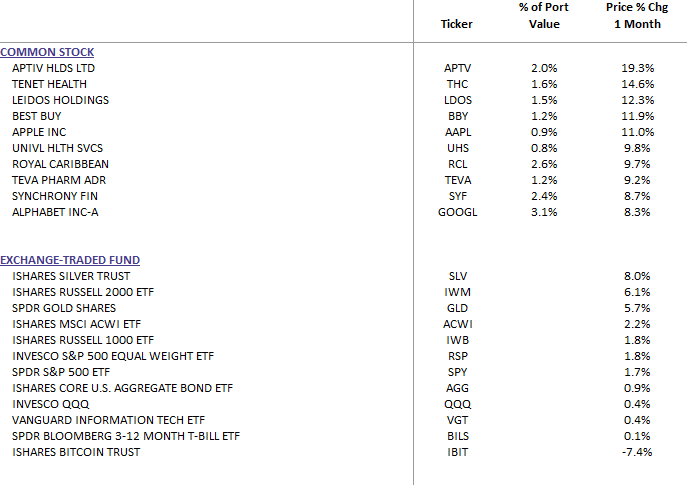

DBS Long Term Growth Top Ten and Benchmark Monthly Performance:

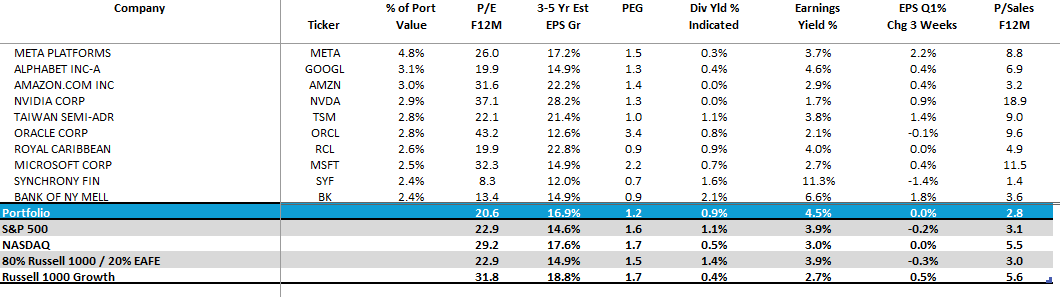

Top 10 Equity Review WealthTrust DBS Long Term Growth Portfolio