Weekly Commentary for the week ending August 16, 2025

Weekly Market Commentary: Stocks Climb on Potential Rate Cut Hopes

Market Overview

U.S. equities surged this week, propelled by favorable economic data fueling expectations of a Federal Reserve interest rate cut in September. Small-cap stocks, as tracked by the Russell 2000 Index, outperformed the S&P 500 by the widest margin since April, while the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite also advanced, with the latter two hitting record highs midweek before a slight retreat by Friday’s close. Tariff and trade developments took a backseat, though news of a 90-day extension on U.S.-China tariff deadlines provided some stability.

Inflation Data Sends Mixed Signals

The Bureau of Labor Statistics (BLS) released its July Consumer Price Index (CPI) data, showing headline inflation cooling to 0.2% month-over-month from 0.3%, driven by lower grocery and energy costs. However, core CPI, excluding food and energy, rose to 0.3% from 0.2%, pushing the year-over-year rate to 3.1%, the highest since February. Services costs were the primary driver, while tariff-impacted goods showed mixed results. Stocks rallied post-release, with markets interpreting the data as supportive of a September rate cut.

Conversely, Thursday’s Producer Price Index (PPI) report indicated a 0.9% month-over-month rise, exceeding expectations of 0.2%, again led by services costs. This tempered rate cut expectations slightly, as reflected by the CME Fed Watch tool, though most indexes recovered by day’s end.

Retail Sales and Consumer Sentiment

Retail sales grew 0.5% in July, bolstered by motor vehicle and parts dealers, with June’s data revised upward to 0.9%. Control group sales, which inform GDP calculations, also rose 0.5%. However, the University of Michigan’s August Consumer Sentiment Index fell to 58.6 from 61.7, driven by inflation concerns, with year-ahead inflation expectations rising to 4.9% from 4.5%.

Bond Market Dynamics

U.S. Treasuries saw flat returns, with short-term yields dipping and long-term yields rising after the PPI data, steepening the yield curve. Municipal bonds remained stable amid heavy issuance, while investment-grade and high-yield corporate bonds outperformed, with strong investor demand reported by T. Rowe Price traders.

July Inflation: A Closer Look

The CPI report showed headline inflation steady at 2.7%, with core CPI at 3.1%, driven by a 0.4% rise in services prices (airfares, medical services, auto repairs). Goods prices rose modestly at 0.2%. The PPI’s 0.9% increase suggests potential pass-through of import costs, though tariff-driven pressures remain limited. While inflation risks persist, a 2022-style surge appears unlikely.

Fed Policy Outlook

At its July meeting, the Fed maintained rates at 4.25%–4.5%, though dissents from Governors Bowman and Waller signaled openness to cuts. Recent data, including softer inflation and a slowing labor market (three-month job gains at their lowest since 2020), has boosted the probability of a September cut to 85% from 40%. A quarter-point “insurance” cut seems likely, though a half-point move may be premature given robust consumer spending. Chair Powell’s Jackson Hole speech on August 22 may clarify the Fed’s stance.

Market Playbook for Rate Cuts

Small-cap stocks (+3%) and value investments outperformed, signaling broader market participation. Historical “insurance” cuts (1995, 1998, 2019) have been bullish for equities, unlike recession-driven cuts (2001, 2007–2008). Current conditions—low unemployment, steady profits, and GDP growth—support the former scenario.

Equity Opportunities: Rate-sensitive sectors like consumer discretionary, financials, and homebuilders may benefit. Mid-caps offer a balanced approach, while emerging-market equities could gain if the U.S. dollar weakens.

Bond Positioning: Short-term bonds provide stability, while 7- to 10-year bonds offer attractive yields. The 10-year Treasury yield is expected to stay within 4%–4.5%. We continue to position our bond investments primarily in short and mid-term treasuries plus adjustable collateral backed bank loans.

The Week Ahead

Key events include housing data, leading economic indicators, and the Federal Reserve’s Jackson Hole Symposium, where Chair Powell’s remarks could shape expectations for September’s policy decision.

Conclusion

The path to rate cuts remains uncertain but increasingly likely, with inflation stable and labor-market softness emerging. A diversified portfolio balancing growth and value exposures is well-positioned for a potential Fed pivot. Investors should monitor upcoming CPI and jobs data, as well as Powell’s Jackson Hole speech, for further clarity.

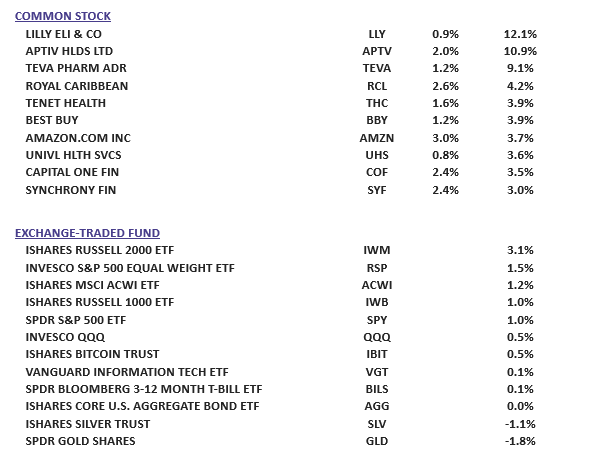

DBS Long Term Growth Top Ten and Benchmark Weekly Performance:

Our previous recommendations to invest in healthcare, consumer discretionary, and financials helped support the portfolio while sector rotation out of technology occurred. We often see this rotation occur several times a year but believe this is again, short term in nature, and provides a good entry point into technology.

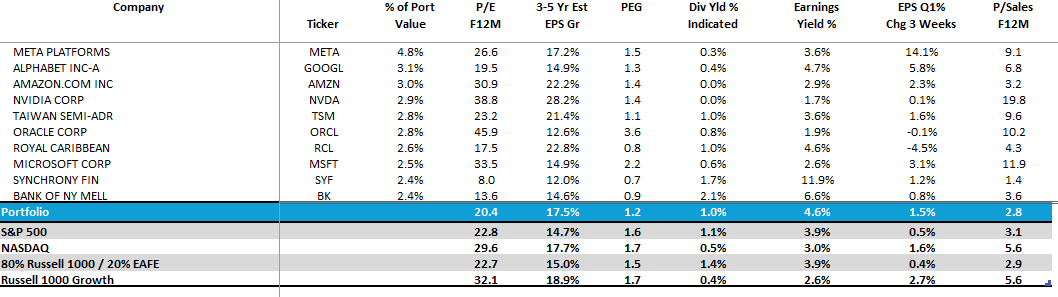

WealthTrust Long Term Growth Portfolio

Top 10 Equity Review