Weekly Commentary for the week ending August 2, 2025

U.S. Stocks Decline Amid Tariff Tensions, Trade Policy Uncertainty, and Weak Economic Data

Market Performance Overview

U.S. stock indexes experienced significant declines during the week ending August 1, 2025, marking the worst weekly performance for some indexes since the tariff-driven sell-off in early April. The Russell 2000 and S&P Midcap 400 indexes were hit hardest, falling 4.17% and 3.53%, respectively. The Dow Jones Industrial Average dropped 2.92%, while the S&P 500 Index declined 2.36%. The Nasdaq Composite, buoyed by technology stocks, performed relatively better, declining 2.17% but retaining its year-to-date lead among major indexes.

Trade Policy and Tariff Developments

Trade policy uncertainty was a dominant factor influencing market sentiment. Leading up to President Donald Trump’s August 1 deadline for new trade deals, markets reacted to a series of announcements. On Thursday, President Trump signed an executive order imposing higher tariffs on most U.S. trading partners, effective August 7, which significantly impacted stock indexes on Friday morning. New trade agreements were reached with the European Union, South Korea, the United Kingdom, and Japan, while a 90-day negotiation extension was granted to Mexico. According to the Yale Budget Lab, these developments have increased the average U.S. tariff rate from approximately 2.4% to 18.3%, the highest since 1934. This shift potentially elevates goods prices thereby reducing consumption over time.

Tariff Impact on Inflation and Consumption

The rise in tariff rates, ranging from 10% to 41% for major trading partners, is likely to drive higher goods inflation. Companies that stockpiled inventories to mitigate tariff costs may now face higher replenishment expenses, while those absorbing costs through lower margins may pass increases to consumers. This could lead to reduced discretionary spending. However, as services constitute 64% of the U.S. CPI basket compared to 36% for goods, the overall inflationary impact may be moderated if services inflation continues to ease.

Corporate Earnings Amid Tariff Headwinds

Corporate earnings were a key focus, with 66% of S&P 500 companies reporting by Friday morning. According to FactSet, 82% of these companies exceeded consensus earnings estimates, achieving a blended earnings growth rate of 10.3%. However, tariff-related challenges were evident, with companies like Ford Motor projecting a $2 billion hit from tariffs this year. Conversely, technology firms such as Microsoft and Meta Platforms reported strong results, citing benefits from artificial intelligence advancements, which bolstered their stock prices.

Federal Reserve Policy and Market Expectations

The Federal Reserve’s July meeting resulted in the federal funds rate remaining at 4.25%–4.5%, marking the fifth consecutive meeting with no change. Notably, two Fed governors dissented, advocating for an immediate 25-basis-point rate cut, and the Fed’s statement acknowledged moderated economic activity in the first half of 2025, which some interpreted as dovish. However, Fed Chair Jerome Powell emphasized persistent inflation above the 2% target and uncertainty regarding tariffs’ economic impact, tempering expectations for an immediate rate cut. Post-meeting, market expectations for a September rate cut dropped but later rebounded following weak jobs data.

Labor Market Signals Slowdown

The July nonfarm jobs report, released on August 1, underscored a softening labor market. Only 73,000 jobs were added, below the consensus estimate of 104,000, with the prior two months’ figures revised downward by 260,000 jobs. The three-month average job growth fell to 35,000, compared to 127,000 in the prior period. The unemployment rate edged up from 4.1% to 4.2%, and labor-force participation dropped to 62.2%, the lowest since November 2022. Despite this, wage growth of 3.9% year-over-year outpaced inflation (2.7%), supporting real wage gains. Job gains were primarily in health care, while manufacturing and government sectors saw declines.

This slowdown has shifted the Federal Reserve’s focus toward supporting employment, increasing the likelihood of a September rate cut. According to CME FedWatch, markets now assign an 80% probability to a rate cut in September, up from 38% post-Fed meeting.

Economic Outlook and Investment Recommendations

The combination of higher tariffs, a softer labor market, and trade policy uncertainty presents challenges for investors. However, potential Federal Reserve rate cuts and fiscal stimulus from a new tax bill effective in 2026 could provide a supportive backdrop. While short-term volatility is expected, a recession is not anticipated in the near term.

Investment Strategy

- Diversification and Quality: Investors should consider rebalancing portfolios during volatility, focusing on diversified allocations across equities, and prioritizing high-quality investments.

- Equity Preferences: U.S. large-cap and mid-cap equities remain attractive, with exposure to growth and value sectors such as technology, consumer discretionary, financials, and health care.

- Fixed Income: Within U.S. investment-grade bonds, extending duration to the 7- to 10-year maturity range offers attractive yields and potential price appreciation if rates decline. We are in the process of instituting our recommendation.

- Earnings Resilience: With over 80% of S&P 500 companies beating earnings expectations, corporate earnings growth remains robust, supporting market fundamentals.

- Long-Term Perspective: Investors' financial advisors should align portfolios with long-term goals, navigating near-term uncertainties while capitalizing on opportunities presented by potential rate cuts and fiscal stimulus.

Conclusion

The U.S. financial markets are navigating a complex landscape marked by elevated tariffs, a softening labor market, and robust corporate earnings. While near-term volatility is likely, the prospect of Federal Reserve rate cuts and fiscal stimulus in 2026 provides a constructive outlook. Staying diversified, focusing on quality investments, and maintaining a long-term perspective will be key to weathering current uncertainties and positioning for future growth.

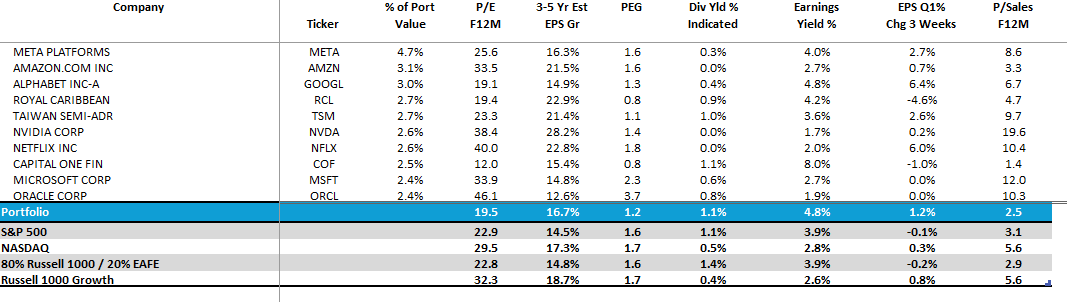

DBS Long Term Growth Portfolio Top Ten Holdings and Valuation Statistics.

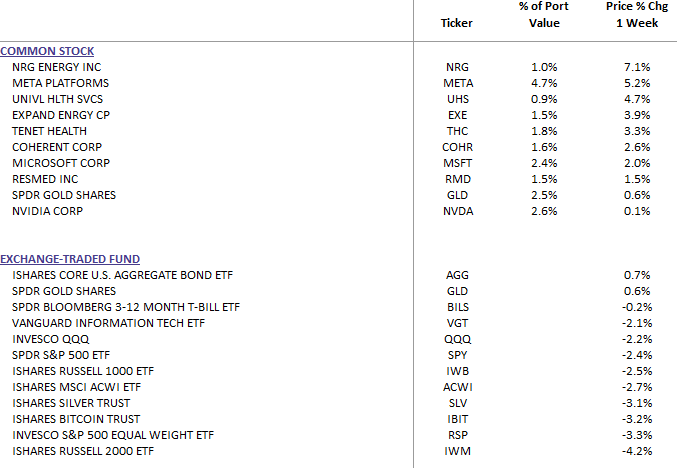

DBS Long Term Growth Top Ten and Benchmark Weekly Performance:

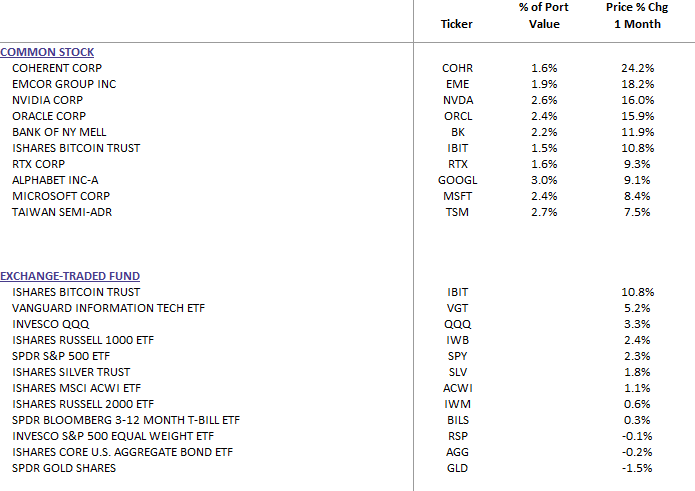

DBS Long Term Growth Top Ten and Benchmark June Performance: