Weekly Commentary for the week ending April 26, 2025

Weekly Market Update: Strong Gains Amid Trade Optimism and Tech Leadership

Market Performance Highlights

U.S. equities surged this week, with the S&P 500 and Nasdaq delivering their second-best weekly performances of 2025. The S&P 500 climbed sharply, driven by big tech, semiconductors (+10.9%), and consumer discretionary stocks. Standouts included Tesla (+18.1%) and Nvidia (+9.4%). Other strong performers were copper and aluminum producers, credit card firms, investment banks, and China-exposed sectors like casinos and tech. Defensive sectors like telecom, food and beverage, and precious metals miners lagged.

Treasuries edged higher with a flatter yield curve, the U.S. dollar index rose 0.1%, and gold fell 0.9%. Bitcoin futures soared 11.7%, while WTI crude oil dipped 1.6%.

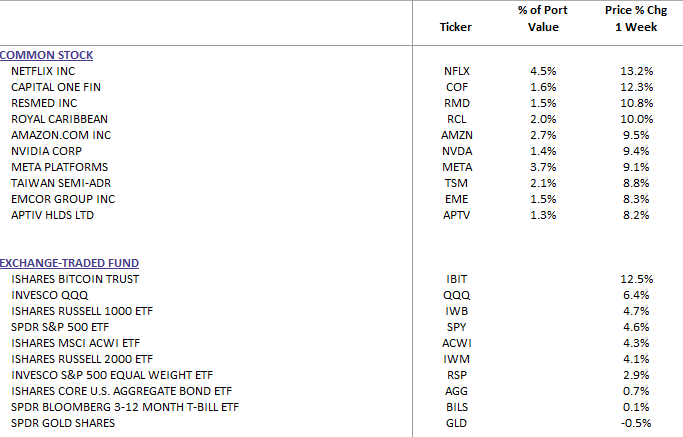

We've taken advantage of the recent volatility by deploying our liquidity in reducing our treasury positions and purchasing assets that we believe provide strong long-term potential after their recent selloff. We've started a position in a Technology ETF, added to the S&P 500 Equal Weight ETF, and the Russell 1000 ETF. We've purchased what we believe to be oversold individual companies in Capital One, whose merger with Discover was approved, which we anticipated, and Aptiv Holdings, an International Car Parts supplier that was down 66% from its 52-week high. Aptiv PLC is one of the leading global technology and mobility companies which mainly serves the automotive sector. It is a designer and manufacturer of vehicle components as well as provider of electrical, electronic and safety technology solutions to the global automotive market. The company delivers end-to-end smart mobility solutions, active safety and autonomous driving technologies and provides enhanced user experience and connected services. Think robo cars!

WealthTrust Long Term Growth Portfolio Weekly Top 10

Key Drivers of the Rally

Easing Trade Tensions

Global trade sentiment improved significantly:

- Reports suggested U.S. trade deals with Japan and India are nearing completion.

- Treasury Secretary Bessent and President Trump hinted at reducing China tariffs from 145% to 50–65%.

- Bloomberg noted China may suspend certain tariffs on U.S. goods, though China’s Ministry of Commerce denied active negotiations.

Federal Reserve Clarity

Concerns about Fed independence eased:

- Early White House comments about removing Fed Chair Powell were clarified, confirming no plans to fire him.

- Fed Governor Waller’s dovish remarks emphasized data-driven policy, calming markets.

Economic and Earnings Insights

Mixed Economic Data

- April PMI data showed weaker Services but expanding Manufacturing.

- March new home sales beat expectations, while existing home sales hit a 16-year low for March.

- Jobless claims remained stable, with continuing claims improving.

Q1 Earnings Strength

- S&P 500 EPS growth reached 10.1%, up from 7.2% last week.

- Alphabet (+7.1%), Netflix (+13.2%), and semiconductors posted strong results.

- Tariff and recession concerns grew, with margin growth weak outside big tech.

- Some strategists lowered S&P 500 targets, while others see upside from bearish positioning.

Corporate Developments

- Alphabet: Beat revenue and earnings, raised dividends, and expanded buybacks.

- Tesla: Missed estimates but rallied on Musk’s future plans and reduced regulatory fears.

- Netflix: Reported record subscriber growth and better engagement.

- Apple: Announced increased iPhone production in India.

- Discover-Capital One: Merger approved.

Sector Performance

- Technology: +7.93%

- Consumer Discretionary: +7.44%

- Communication Services: +6.36%

- Consumer Staples: -1.36% (weakest)

Looking Ahead

Next week brings critical earnings from GM, Visa, Microsoft, Meta, Apple, and Amazon. Key economic releases include:

- JOLTS job openings, Consumer Confidence (Tuesday)

- Q1 GDP, Core PCE, ADP payrolls (Wednesday)

- ISM Manufacturing (Thursday)

- Nonfarm payrolls, unemployment (Friday)

Payroll growth is expected to slow, with wage data under scrutiny for inflation signals.

Outlook: Markets Stabilize, but Volatility Lingers

Equity and bond markets rallied as trade rhetoric softened and Fed concerns faded. The S&P 500’s 10% rebound from April 9 lows leave it 10% below February highs. Further gains likely require concrete trade deals, not just optimism. Markets may stay rangebound with periodic volatility before revisiting early-2025 levels.

We expect a flat S&P 500 in 2025 but see opportunities in diversified portfolios. (This is a stock picker's market!) Mid-single-digit earnings growth is achievable if economic slowdowns remain mild. Health care and financials offer attractive prospects, with health care leading Q1 earnings and financials benefiting from potential tax cuts and deregulation.